Answered step by step

Verified Expert Solution

Question

1 Approved Answer

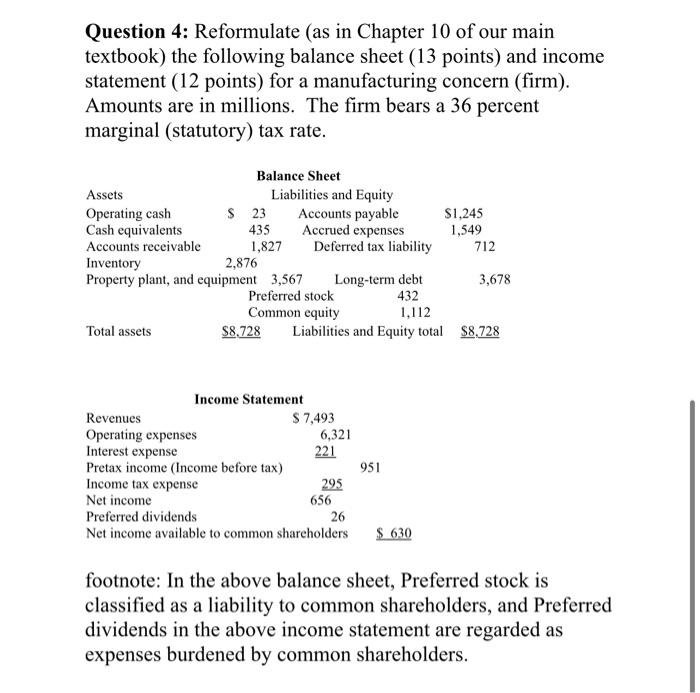

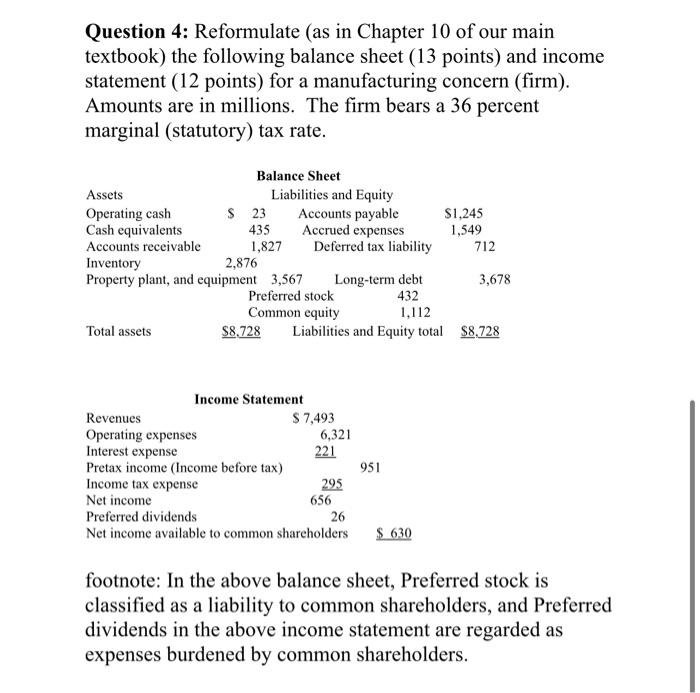

please explain the answer chapter 10 Question 4: Reformulate (as in Chapter 10 of our main textbook) the following balance sheet (13 points) and income

please explain the answer

chapter 10

Question 4: Reformulate (as in Chapter 10 of our main textbook) the following balance sheet (13 points) and income statement (12 points) for a manufacturing concern (firm). Amounts are in millions. The firm bears a 36 percent marginal (statutory) tax rate. Balance Sheet Assets Liabilities and Equity Operating cash $ 23 Accounts payable $1,245 Cash equivalents 435 Accrued expenses 1,549 Accounts receivable 1,827 Deferred tax liability 712 Inventory 2,876 Property plant, and equipment 3,567 Long-term debt 3,678 Preferred stock 432 Common equity 1,112 Total assets $8,728 Liabilities and Equity total $8,728 Income Statement Revenues $ 7,493 Operating expenses 6,321 Interest expense 221 Pretax income (Income before tax) Income tax expense 295 Net income 656 Preferred dividends 26 Net income available to common shareholders 951 $ 630 footnote: In the above balance sheet, Preferred stock is classified as a liability to common shareholders, and Preferred dividends in the above income statement are regarded as expenses burdened by common shareholders. Question 4: Reformulate (as in Chapter 10 of our main textbook) the following balance sheet (13 points) and income statement (12 points) for a manufacturing concern (firm). Amounts are in millions. The firm bears a 36 percent marginal (statutory) tax rate. Balance Sheet Assets Liabilities and Equity Operating cash $ 23 Accounts payable $1,245 Cash equivalents 435 Accrued expenses 1,549 Accounts receivable 1,827 Deferred tax liability 712 Inventory 2,876 Property plant, and equipment 3,567 Long-term debt 3,678 Preferred stock 432 Common equity 1,112 Total assets $8,728 Liabilities and Equity total $8,728 Income Statement Revenues $ 7,493 Operating expenses 6,321 Interest expense 221 Pretax income (Income before tax) Income tax expense 295 Net income 656 Preferred dividends 26 Net income available to common shareholders 951 $ 630 footnote: In the above balance sheet, Preferred stock is classified as a liability to common shareholders, and Preferred dividends in the above income statement are regarded as expenses burdened by common shareholders Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started