Please explain the answer for this assignment,

thanks,

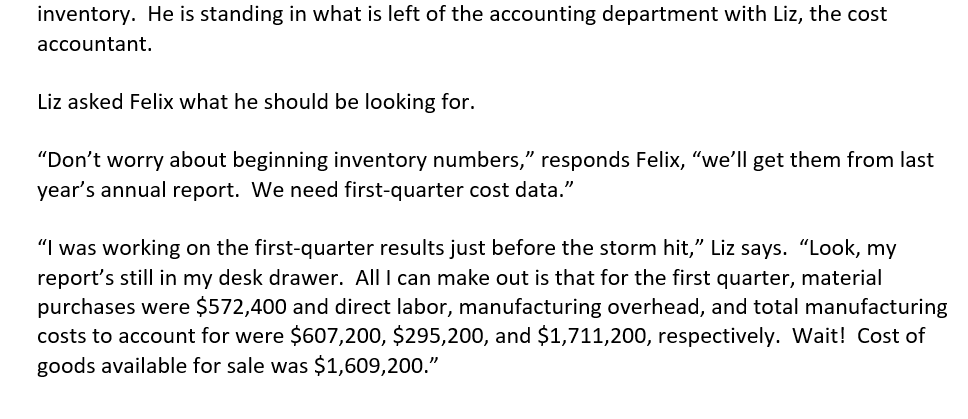

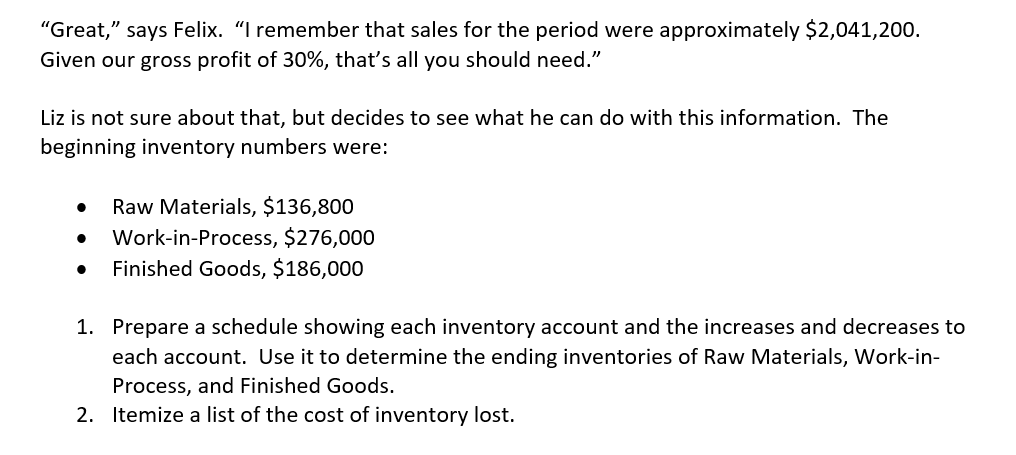

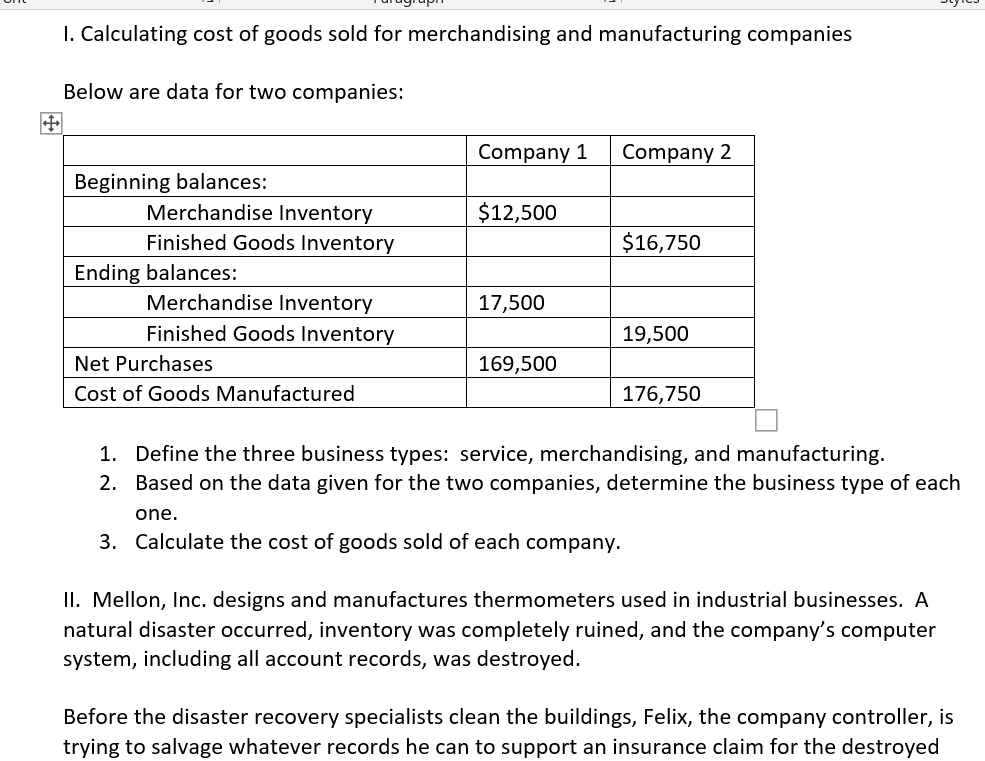

--. nun-3.1.,"- |. Calculating cost of goods sold for merchandising and manufacturing companies Below are data for two companies: Company 1 Company 2 Beginning balances: Merchandise Inventory $12,500 Finished Goods Inventory $16,750 Ending balances: Merchandise Inventory 17,500 Finished Goods Inventory 19,500 Net Purchases 169,500 Cost of Goods Manufactured 176,750 j 1. Define the three business types: service, merchandising, and manufacturing. 2. Based on the data given for the two companies, determine the business type of each one. 3. Calculate the cost of goods sold of each company. ||. Mellon, Inc. designs and manufactures thermometers used in industrial businesses. A natural disaster occurred, inventory was completely ruined, and the company's computer system, including all account records, was destroyed. Before the disaster recovery specialists clean the buildings, Felix, the company controller, is trying to salvage whatever records he can to support an insurance claim for the destroyed inventory. He is standing in what is left of the accounting department with Liz, the cost accountant. Liz asked Felix what he should be looking for. "Don't worry about beginning inventory numbers," responds Felix, "we'll get them from last year's annual report. We need first-quarter cost data." \"I was working on the first-quarter results just before the storm hit,\" Liz says. "Look, mv report's still in my desk drawer. All I can make out is that for the first quarter, material purchases were $572,400 and direct labor, manufacturing overhead, and total manufacturing costs to account for were $607,200, $295,200, and $1,711,200, respectively. Wait! Cost of goods available for sale was $1,609,200." \"Great," says Felix. "I remember that sales for the period were approximately $2,041,200. Given our gross profit of 30%, that's all you should need.\" Liz is not sure about that, but decides to see what he can do with this information. The beginning inventory numbers were: 0 Raw Materials, $136,800 0 Work-in-Process, $276,000 I Finished Goods, $186,000 1. Prepare a schedule showing each inventory account and the increases and decreases to each account. Use it to determine the ending inventories of Raw Materials, Work-in- Process, and Finished Goods. 2. Itemize a list of the cost of inventory lost