Answered step by step

Verified Expert Solution

Question

1 Approved Answer

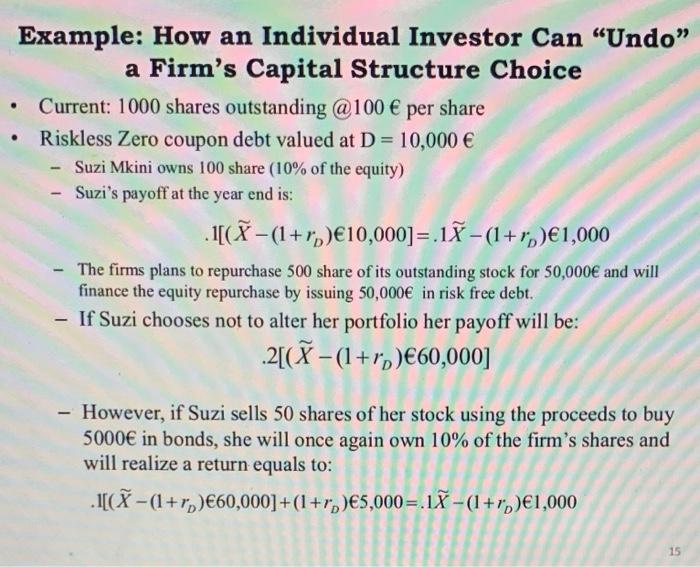

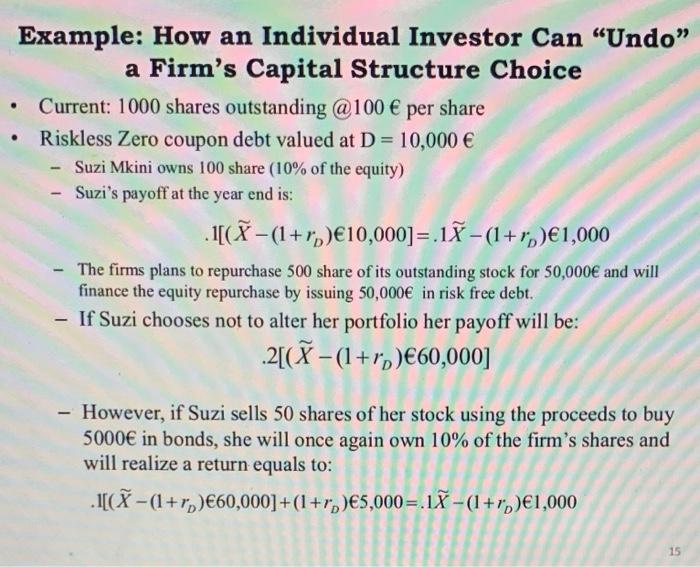

please explain the example below (modigliani miller) . . Example: How an Individual Investor Can Undo a Firm's Capital Structure Choice Current: 1000 shares outstanding

please explain the example below

. . Example: How an Individual Investor Can Undo" a Firm's Capital Structure Choice Current: 1000 shares outstanding @100 per share Riskless Zero coupon debt valued at D= 10,000 Suzi Mkini owns 100 share (10% of the equity) Suzi's payoff at the year end is: .1[( -(1+r)10,000] =. -(1+r)1,000 The firms plans to repurchase 500 share of its outstanding stock for 50,000 and will finance the equity repurchase by issuing 50,000 in risk free debt. If Suzi chooses not to alter her portfolio her payoff will be: 2[(-(1+r)60,000] - However, if Suzi sells 50 shares of her stock using the proceeds to buy 5000 in bonds, she will once again own 10% of the firm's shares and will realize a return equals to: [C-(1+r)60,000]+(1+r)5,000=.. - (1+r)1,000 15 (modigliani miller)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started