Answered step by step

Verified Expert Solution

Question

1 Approved Answer

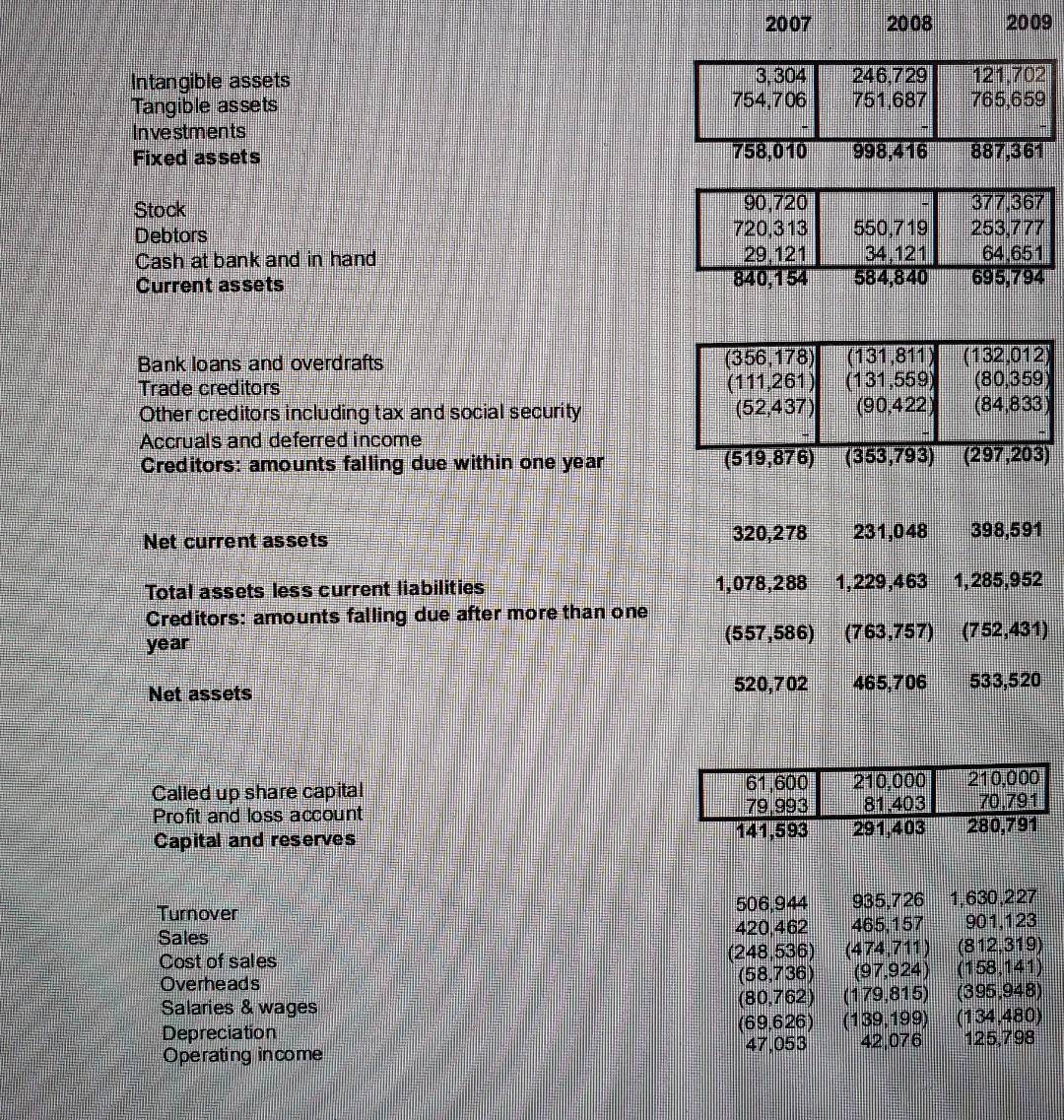

Please explain the financial situation this company is in and whether they will be able remain in business or not. 2007 2008 2009 3,304 754,706

Please explain the financial situation this company is in and whether they will be able remain in business or not.

2007 2008 2009 3,304 754,706 246.729 751,687 121.702 765.659 Intangible assets Tangible assets Investments Fixed assets 758,010 998,416 887,361 Stock Debtors Cash at bank and in hand Current assets 90.720 720,313 29, 121 840,154 550,719 34,121 584,840 G77367 253.777 64.65) 6915794 Bank loans and overdrafts Trade creditors Other creditors including tax and social security Accruals and deferred income Creditors: amounts falling due within one year (356,178) (111,261) (52.437) (131,811 (131,559) (90.422) (132 012 (80,359) (84,833) (519,876) (359,793) (297,203) 320,278 Net current assets 231,048 398,591 1,078,288 1,229,463 1,285,952 Total assets less current liabilities Creditors: amounts falling due after more than one year (557,586) (763.757 (752,431) 520,702 465,706 533,520 Net assets Called up share capital Profit and loss account Capital and reserves 61 600 79993 11747.593 210.000 81.403 291403 210.000 70.791 280,791 Turnover Sales Cost of sales Overheads Salaries & wages Depreciation Operating income 506944 420 462 (248,536) (58.7136) (80.762) (69626) 471053 935.726 465.157 (474 711) (97,924) (179.815) (139.199) 42 076 1.630 227 901,123 (812.319) (158,141) (695.948) (134.480) 125.798Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started