Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain The Goodsmith Charitable Foundation, which is tax-exempt, issued debt last year at 9 percent to help finance a new playground facility in Los

please explain

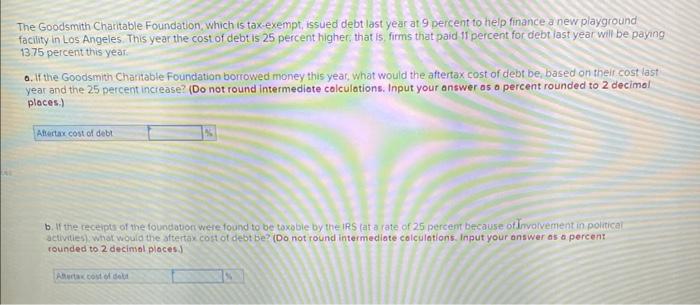

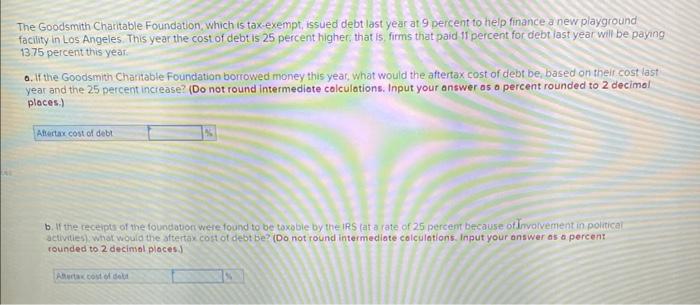

The Goodsmith Charitable Foundation, which is tax-exempt, issued debt last year at 9 percent to help finance a new playground facility in Los Angeles. This year the cost of debt is 25 percent higher, that is, firms that paid 11 percent for debt last year will be paying 1375 peicent this year: 0. If the Goodsmith Chantable Foundation borrowed money this year, what would the aftertax cost of debt be, based on theif cost last year and the 25 percent inciease? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimol pleces.) b. If the receipts of the foundabon were found to be toxoble by the IRS (at a rate of 25 percent betrause of Iivivaivement in poitical activities). What would the aftentak cost of debt be? (Do not round intermediate colculations. Input your answer as a percent: rounded to 2 decimol ploces

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started