Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the knowledge of this ppt and give some ex about that Contributions tax - Once in your fund, concessional contributions are taxed at

Please explain the knowledge of this ppt and give some ex about that

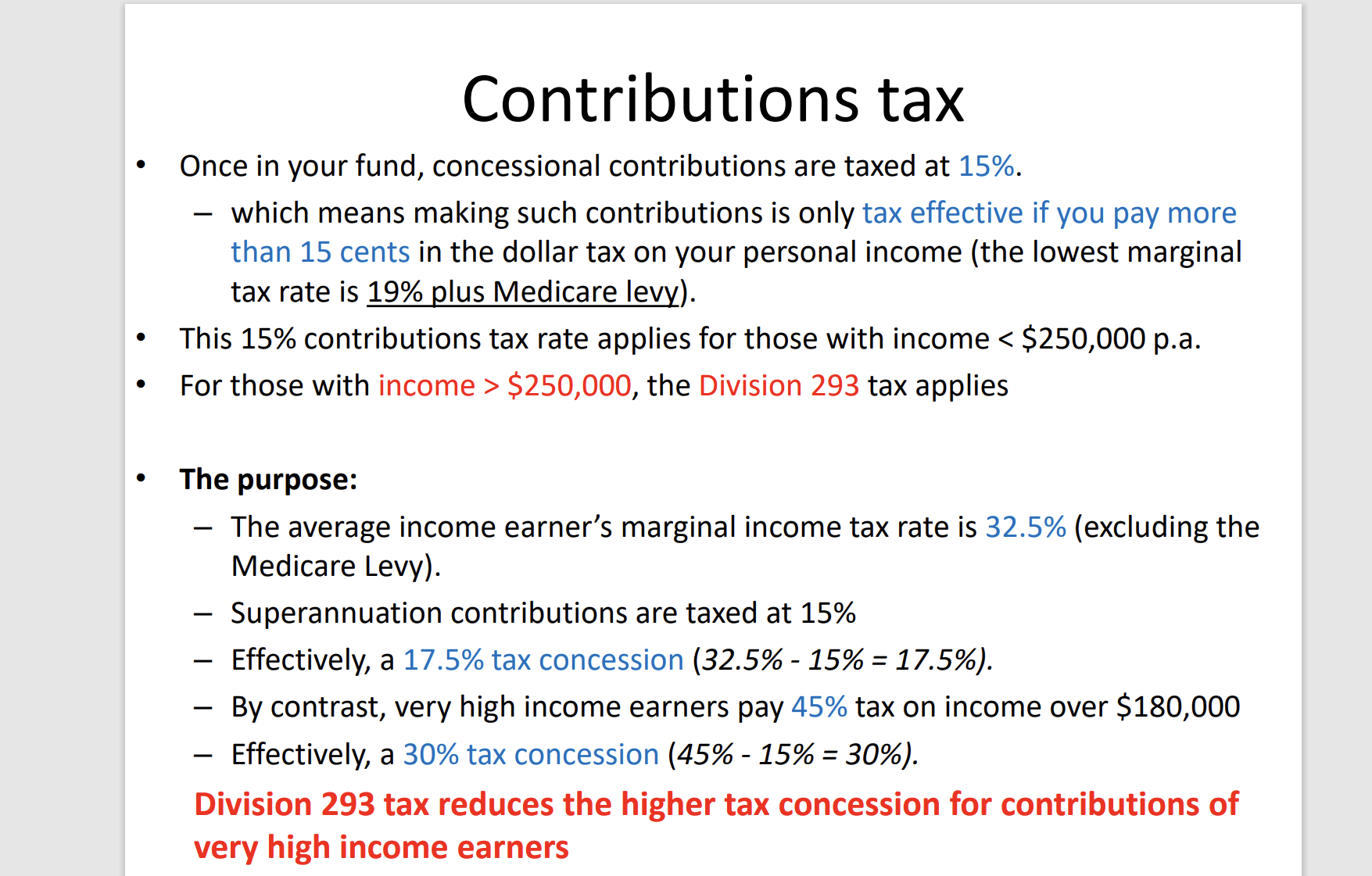

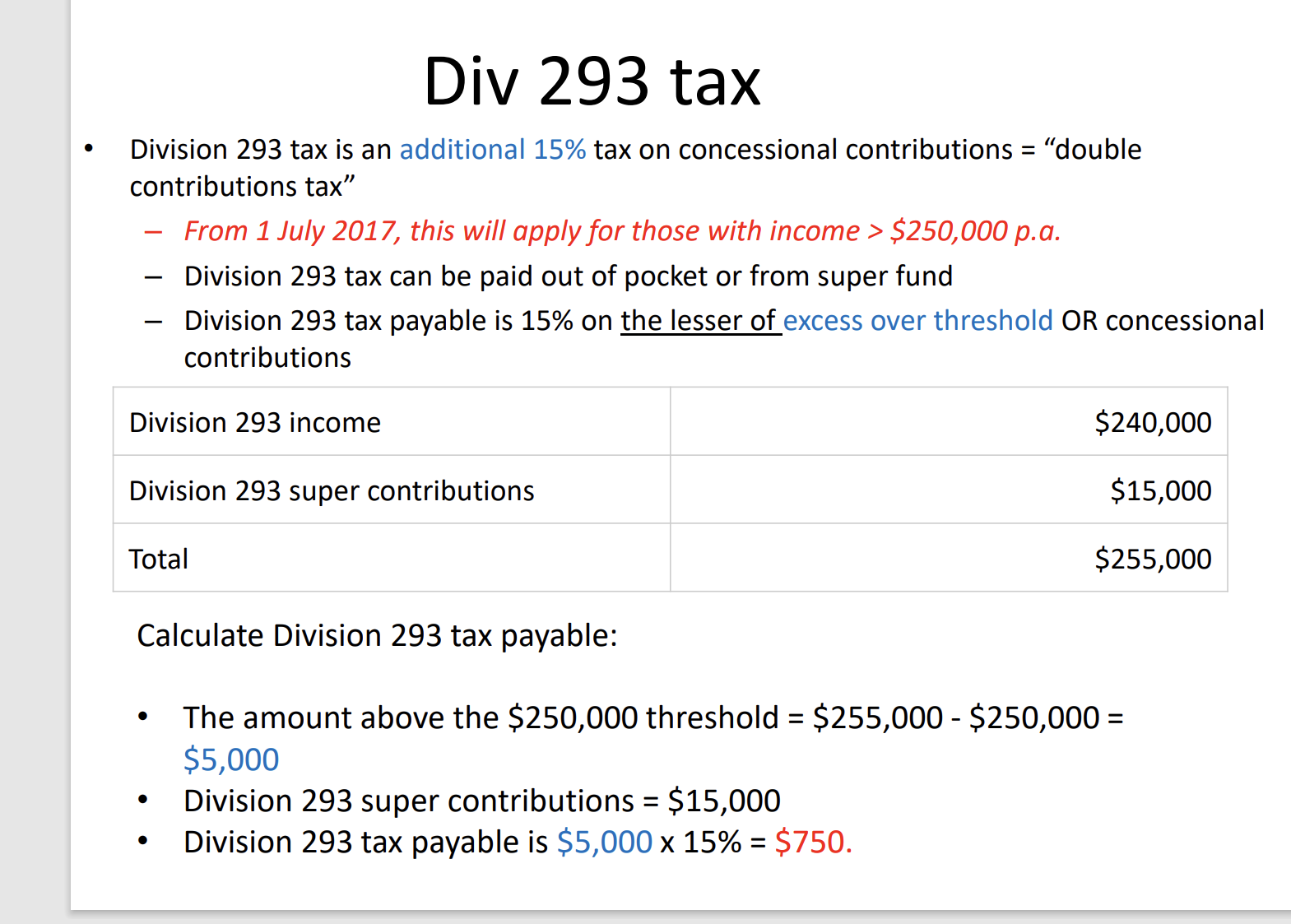

Contributions tax - Once in your fund, concessional contributions are taxed at 15%. - which means making such contributions is only tax effective if you pay more than 15 cents in the dollar tax on your personal income (the lowest marginal tax rate is 19% plus Medicare levy). - This 15% contributions tax rate applies for those with income $250,000, the Division 293 tax applies - The purpose: - The average income earner's marginal income tax rate is 32.5% (excluding the Medicare Levy). - Superannuation contributions are taxed at 15% - Effectively, a 17.5% tax concession (32.5\% - 15\% = 17.5\%). - By contrast, very high income earners pay 45% tax on income over $180,000 - Effectively, a 30% tax concession (45\% - 15\% = 30\%). Division 293 tax reduces the higher tax concession for contributions of very high income earners Division 293 tax is an additional 15\% tax on concessional contributions = "double contributions tax" - From 1 July 2017, this will apply for those with income >$250,000 p.a. - Division 293 tax can be paid out of pocket or from super fund - Division 293 tax payable is 15% on the lesser of excess over threshold OR concessional contributions Calculate Division 293 tax payable: - The amount above the $250,000 threshold =$255,000$250,000= $5,000 - Division 293 super contributions =$15,000 - Division 293 tax payable is $5,00015%=$750

Contributions tax - Once in your fund, concessional contributions are taxed at 15%. - which means making such contributions is only tax effective if you pay more than 15 cents in the dollar tax on your personal income (the lowest marginal tax rate is 19% plus Medicare levy). - This 15% contributions tax rate applies for those with income $250,000, the Division 293 tax applies - The purpose: - The average income earner's marginal income tax rate is 32.5% (excluding the Medicare Levy). - Superannuation contributions are taxed at 15% - Effectively, a 17.5% tax concession (32.5\% - 15\% = 17.5\%). - By contrast, very high income earners pay 45% tax on income over $180,000 - Effectively, a 30% tax concession (45\% - 15\% = 30\%). Division 293 tax reduces the higher tax concession for contributions of very high income earners Division 293 tax is an additional 15\% tax on concessional contributions = "double contributions tax" - From 1 July 2017, this will apply for those with income >$250,000 p.a. - Division 293 tax can be paid out of pocket or from super fund - Division 293 tax payable is 15% on the lesser of excess over threshold OR concessional contributions Calculate Division 293 tax payable: - The amount above the $250,000 threshold =$255,000$250,000= $5,000 - Division 293 super contributions =$15,000 - Division 293 tax payable is $5,00015%=$750 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started