Please explain the solution steps

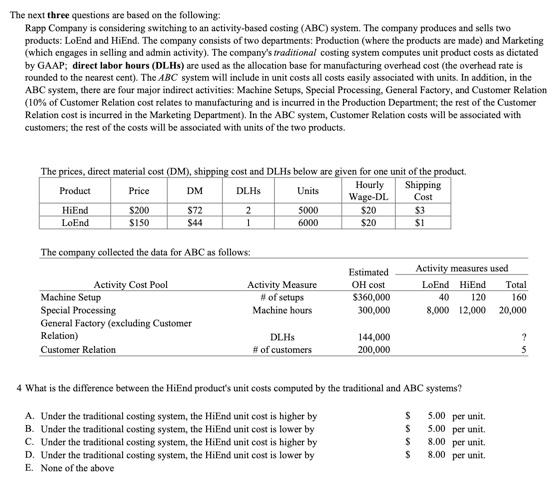

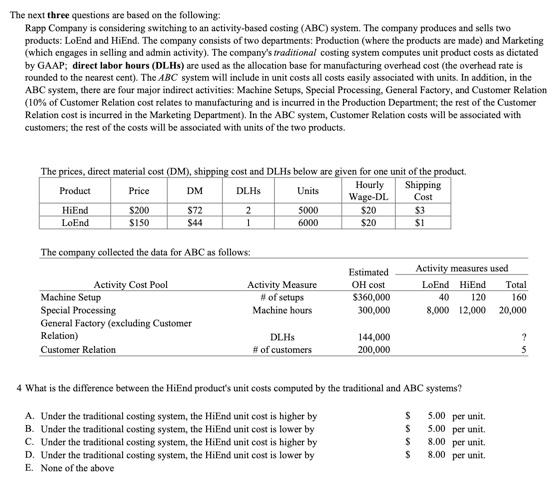

The next three questions are based on the following: Rapp Company is considering switching to an activity-based costing (ABC) system. The company produces and sells two products: LoEnd and Hi End. The company consists of two departments: Production (where the products are made) and Marketing (which engages in selling and admin activity). The company's traditional costing system computes unit product costs as dictated by GAAP, direct labor hours (DLHs) are used as the allocation base for manufacturing overhead cost (the overhead rate is rounded to the nearest cent). The ABC system will include in unit costs all costs casily associated with units. In addition, in the ABC system, there are four major indirect activities: Machine Setups, Special Processing, General Factory, and Customer Relation (10% of Customer Relation cost relates to manufacturing and is incurred in the Production Department, the rest of the Customer Relation cost is incurred in the Marketing Department). In the ABC system, Customer Relation costs will be associated with customers, the rest of the costs will be associated with units of the two products, The prices, direct material cost (DM), shipping cost and DLHs below are given for one unit of the product, Product Price DM DLHS Units Hourly Shipping Wage-DL Cost HiEnd $200 $72 2 5000 $20 $3 LoEnd $150 $44 1 6000 $20 $1 The company collected the data for ABC as follows: Activity Measure # of setups Machine hours Estimated OH cost $360,000 300,000 Activity Cost Pool Machine Setup Special Processing General Factory (excluding Customer Relation) Customer Relation Activity measures used LoEnd HiEnd Total 40 120 160 8,000 12,000 20,000 DLHs # of customers 144,000 200,000 4 What is the difference between the HiEnd product's unit costs computed by the traditional and ABC systems? S A. Under the traditional costing system, the HiEnd unit cost is higher by B. Under the traditional costing system, the HiEnd unit cost is lower by C. Under the traditional costing system, the HiEnd unit cost is higher by D. Under the traditional costing system, the HiEnd unit cost is lower by E. None of the above 5.00 per unit 5.00 per unit 8.00 per unit 8.00 per unit S S The next three questions are based on the following: Rapp Company is considering switching to an activity-based costing (ABC) system. The company produces and sells two products: LoEnd and Hi End. The company consists of two departments: Production (where the products are made) and Marketing (which engages in selling and admin activity). The company's traditional costing system computes unit product costs as dictated by GAAP, direct labor hours (DLHs) are used as the allocation base for manufacturing overhead cost (the overhead rate is rounded to the nearest cent). The ABC system will include in unit costs all costs casily associated with units. In addition, in the ABC system, there are four major indirect activities: Machine Setups, Special Processing, General Factory, and Customer Relation (10% of Customer Relation cost relates to manufacturing and is incurred in the Production Department, the rest of the Customer Relation cost is incurred in the Marketing Department). In the ABC system, Customer Relation costs will be associated with customers, the rest of the costs will be associated with units of the two products, The prices, direct material cost (DM), shipping cost and DLHs below are given for one unit of the product, Product Price DM DLHS Units Hourly Shipping Wage-DL Cost HiEnd $200 $72 2 5000 $20 $3 LoEnd $150 $44 1 6000 $20 $1 The company collected the data for ABC as follows: Activity Measure # of setups Machine hours Estimated OH cost $360,000 300,000 Activity Cost Pool Machine Setup Special Processing General Factory (excluding Customer Relation) Customer Relation Activity measures used LoEnd HiEnd Total 40 120 160 8,000 12,000 20,000 DLHs # of customers 144,000 200,000 4 What is the difference between the HiEnd product's unit costs computed by the traditional and ABC systems? S A. Under the traditional costing system, the HiEnd unit cost is higher by B. Under the traditional costing system, the HiEnd unit cost is lower by C. Under the traditional costing system, the HiEnd unit cost is higher by D. Under the traditional costing system, the HiEnd unit cost is lower by E. None of the above 5.00 per unit 5.00 per unit 8.00 per unit 8.00 per unit S S