Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain the solutions :) 1.8 Exercise 19 The non-life insurance company XX has the shareholders' fund of 16 million PLN as of January 1st,

Please explain the solutions :)

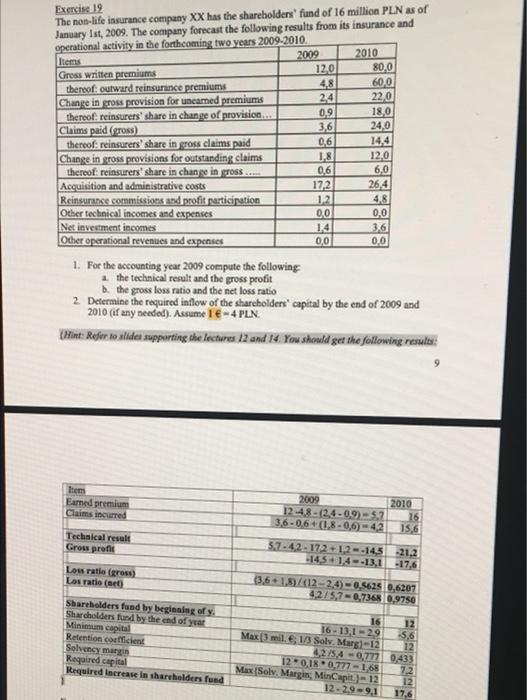

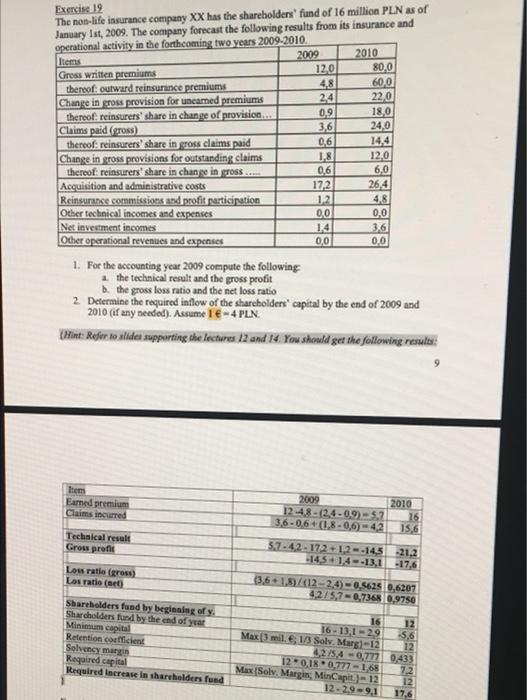

1.8 Exercise 19 The non-life insurance company XX has the shareholders' fund of 16 million PLN as of January 1st, 2009. The company forecast the following results from its insurance and operational activity in the forthcoming two years 2009-2010. Items 2009 2010 12,0 80,0 Gross written premiums 4.8 60,0 thereof outward reinsurance premiums 2,4 22,0 Change in gross provision for uncared premiums thereofreinsurers' share in change of provision... 09 18,0 Claims paid (ross) 3,6 24,0 thereofreinsurers' share in gross claims paid 0,6 14,4 Change in gross provisions for outstanding claims 12.0 thereofreinsurers' share in change in gross... 0,6 6,0 Acquisition and administrative costs 17,2 26,4 Reinsurance commissions and profit participation 12 4,8 Other technical incomes and expenses 0,0 0.0 Net investment incomes 14 3,6 Other operational revenues and expenses 0,0 0,0 1. For the accounting year 2009 compute the following the technical result and the gross profit b. the gross loss ratio and the net loss ratio 2. Determine the required inflow of the shareholders' capital by the end of 2009 and 2010 (if any needed). Assume 1 -4 PLN. Hint: Refersoaldes supporting the lectures 12 and 14. You should get the following reale Item Earned premium Claims incurred 2009 2010 12-48-(2,4-0,9) - 5.7 16 3.6 -0.6+(1,8-0,6) - 42 15,6 Technical result Grow proti 5.7-42-172-12-14,5 -145 +14--13,1 -21,2 -17,6 Los ratio (ro Los ratio (net) 3,6-1,5412-2.4 -0.5625 0,6207 42/5,7 -0,7368 0.9750 Shareholders fund by beginning of y. Shareholders fund by the end of year Minimum capital Retention coefficient Solvency marge Required capital Required increase is shareholders fund 16 12 16-131-29 Max[3 mil. , 1/3 Solv Marg1-12 12 215,4 -0,0,433 12- 0,18 0,777-165 7.2 Max Solv. Margis, MinCapit-12 12 12.29-9,1 17.6 Ninien 1.8 Exercise 19 The non-life insurance company XX has the shareholders' fund of 16 million PLN as of January 1st, 2009. The company forecast the following results from its insurance and operational activity in the forthcoming two years 2009-2010. Items 2009 2010 12,0 80,0 Gross written premiums 4.8 60,0 thereof outward reinsurance premiums 2,4 22,0 Change in gross provision for uncared premiums thereofreinsurers' share in change of provision... 09 18,0 Claims paid (ross) 3,6 24,0 thereofreinsurers' share in gross claims paid 0,6 14,4 Change in gross provisions for outstanding claims 12.0 thereofreinsurers' share in change in gross... 0,6 6,0 Acquisition and administrative costs 17,2 26,4 Reinsurance commissions and profit participation 12 4,8 Other technical incomes and expenses 0,0 0.0 Net investment incomes 14 3,6 Other operational revenues and expenses 0,0 0,0 1. For the accounting year 2009 compute the following the technical result and the gross profit b. the gross loss ratio and the net loss ratio 2. Determine the required inflow of the shareholders' capital by the end of 2009 and 2010 (if any needed). Assume 1 -4 PLN. Hint: Refersoaldes supporting the lectures 12 and 14. You should get the following reale Item Earned premium Claims incurred 2009 2010 12-48-(2,4-0,9) - 5.7 16 3.6 -0.6+(1,8-0,6) - 42 15,6 Technical result Grow proti 5.7-42-172-12-14,5 -145 +14--13,1 -21,2 -17,6 Los ratio (ro Los ratio (net) 3,6-1,5412-2.4 -0.5625 0,6207 42/5,7 -0,7368 0.9750 Shareholders fund by beginning of y. Shareholders fund by the end of year Minimum capital Retention coefficient Solvency marge Required capital Required increase is shareholders fund 16 12 16-131-29 Max[3 mil. , 1/3 Solv Marg1-12 12 215,4 -0,0,433 12- 0,18 0,777-165 7.2 Max Solv. Margis, MinCapit-12 12 12.29-9,1 17.6 Ninien

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started