Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain The source of Gary's LIF assets is from his membership in a registered pension plan during his employment with Cygnus Corporation. Gary lives

Please explain

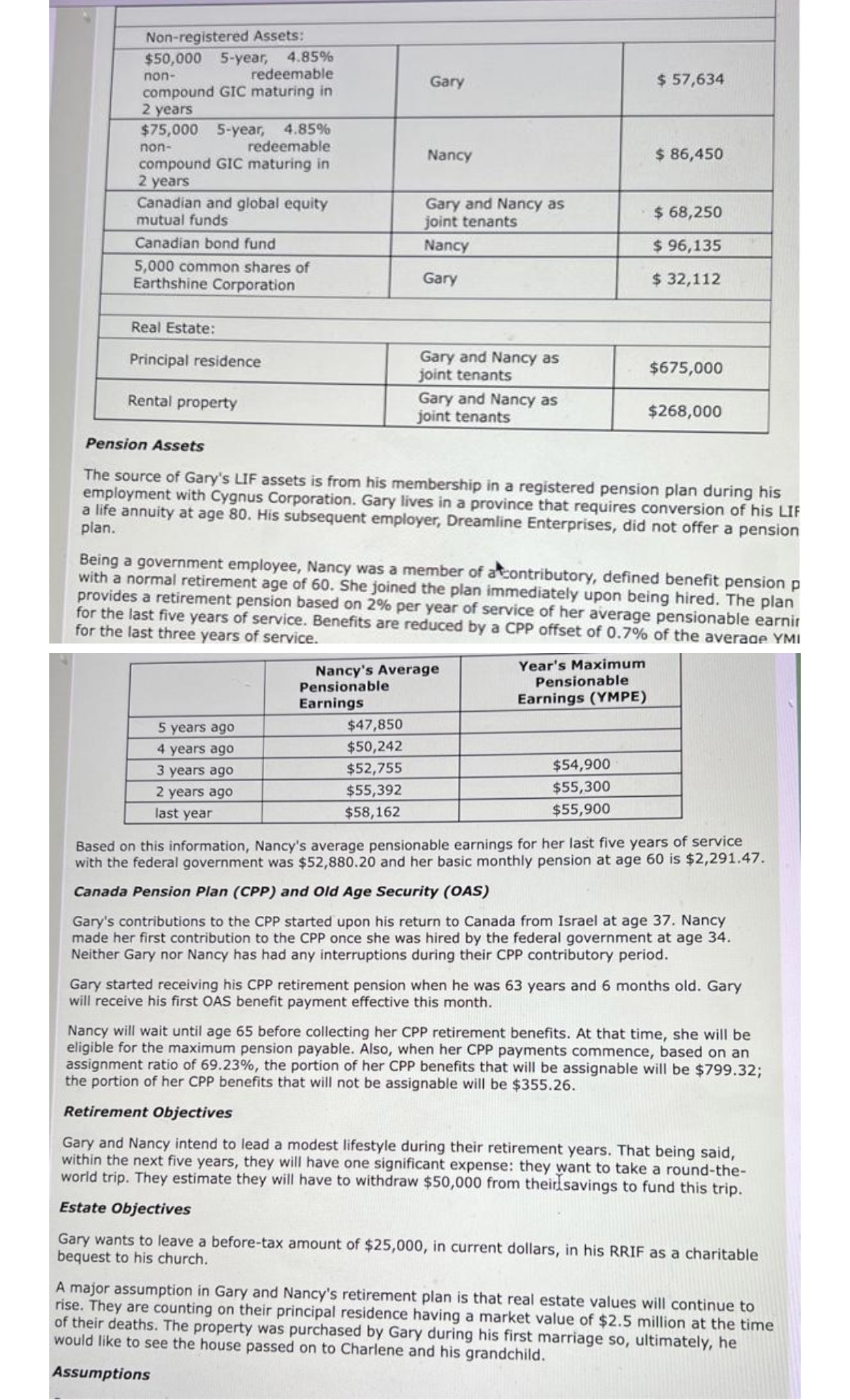

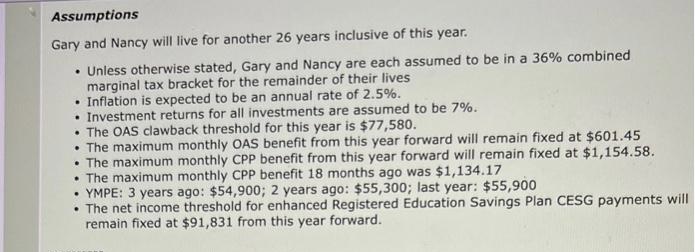

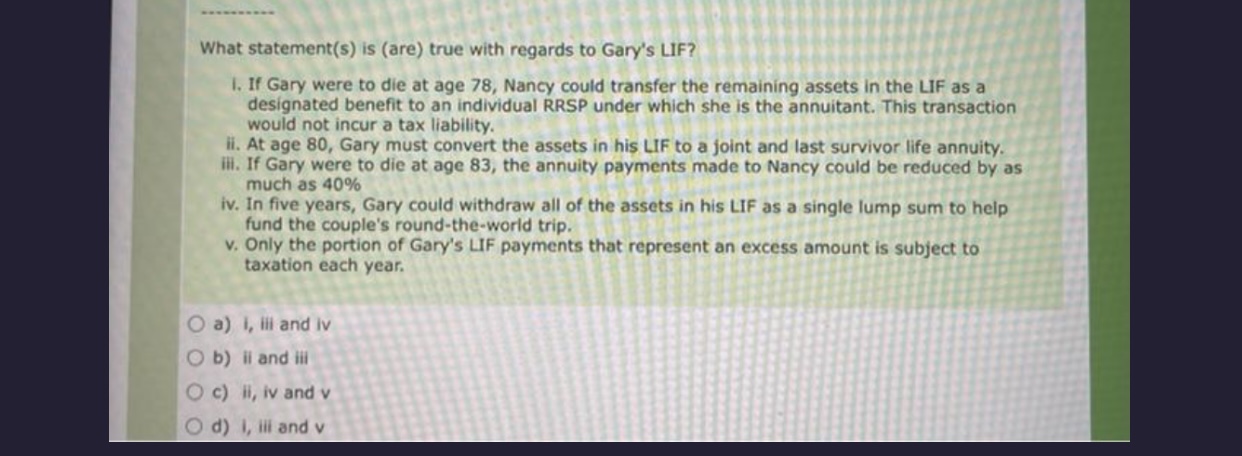

The source of Gary's LIF assets is from his membership in a registered pension plan during his employment with Cygnus Corporation. Gary lives in a province that requires conversion of his LIF a life annuity at age 80 . His subsequent employer, Dreamline Enterprises, did not offer a pension plan. Being a government employee, Nancy was a member of atcontributory, defined benefit pension p with a normal retirement age of 60 . She joined the plan immediately upon being hired. The plan provides a retirement pension based on 2% per year of service of her average pensionable earnit for the last five years of service. Benefits are reduced by a CPP offset of 0.7% of the average YMI for the last three years of service. Based on this information, Nancy's average pensionable earnings for her last five years of service with the federal government was $52,880.20 and her basic monthly pension at age 60 is $2,291.47. Canada Pension Plan (CPP) and Old Age Security (OAS) Gary's contributions to the CPP started upon his return to Canada from Israel at age 37. Nancy made her first contribution to the CPP once she was hired by the federal government at age 34 . Neither Gary nor Nancy has had any interruptions during their CPP contributory period. Gary started receiving his CPP retirement pension when he was 63 years and 6 months old. Gary will receive his first OAS benefit payment effective this month. Nancy will wait until age 65 before collecting her CPP retirement benefits. At that time, she will be eligible for the maximum pension payable. Also, when her CPP payments commence, based on an assignment ratio of 69.23%, the portion of her CPP benefits that will be assignable will be $799.32; the portion of her CPP benefits that will not be assignable will be $355.26. Retirement Objectives Gary and Nancy intend to lead a modest lifestyle during their retirement years. That being said, within the next five years, they will have one significant expense: they want to take a round-theworld trip. They estimate they will have to withdraw $50,000 from theitlsavings to fund this trip. Estate Objectives Gary wants to leave a before-tax amount of $25,000, in current dollars, in his RRIF as a charitable bequest to his church. A major assumption in Gary and Nancy's retirement plan is that real estate values will continue to rise. They are counting on their principal residence having a market value of $2.5 million at the time of their deaths. The property was purchased by Gary during his first marriage so, ultimately, he would like to see the house passed on to Charlene and his grandchild. Assumptions Assumptions Gary and Nancy will live for another 26 years inclusive of this year. - Unless otherwise stated, Gary and Nancy are each assumed to be in a 36% combined marginal tax bracket for the remainder of their lives - Inflation is expected to be an annual rate of 2.5%. - Investment returns for all investments are assumed to be 7%. - The OAS clawback threshold for this year is $77,580. - The maximum monthly OAS benefit from this year forward will remain fixed at $601.45 - The maximum monthly CPP benefit from this year forward will remain fixed at $1,154.58. - The maximum monthly CPP benefit 18 months ago was $1,134.17 - YMPE: 3 years ago: $54,900;2 years ago: $55,300; last year: $55,900 - The net income threshold for enhanced Registered Education Savings Plan CESG payments w remain fixed at $91,831 from this year forward. What statement(s) is (are) true with regards to Gary's LIF? I. If Gary were to die at age 78 , Nancy could transfer the remaining assets in the LIF as a designated benefit to an individual RRSP under which she is the annuitant. This transaction would not incur a tax liability. ii. At age 80 , Gary must convert the assets in his LIF to a joint and last survivor life annuity. iii. If Gary were to die at age 83 , the annuity payments made to Nancy could be reduced by as much as 40% iv. In five years, Gary could withdraw all of the assets in his LIF as a single lump sum to help fund the couple's round-the-worid trip. v. Only the portion of Gary's LIF payments that represent an excess amount is subject to taxation each year. a) i, iii and iv b) ii and iii c) ii, iv and v d) I, iii and vStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started