Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain. this is all the information I was given Use the following information to answer the next 3 questions Financial Statements Forecast - Steed

Please explain. this is all the information I was given

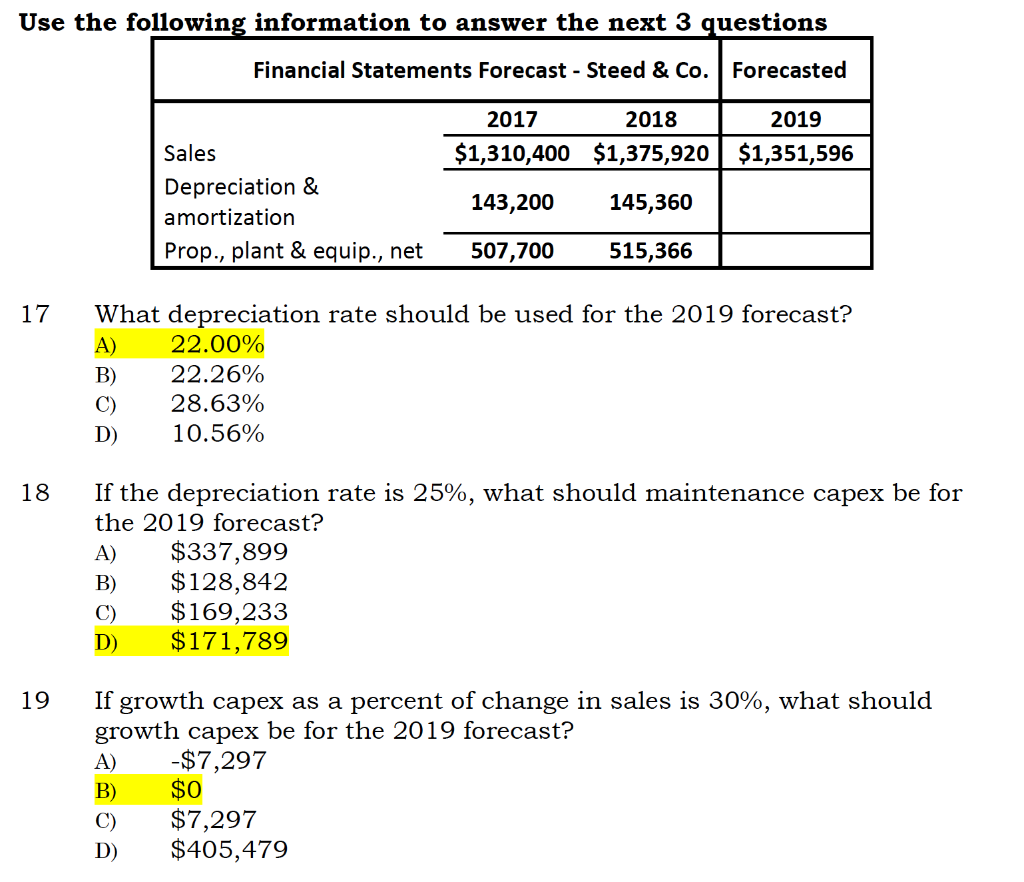

Use the following information to answer the next 3 questions Financial Statements Forecast - Steed & Co. Forecasted 2017 $1,310,400 2018 2019 $1,375,920 | $1,351,596 Sales Depreciation & amortization Prop., plant & equip., net 143,200 145,360 507,700 515,366 17 What depreciation rate should be used for the 2019 forecast? A) 22.00% 22.26% C) 28.63% D) 10.56% 18 If the depreciation rate is 25%, what should maintenance capex be for the 2019 forecast? A) $337,899 B) $128,842 $169,233 D) $171,789 19 If growth capex as a percent of change in sales is 30%, what should growth capex be for the 2019 forecast? A) $7,297 B) C) $7,297 D) $405,479 $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started