please explain this question step by step, dont give just the answers, explain how you solved it

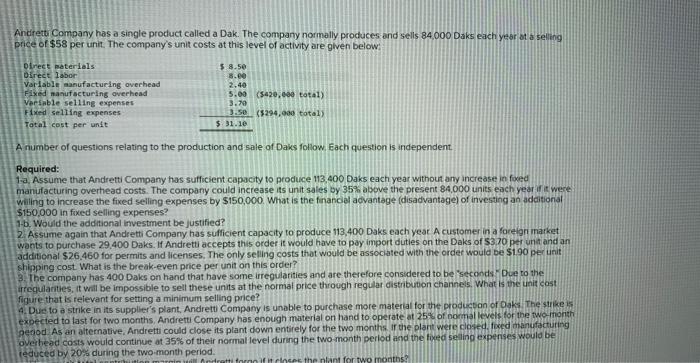

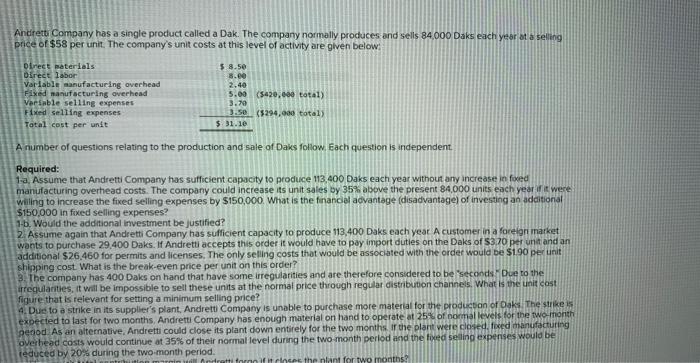

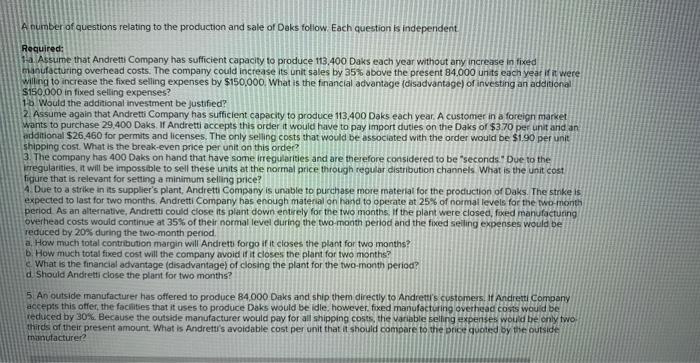

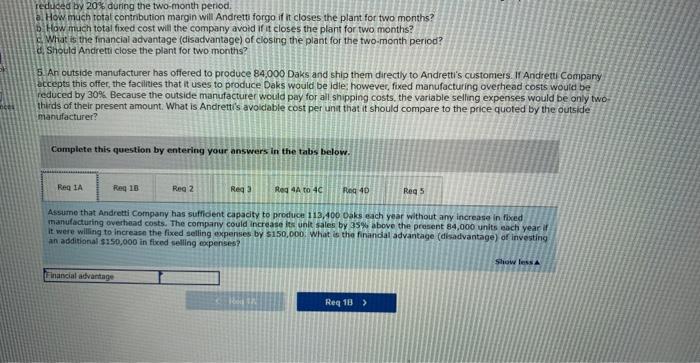

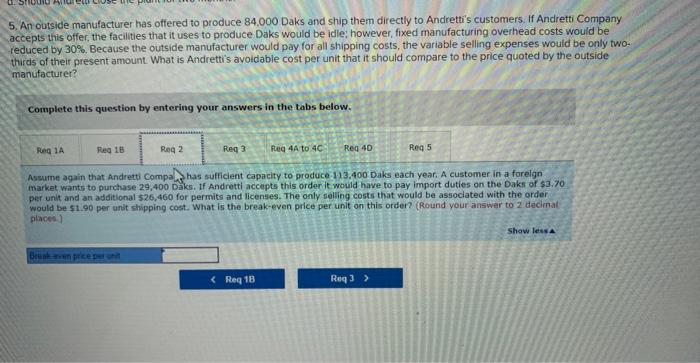

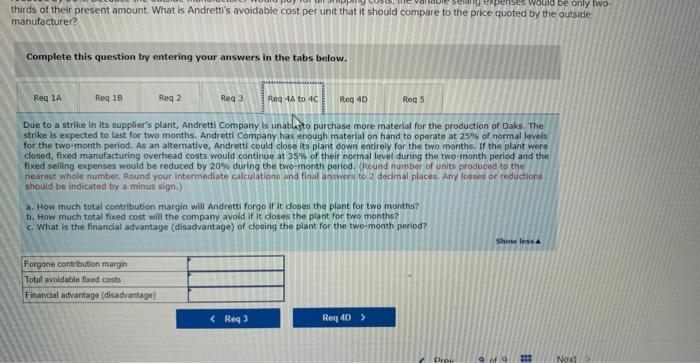

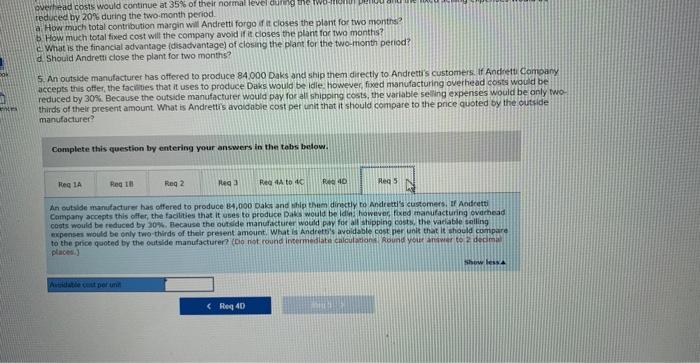

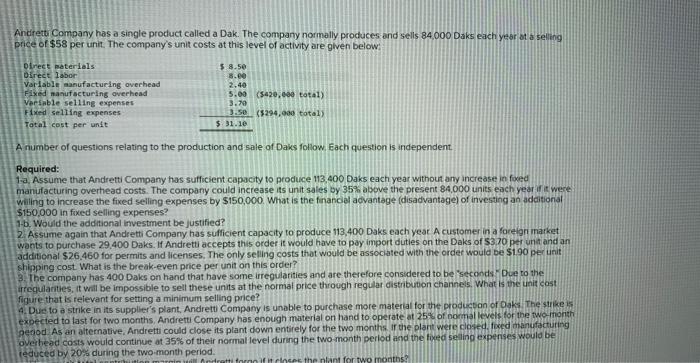

Andretti Company has a single product called a Dak. The company normally produces and sells 84,000 Daks each yeor ot a selling price of $58 per unit. The company's unit costs at this level of activity are given below: A number of questions relating to the production and sale of Daks follow Each question is independent. Required: 12, Assume that Andretti Company has sufficient capacity to produce 113,400 Daks each year without any increase in foeed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 84.000 units each year if is were wiling to increase the fixed selling expenses by $150,000. What is the financid advantage (disadvantage) of investing an additionial $150,000 in foxed selling expenses? 1.b. Would the additional investment be justified? 2. Assume again that Andretti Company has sufficient capacity to produce 113,400 Daks each yeat A customer in a foce wants to purchase 29,400 Daks. If Andretti accepts this order it woukd have to pay import duties on the Daks of 5370 per unt and an additional $26,460 for permits and licenses. The only selling costs that would be associated with the order would be $190 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 400 Daks on hand that have some irregularities and are therefore considered to be "seconds 5 Due to the irrequilarities, it will be impossible to sell these units at the normal price throogh regular distributon channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant. Andrett Compony is unable to purchase more materlal for the productan of Dakk the shike is exoected to last for two months. Andrefti Company has enough materiat on hand to operate at 2598 of nommal levels for the two-liorth peood As an alternative. Andretti could close its plant dowm entirely for the two months ir the plart were ciosed. fored manufacturing oyesbed costs would continue at 35% of their nomal devel dunng the two-month perlod and the fixed selling expetrises would be leduced by 20% during the two-month period. A number of questions relating to the production and sale of Daks follow Each question is independent. Required: 1. Assume that Andretti Company has sufficient capacity to produce 113.400 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 35% above the present 84.000 units each year if it were Wiling to increase the fixed selling expenses by $150,000. What is the financial advantage (disadvantage) of investing an additional $150.000 in fixed selling expenses? 16 Would the additional investment be justified? 2. Assume again that Andretti Company has sufficient capacity to produce 113,400 Daks each year, A customer in a foreign market wants to purchase 29,400 Daks. If Andretti accepts this order it would have to pay import duties on the Daks of $3.70 per unit and an pdoitional $26,460 for permits and licenses. The only selling costs that would be associated with the order would be $190 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 400 Daks on hand that have some irregularises and are therefore considered to be "seconds" Due to the igregularities, it will be impossable to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andretti Company is unible to purchase more material for the proctuction of Daks. The stnke is expected to last for two months. Andretti Company has enough material on hard to operate at 25% of normal levels for the fo-month period As an alternative, Andremi couid close its plant down entirely for the two months. If the plant were closed, foxed manufacturing overhead costs would continue at 35% of their normal level during the fwo-month period and the fixed seiling expenses would be reduced by 20% during the two-month period a. How much total contrbution margin will Andretu forgo if it cioses the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? C. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andreti close the plant for two months? 5 An outside manufacturer has offered to produce 84,000 Daks and ship them directly to Andrett's customers. It Andrett Company accepis this offer, the fachlities that it uses to produce Daks would be idle. however. fixed manufacturing overhegac costs would be reduced by 30R. Because the outside manufacturer would pay for all shipping costs, the variabie seling expenses would be cnly two: thirds of their present amount. What is Andrett's avoidable cost per unit that it should compare to the price quoted oy the outside tminufacture? a. How much total contribution margin will Andretti forgo if it closes the plant for two months? B. How much totat fised cost will the company avoid if it closes the plant for two months? Ch. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? 5. An outside manufacturer has offered to produce 84,000 Daks and ship them directly to Andretti's customers. If Andretu Compary accepts this offer, the facilities that it uses to produce Daks would be idle: however, fixed manufacturing overhead costs would be reduced by 30% Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two. thirds of their present amount. What is Andretti's avoidable cost per unt that it should compare to the price quoted by the outside mansfacturer? Complete this question by entering your answers in the tabs below. Assume that Andretti Company has suffident capacty to produce 113,400 0aks each year without any increase in fixed manulactuting oveticad costs, The company could increase its unit sales by 35% above the present 84,000 units each year of It were willing to increase the fixed selling expenses by 5150,000 What is the finindal advantage (disadvantage) of investing an additional s:sp,000 in fixed selling expenses? 5. An outside manufacturer has offered to produce 84.000 Daks and ship them directly to Andretti's customers. If Andretti Company accepts this offer, the facilities that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only twothirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside manufacturer? Complete this question by entering your answers in the tabs below. Assume again that Andreti Compa has sufficlent capacity to produce-113.400. Daks each year. A customer in a forelgn market wants to purchase 29,400 Diks. If Andretti accepts this orderit would have to pay import duties on the Daks of $3.70 per unit and an additional 526,460 for permits and licenses. The only selling costs that would be assoclated with the order would be $1.90 per unit shipping cost. What is the break-even price per unit on this order? (Round your answer to 2 decimat) places.) hirds of their present amount. What is Andretti's avoidable cost per unit that it should compare to the price quoted by the outside nanufacturer? Complete this question by entering your answers in the tabs below. Due to a strike in its supplier's plant, Andretti Company is unablasto purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company has enough material on hand to operate at 2596 of normal levels for the two-month period. As an alternative, Andretti could close its plant down entirely for the two months. If the plant were closed, ficed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period. (Round number of units produced to the nearast whole number. Round your intermediate calculations and finat answers to 2 dedimal places. Any losses or reductions should be indicated by a minus sign.) a. How much total contribution margin will Andretti forgo if it closes the plant for two months? b. How much total fixed cost will the company avold if it closes the plant for two montho? c. What is the financial advantage (disadvantage) of closing the plant for the two-month period? reduced by 20% during the two-month period. a How much total contribution masgin will Andretti forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plart for two months? C. What is the financial advantage (disadvantage) of elosing the plant for the two-month period? d. Shouid Andrettr close the plant for two months? 5. An outside manufacturer has offered to produce 84,000 Daks and ship them directly to Andrettis customers. If Andwett Company accepts this offer, the faciates that it uses to produce Daks would be idle. however, fixed hanufacturing overhead costs wocld be reduced by 30 i. Because the outside manufacturer would pay for all shipping costs, the variable se.ling expenses would be only wo-. thirds of their present amount. What is Andrettis avoidabie cost per unit that it should compare to the price quoted by the outside manutacturer? Complete this question by entering your answers in the tobs below. An outalde manufacture has offered to produce 84,000 paks and whip them dinctly to Andreti's customets. If Aoifetsi copts mould be reduced by 20%. Because the outside manudacturer would pey fot all shipping costs. the vaclable salling expenses mould be only two-thirds of thelr present amount. What is Andreto's avoldable cost per unit that it stiould comp pare plaoes