Question

*PLEASE EXPLAIN THOROUGHLY AND CLEARLY. IF CALCULATOR USED PLEASE EXPLAIN CALCULATIONS. THANK YOU! 2. How much interest will you pay in the 11th year of

*PLEASE EXPLAIN THOROUGHLY AND CLEARLY. IF CALCULATOR USED PLEASE EXPLAIN CALCULATIONS. THANK YOU!

2. How much interest will you pay in the 11th year of a $95,000, 5.5%, 25 year mortgage?

3. How much will you pay into principal on a 6 3/8%, $135,000, 15 year mortgage in the final 2 years of the mortgage.

4. Compute the balance, at 9 1/4 years, on a $155,000, 7,75%, 30 year mortgage.

5. You need a loan of $135,000, but want pay it off as soon as possible. For a 6.25% rate, and 30 year term, what will your required monthly payment be? If you choose to pay $1750 per month on this loan how fast will you be able to pay it off?

6. With a graduated payment mortgage, your initial payments are too low to amortize your loan at the standard rate. If a 125,000 mortgage rate with a 9% interest rate is chosen, and the first year payment is $750/mo., what will the balance be after the first year? How much will you have paid into interest in the first year?

7. You have acquired a $115,000 mortgage at 7.125%, for 30 years. If you make a triple payment on the first anniversary of the mortgage, and then make the required payments from then on, how many fewer mortgage payments will you make than if you just paid your required amount for the life of the loan.

8. A reset mortgage allows for one interest rate reset during the life of the loan. If you have a 5/25, the mortgage rate will be reset after 5 years, to fully amortize at the end of the original 30 year period (i.e. after 23 more years). For a 5 5/8%, $100,000, mortgage, compute the reset payment if the new rate resets to 7 3/8%.

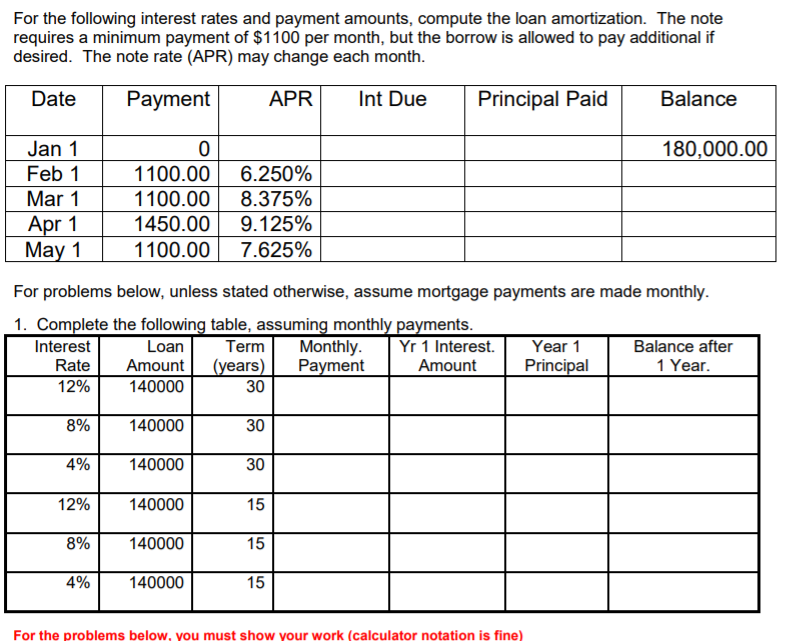

For the following interest rates and payment amounts, compute the loan amortization. The note requires a minimum payment of $1100 per month, but the borrow is allowed to pay additional if desired. The note rate (APR) may change each month Date Principal Paid Payment APR Int Due Balance Jan 1 0 6.250% 180,000.00 Feb 1 1100.00 1100.00 1450.00 Mar 1 8.375% Apr 1 May 1 9.125% 1100.00 7.625% For problems below, unless stated otherwise, assume mortgage payments are made monthly 1. Complete the following table, assuming monthly payments Monthly. Payment Year 1 Principal Balance after 1 Year Interest Loan Term Yr 1 Interest. Rate Amount (years) 30 Amount 12% 140000 8% 140000 30 4% 30 140000 15 12% 140000 8% 140000 15 4% 140000 15 For the problems below, you must show your work (calculator notation is fine)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started