Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain with detail.... Case 1: Capital Budgeting: Competition in the Aircraft Industry In early 2018, Boeing was involved in a titanic struggle with European

Please explain with detail....

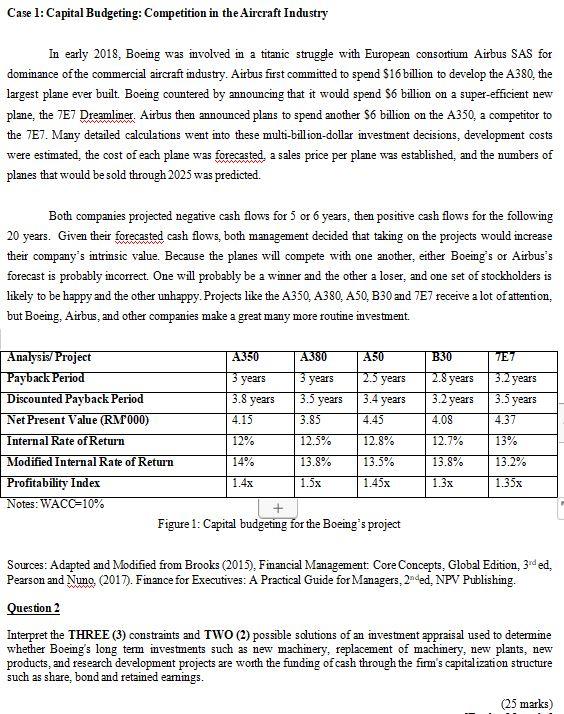

Case 1: Capital Budgeting: Competition in the Aircraft Industry In early 2018, Boeing was involved in a titanic struggle with European consortium Airbus SAS for dominance of the commercial aircraft industry. Airbus first committed to spend $16 billion to develop the A380, the largest plane ever built. Boeing countered by announcing that it would spend $6 billion on a super-efficient new plane, the 7E7 Dreamliner. Airbus then announced plans to spend another $6 billion on the A350, a competitor to the 7E7. Many detailed calculations went into these multi-billion-dollar investment decisions, development costs were estimated, the cost of each plane was forecasted, a sales price per plane was established, and the numbers of planes that would be sold through 2025 was predicted. a Both companies projected negative cash flows for 5 or 6 years, then positive cash flows for the following 20 years. Given their forecasted cash flows, both management decided that taking on the projects would increase their company's intrinsic value. Because the planes will compete with one another, either Boeing's or Airbus's forecast is probably incorrect. One will probably be a winner and the other a loser, and one set of stockholders is likely to be happy and the other unhappy. Projects like the A350, A380, A50, B30 and 7E7 receive a lot of attention, but Boeing, Airbus, and other companies make a great many more routine investment. B30 7E7 2.5 years 3.4 years 2.8 years 3.2 years 3.2 years 3.5 years 3.8 years 3.5 years 4.08 4.37 Analysis/ Project A350 A380 A50 Payback Period 3 years 3 years Discounted Payback Period Net Present Value (RM000) 4.15 3.85 4.45 Internal Rate of Return 12% 12.5% 12.8% Modified Internal Rate of Return 14% 13.8% 13.5% Profitability Index 1.4x 1.5x 1.45x Notes: WACC=10% Figure 1: Capital budgeting for the Boeing's project 12.7% 13% 13.8% 13.2% 1.3x 1.35x Sources: Adapted and Modified from Brooks (2015), Financial Management: Core Concepts, Global Edition, 3-ded, Pearson and Nuno. (2017). Finance for Executives: A Practical Guide for Managers, 2-ded. NPV Publishing. Question 2 Interpret the THREE (3) constraints and TWO (2) possible solutions of an investment appraisal used to determine whether Boeing's long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structure such as share, bond and retained eamings. (25 marks) Case 1: Capital Budgeting: Competition in the Aircraft Industry In early 2018, Boeing was involved in a titanic struggle with European consortium Airbus SAS for dominance of the commercial aircraft industry. Airbus first committed to spend $16 billion to develop the A380, the largest plane ever built. Boeing countered by announcing that it would spend $6 billion on a super-efficient new plane, the 7E7 Dreamliner. Airbus then announced plans to spend another $6 billion on the A350, a competitor to the 7E7. Many detailed calculations went into these multi-billion-dollar investment decisions, development costs were estimated, the cost of each plane was forecasted, a sales price per plane was established, and the numbers of planes that would be sold through 2025 was predicted. a Both companies projected negative cash flows for 5 or 6 years, then positive cash flows for the following 20 years. Given their forecasted cash flows, both management decided that taking on the projects would increase their company's intrinsic value. Because the planes will compete with one another, either Boeing's or Airbus's forecast is probably incorrect. One will probably be a winner and the other a loser, and one set of stockholders is likely to be happy and the other unhappy. Projects like the A350, A380, A50, B30 and 7E7 receive a lot of attention, but Boeing, Airbus, and other companies make a great many more routine investment. B30 7E7 2.5 years 3.4 years 2.8 years 3.2 years 3.2 years 3.5 years 3.8 years 3.5 years 4.08 4.37 Analysis/ Project A350 A380 A50 Payback Period 3 years 3 years Discounted Payback Period Net Present Value (RM000) 4.15 3.85 4.45 Internal Rate of Return 12% 12.5% 12.8% Modified Internal Rate of Return 14% 13.8% 13.5% Profitability Index 1.4x 1.5x 1.45x Notes: WACC=10% Figure 1: Capital budgeting for the Boeing's project 12.7% 13% 13.8% 13.2% 1.3x 1.35x Sources: Adapted and Modified from Brooks (2015), Financial Management: Core Concepts, Global Edition, 3-ded, Pearson and Nuno. (2017). Finance for Executives: A Practical Guide for Managers, 2-ded. NPV Publishing. Question 2 Interpret the THREE (3) constraints and TWO (2) possible solutions of an investment appraisal used to determine whether Boeing's long term investments such as new machinery, replacement of machinery, new plants, new products, and research development projects are worth the funding of cash through the firm's capitalization structure such as share, bond and retained eamings. (25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started