Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain work. I am seeing a lot of answers with 1500 for revenues and am not sure how it goes from 1200 to 1500.

Please explain work. I am seeing a lot of answers with 1500 for revenues and am not sure how it goes from 1200 to 1500. Please explain work instead of just posting the answer. Thank you.

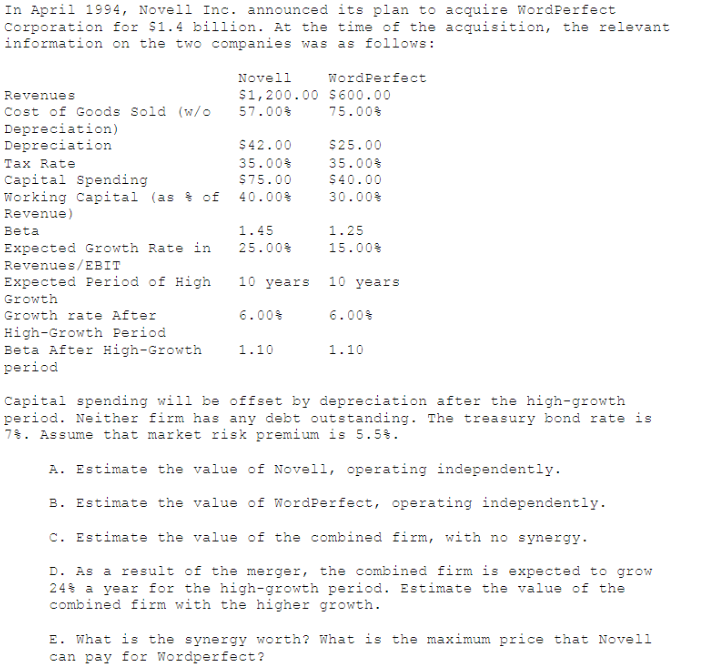

In April 1994, Novell Inc. announced its plan to acquire WordPerfect Corporation for $1.4 billion. At the time of the acquisition, the relevant information on the two companies was as follows: Novell WordPerfect $1,200.00 $600.00 57.00% 75.000 S42.00 35.00% $75.00 40.00% $25.00 35.00% $40.00 30.00% Revenues Cost of Goods Sold (w/o Depreciation) Depreciation Tax Rate Capital Spending Working Capital (as of Revenue) Beta Expected Growth Rate in Revenues/EBIT Expected period of High Growth Growth rate After High-Growth Period Beta After High-Growth period 1.45 25.00% 1.25 15.000 10 years 10 years 6.00% 6.00% 1.10 1.10 Capital spending will be offset by depreciation after the high-growth period. Neither firm has any debt outstanding. The treasury bond rate is 78. Assume that market risk premium is 5.5%. A. Estimate the value of Novell, operating independently. B. Estimate the value of WordPerfect, operating independently. C. Estimate the value of the combined firm, with no synergy. D. As a result of the merger, the combined firm is expected to grow 24% a year for the high-growth period. Estimate the value of the combined firm with the higher growth. n E. What is the synergy worth? What is the maximum price that Novell can pay for Wordperfect? In April 1994, Novell Inc. announced its plan to acquire WordPerfect Corporation for $1.4 billion. At the time of the acquisition, the relevant information on the two companies was as follows: Novell WordPerfect $1,200.00 $600.00 57.00% 75.000 S42.00 35.00% $75.00 40.00% $25.00 35.00% $40.00 30.00% Revenues Cost of Goods Sold (w/o Depreciation) Depreciation Tax Rate Capital Spending Working Capital (as of Revenue) Beta Expected Growth Rate in Revenues/EBIT Expected period of High Growth Growth rate After High-Growth Period Beta After High-Growth period 1.45 25.00% 1.25 15.000 10 years 10 years 6.00% 6.00% 1.10 1.10 Capital spending will be offset by depreciation after the high-growth period. Neither firm has any debt outstanding. The treasury bond rate is 78. Assume that market risk premium is 5.5%. A. Estimate the value of Novell, operating independently. B. Estimate the value of WordPerfect, operating independently. C. Estimate the value of the combined firm, with no synergy. D. As a result of the merger, the combined firm is expected to grow 24% a year for the high-growth period. Estimate the value of the combined firm with the higher growth. n E. What is the synergy worth? What is the maximum price that Novell can pay for WordperfectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started