Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill in blanks. 2. Break down the difference in cost from (1) above into a labor rate variance and a labor efficiency variance. (Indicate

Please fill in blanks.

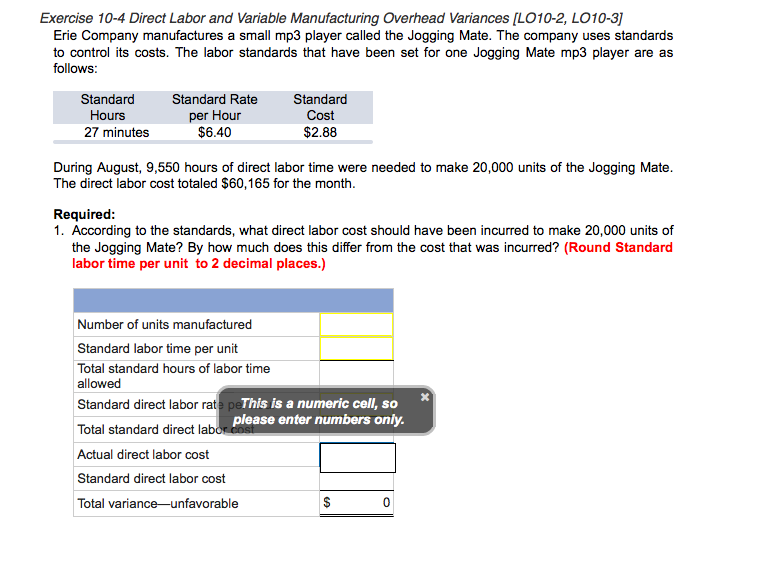

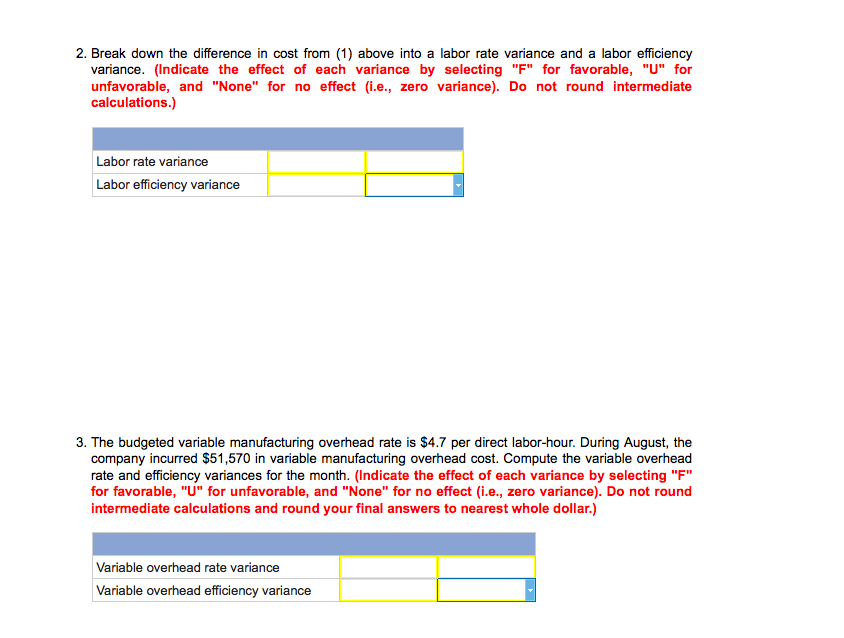

2. Break down the difference in cost from (1) above into a labor rate variance and a labor efficiency variance. (Indicate the effect of each variance by selecting F for favorable, U for unfavorable, and None for no effect (i.e., zero variance). Do not round intermediate calculations.) Labor rate variance Labor efficiency variance 3. The budgeted variable manufacturing overhead rate is $4.7 per direct labor-hour. During August, the company incurred $51,570 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (Indicate the effect of each variance by selecting F for favorable, U for unfavorable, and None for no effect (i.e., zero variance). Do not round intermediate calculations and round your final answers to nearest whole dollar.) Variable overhead rate variance Variable overhead efficiency variance Exercise 10-4 Direct Labor and Variable Manufacturing Overhead Variances (L010-2, L010-3) Erie Company manufactures a small mp3 player called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate mp3 player are as follows: Standard Standard Rate Standard Hours per Hour Cost 27 minutes $6.40 $2.88 During August, 9,550 hours of direct labor time were needed to make 20,000 units of the Jogging Mate. The direct labor cost totaled $60,165 for the month. Required: 1. According to the standards, what direct labor cost should have been incurred to make 20,000 units of the Jogging Mate? By how much does this differ from the cost that was incurred? (Round Standard labor time per unit to 2 decimal places.) Number of units manufactured Standard labor time per unit Total standard hours of labor time allowed Standard direct labor rat Total standard direct lab Actual direct labor cost Standard direct labor cost Total variance-unfavorable This is a numeric cell, so please enter numbers onlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started