Please fill in the blanks and answer 5-6 as well, ignore 7. Will upvote !

Please fill in the blanks and answer 5-6 as well, ignore 7. Will upvote !

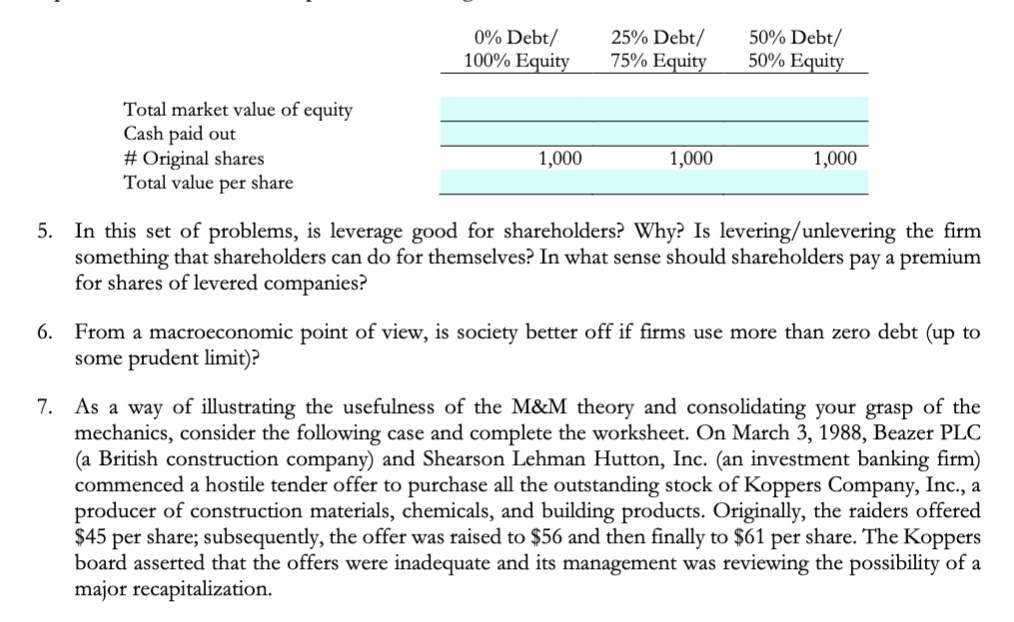

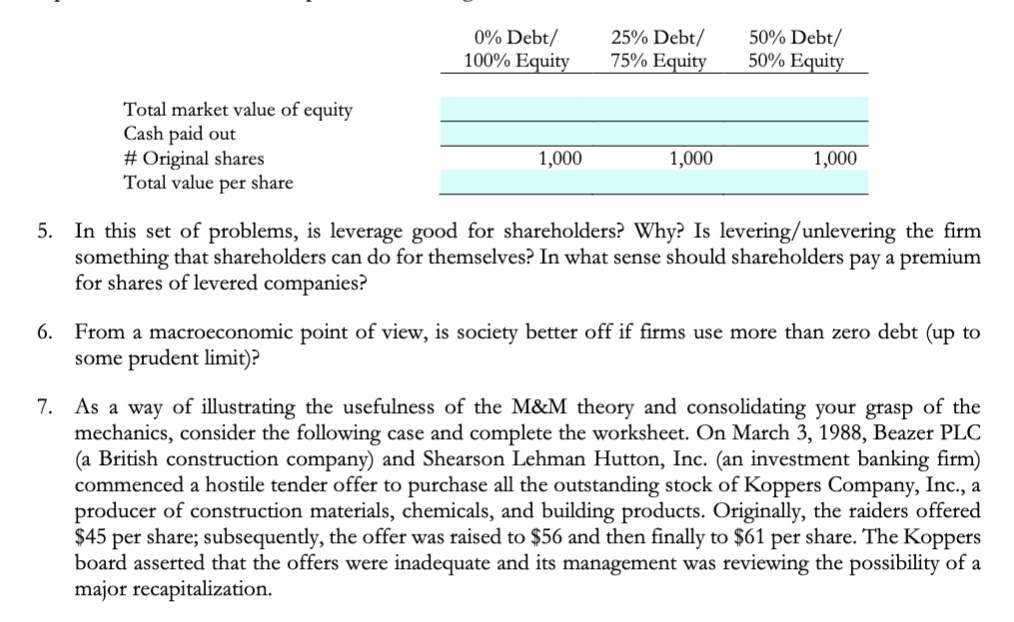

0% Debt/ 100% Equity 25% Debt/ 75% Equity 50% Debt/ 50% Equity Total market value of equity Cash paid out # Original shares Total value per share 1,000 1,000 1,000 5. In this set of problems, is leverage good for shareholders? Why? Is levering/unlevering the firm something that shareholders can do for themselves? In what sense should shareholders pay a premium for shares of levered companies? 6. From a macroeconomic point of view, is society better off if firms use more than zero debt (up to some prudent limit)? 7. As a way of illustrating the usefulness of the M&M theory and consolidating your grasp of the mechanics, consider the following case and complete the worksheet. On March 3, 1988, Beazer PLC (a British construction company) and Shearson Lehman Hutton, Inc. (an investment banking firm) commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally, the raiders offered $45 per share; subsequently, the offer was raised to $56 and then finally to $61 per share. The Koppers board asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization. 0% Debt/ 100% Equity 25% Debt/ 75% Equity 50% Debt/ 50% Equity Total market value of equity Cash paid out # Original shares Total value per share 1,000 1,000 1,000 5. In this set of problems, is leverage good for shareholders? Why? Is levering/unlevering the firm something that shareholders can do for themselves? In what sense should shareholders pay a premium for shares of levered companies? 6. From a macroeconomic point of view, is society better off if firms use more than zero debt (up to some prudent limit)? 7. As a way of illustrating the usefulness of the M&M theory and consolidating your grasp of the mechanics, consider the following case and complete the worksheet. On March 3, 1988, Beazer PLC (a British construction company) and Shearson Lehman Hutton, Inc. (an investment banking firm) commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally, the raiders offered $45 per share; subsequently, the offer was raised to $56 and then finally to $61 per share. The Koppers board asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization

Please fill in the blanks and answer 5-6 as well, ignore 7. Will upvote !

Please fill in the blanks and answer 5-6 as well, ignore 7. Will upvote !