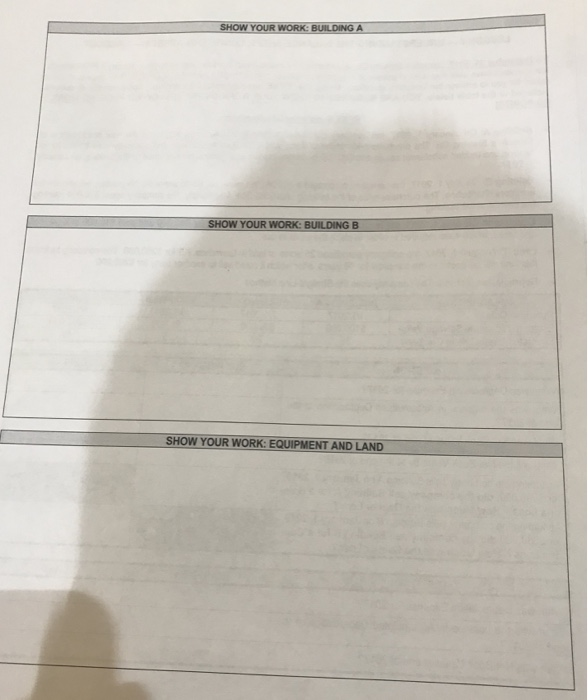

Please fill in the blanks and show your work

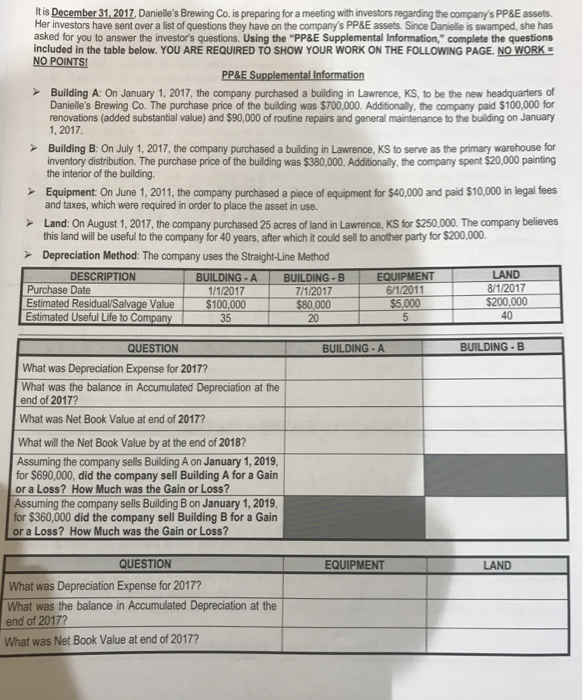

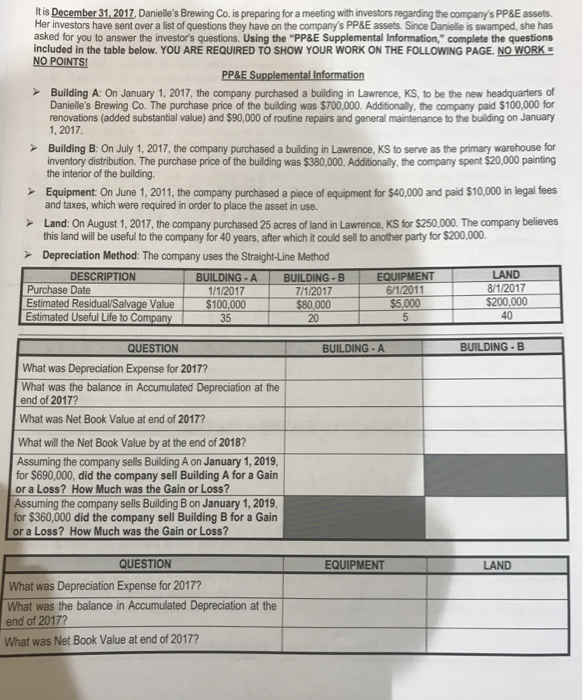

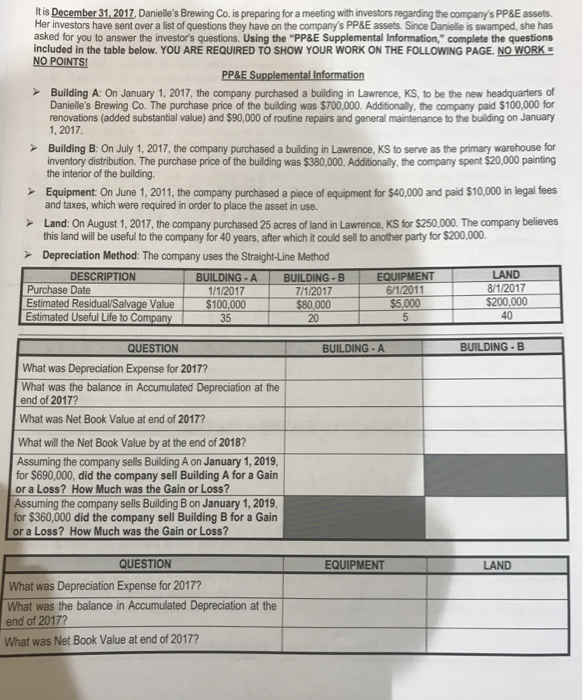

It is December 31,2017, Danielle's Brewing Co. is preparing for a meeting with investors regarding the company's PP&E assets Her investors have sent over a list of questions they have on the company's PP&E assets. Since Danielle is swamped, she has asked for you to answer the investor's questions. Using the "PP&E Supplemental Information," complete the questions included in the table below. YOU ARE REQUIRED TO SHOW YOUR WORK ON THE FOLLOWING PAGE. NO WORK NO POINTS PP&E Supplemental Information Building A: On January 1, 2017, the company purchased a building in Lawrence, KS, to be the new headquarters of Danielle's Brewing Co. The purchase price of the building was $700,000. Additionally, the company paid $100,000 for renovations (added substantial value) and $90,000 of routine repairs and general maintenance to the building on January 1, 2017 Building B: On July 1, 2017, the company purchased a building in Lawrence, KS to serve as the primary warehouse for inventory distribution. The purchase price of the building was $380,000. Additionally, the company spent $20,000 painting the interior of the building Equipment On June 1, 2011, the company purchased a piece of equipment for $40,000 and paid $10,000 in legal fees and taxes, which were required in order to place the asset in use. Land: On August 1,2017, the company purchased 25 acres of land in Lawrence, KS for $250,000. The company believes this land will be useful to the company for 40 years, after which it could sell to another party for $200,000. Depreciation Method: The company uses the Straight-Line Method DESCRIPTION | BULDING-AI BUILDING-B I EQUIPMENT I LAND 8/1/2017 $200,000 40 Purchase Date 6/1/2011 $5,000 /1/2017 7/1/2017 $80,000 20 Estimated Residual/Salvage Value $100,000 35 QUESTION BUILDING-A BUILDING-B What was Depreciation Expense for 2017? What was the balance in Accumulated Depreciation at the end of 2017? What was Net Book Value at end of 2017? What will the Net Book Value by at the end of 2018? Assuming the company sells Building A on January 1,2019, for $690,000, did the company sell Building A for a Gain or a Loss? How Much was the Gain or Loss? Assuming the company sells Building B on January 1, 2019 for $360,000 did the company sell Building B for a Gain or a Loss? How Much was the Gain or Loss? QUESTION EQUIPMENT LAND What was Depreciation Expense for 2017? What was the balance in Accumulated Depreciation at the end of 2017? What was Net Book Value at end of 2017