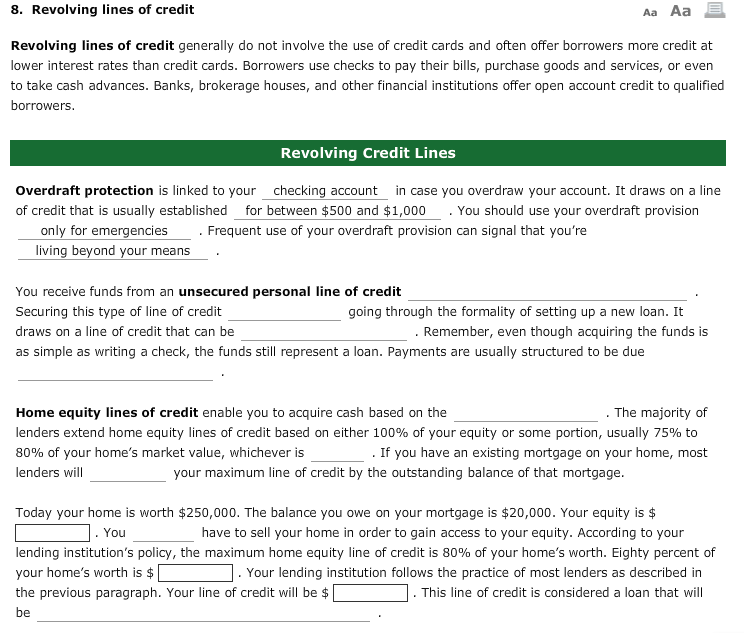

Question

Please fill in the blanks Drop down options for fill in blanks: 1. Checking account, debit card, OR student loan 2. between 500 and 1000

Please fill in the blanks

Drop down options for fill in blanks:

1. Checking account, debit card, OR student loan

2. between 500 and 1000 OR without any dollar limitation

3. only for emergencies OR whenever its convenient

4. living beyond your means OR managing your cash wisely

5. when you decide to write a check for them OR based on a regular disbursement schedule

6. requires OR doesn't require

7. for $25,000 or more OR with no dollar limitation

8. once a month, once a year, OR when you have spare money

9. size of your home OR equity in your home

10. less OR more

11. decrease OR increase

12. do OR do not

13. secured with an additional mortgage on your house OR unsecured

There are no drop down options for the fill in the blank dollar amounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started