Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill in the following information for year 2022 for Alphabet Inc. based on real data. Property and Depreciation If material, separate categories of property,

Please fill in the following information for year 2022 for Alphabet Inc. based on real data.

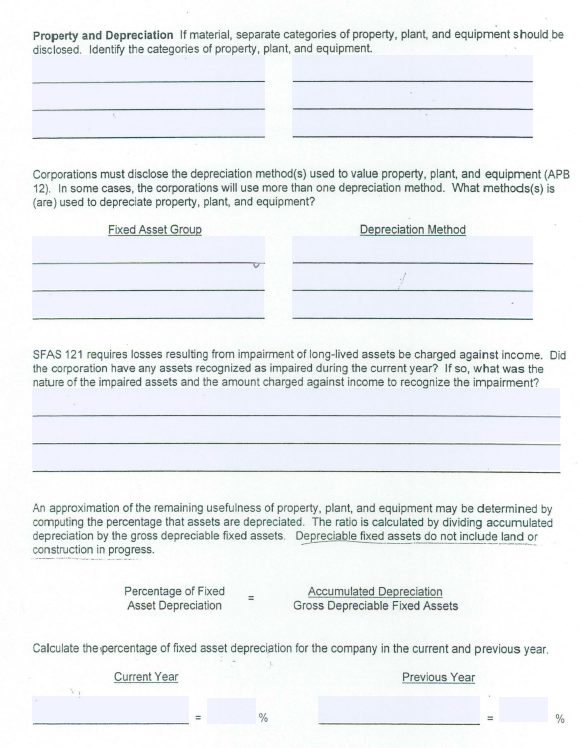

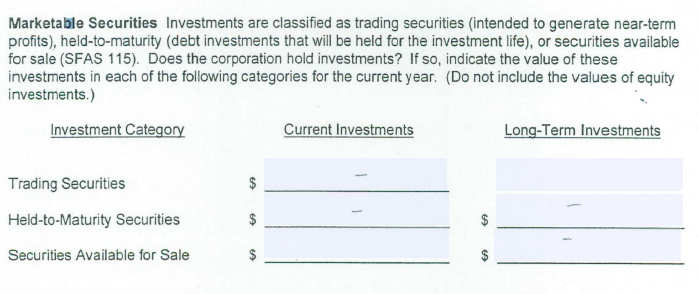

Property and Depreciation If material, separate categories of property, plant, and equipment should be disclosed. Identify the categories of property, plant, and equipment. Corporations must disclose the depreciation method(s) used to value property, plant, and equipment (APB 12). In some cases, the corporations will use more than one depreciation method. What methods(s) is (are) used to depreciate property, plant, and equipment? SFAS 121 requires losses resulting from impairment of long-lived assets be charged against income. Did the corporation have any assets recognized as impaired during the current year? If so, what was the nature of the impaired assets and the amount charged against income to recognize the impairment? An approximation of the remaining usefulness of property, plant, and equipment may be determined by computing the percentage that assets are depreciated. The ratio is calculated by dividing accumulated depreciation by the gross depreciable fixed assets. Depreciable fixed assets do not include land or construction in progress. Calculate the percentage of fixed asset depreciation for the company in the current and previous year. Marketable Securities Investments are classified as trading securities (intended to generate near-term profits), held-to-maturity (debt investments that will be held for the investment life), or securities available for sale (SFAS 115). Does the corporation hold investments? If so, indicate the value of these investments in each of the following categories for the current year. (Do not include the values of equity investments.) Property and Depreciation If material, separate categories of property, plant, and equipment should be disclosed. Identify the categories of property, plant, and equipment. Corporations must disclose the depreciation method(s) used to value property, plant, and equipment (APB 12). In some cases, the corporations will use more than one depreciation method. What methods(s) is (are) used to depreciate property, plant, and equipment? SFAS 121 requires losses resulting from impairment of long-lived assets be charged against income. Did the corporation have any assets recognized as impaired during the current year? If so, what was the nature of the impaired assets and the amount charged against income to recognize the impairment? An approximation of the remaining usefulness of property, plant, and equipment may be determined by computing the percentage that assets are depreciated. The ratio is calculated by dividing accumulated depreciation by the gross depreciable fixed assets. Depreciable fixed assets do not include land or construction in progress. Calculate the percentage of fixed asset depreciation for the company in the current and previous year. Marketable Securities Investments are classified as trading securities (intended to generate near-term profits), held-to-maturity (debt investments that will be held for the investment life), or securities available for sale (SFAS 115). Does the corporation hold investments? If so, indicate the value of these investments in each of the following categories for the current year. (Do not include the values of equity investments.)

Property and Depreciation If material, separate categories of property, plant, and equipment should be disclosed. Identify the categories of property, plant, and equipment. Corporations must disclose the depreciation method(s) used to value property, plant, and equipment (APB 12). In some cases, the corporations will use more than one depreciation method. What methods(s) is (are) used to depreciate property, plant, and equipment? SFAS 121 requires losses resulting from impairment of long-lived assets be charged against income. Did the corporation have any assets recognized as impaired during the current year? If so, what was the nature of the impaired assets and the amount charged against income to recognize the impairment? An approximation of the remaining usefulness of property, plant, and equipment may be determined by computing the percentage that assets are depreciated. The ratio is calculated by dividing accumulated depreciation by the gross depreciable fixed assets. Depreciable fixed assets do not include land or construction in progress. Calculate the percentage of fixed asset depreciation for the company in the current and previous year. Marketable Securities Investments are classified as trading securities (intended to generate near-term profits), held-to-maturity (debt investments that will be held for the investment life), or securities available for sale (SFAS 115). Does the corporation hold investments? If so, indicate the value of these investments in each of the following categories for the current year. (Do not include the values of equity investments.) Property and Depreciation If material, separate categories of property, plant, and equipment should be disclosed. Identify the categories of property, plant, and equipment. Corporations must disclose the depreciation method(s) used to value property, plant, and equipment (APB 12). In some cases, the corporations will use more than one depreciation method. What methods(s) is (are) used to depreciate property, plant, and equipment? SFAS 121 requires losses resulting from impairment of long-lived assets be charged against income. Did the corporation have any assets recognized as impaired during the current year? If so, what was the nature of the impaired assets and the amount charged against income to recognize the impairment? An approximation of the remaining usefulness of property, plant, and equipment may be determined by computing the percentage that assets are depreciated. The ratio is calculated by dividing accumulated depreciation by the gross depreciable fixed assets. Depreciable fixed assets do not include land or construction in progress. Calculate the percentage of fixed asset depreciation for the company in the current and previous year. Marketable Securities Investments are classified as trading securities (intended to generate near-term profits), held-to-maturity (debt investments that will be held for the investment life), or securities available for sale (SFAS 115). Does the corporation hold investments? If so, indicate the value of these investments in each of the following categories for the current year. (Do not include the values of equity investments.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started