Answered step by step

Verified Expert Solution

Question

1 Approved Answer

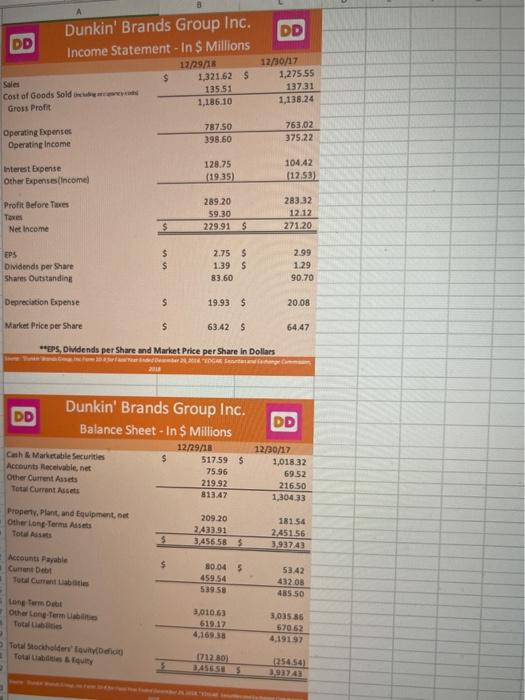

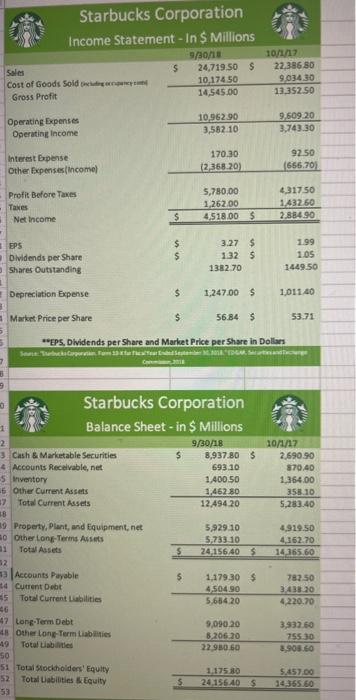

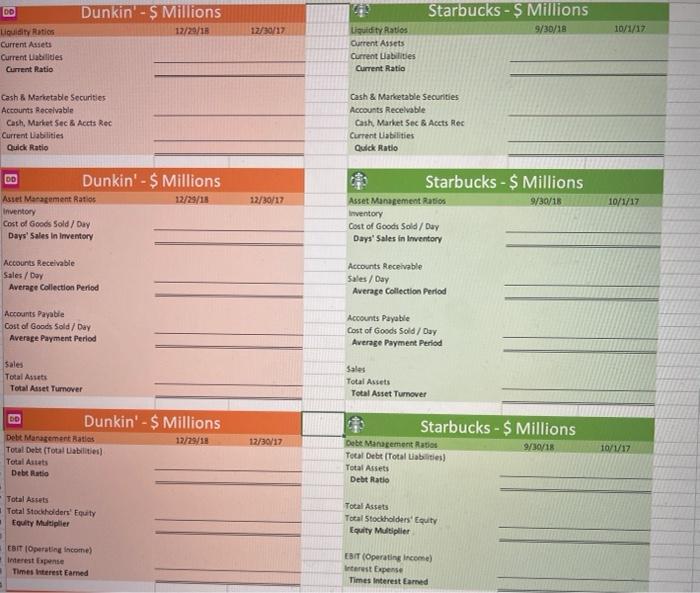

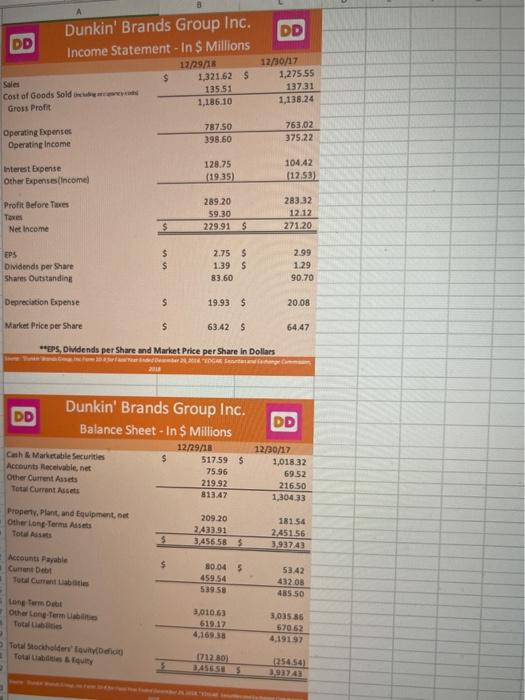

Please fill in the info with the information provided below DD Dunkin' Brands Group Inc. DD Income Statement - In $ Millions 17/9/18 Sales $

Please fill in the info with the information provided below

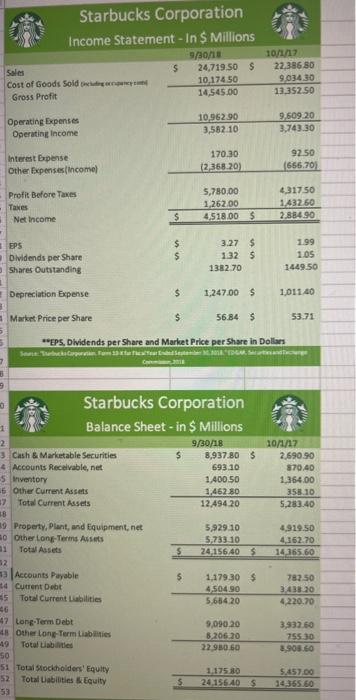

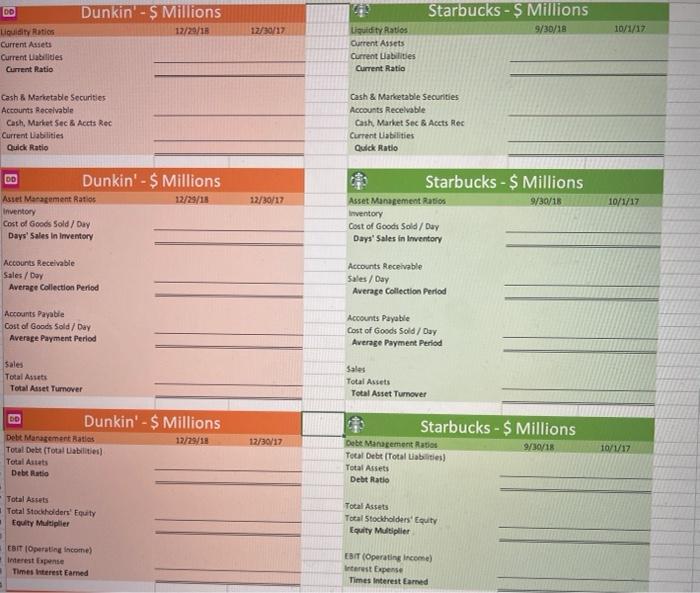

DD Dunkin' Brands Group Inc. DD Income Statement - In $ Millions 17/9/18 Sales $ 1,321.625 Cost of Goods Sold 135.51 Gross Profit 1,186.10 12/30/17 1,275.55 137.31 1.138.24 Operating Expenses Operating Income 787.50 398.50 763.02 375.22 Interest Expense Other Expenses (Income 128.75 (1935) 104.42 (1253) 28332 Profit Before Taxes Taxes Net Income 289 20 59.30 229.91 $ 12.12 271.20 EPS $ $ Dividends per Share Shares Outstanding 2.75 $ 1.39 $ 83.60 2.99 1.29 90.70 Depreciation Expense $ 19.93 $ 20.08 Market Price per Share s 63.42 S 64.47 EPS, Mdends per Share and Market Price per Share In Dollars DD Dunkin' Brands Group Inc. Balance Sheet - In $ Millions DD $ Cash & Marketable Securities Accounts Receivable net Other Current Assets Total Current Assets 12/29/18 517.59 $ 75.96 219.92 813.47 12/30/17 1,018.32 69.52 216.50 1,304.33 Property. Plant, and Equipment, et Other Long Term Assets Totus 209.20 2.43391 3.456585 181.54 2.451.56 3,93743 $ Accounts Payable Current Debt $ 30.045 459.54 539 58 53.42 432 08 485 50 Long Term Debt Other Long Term 3,010.63 512.17 4,169.38 3,03585 620 62 4,19197 Total Stockholders' Totabile 1712.80) 254.54) 3.9374 Starbucks Corporation Income Statement - In $ Millions $ Sales Cost of Goods Sold Gross Profit 9/30/10 24,719.50 $ 10.174.50 14,545.00 10/1/17 22.386.80 903430 13352.50 Operating Expenses Operating Income 10,962.90 3,582.10 9.609 20 3.743.30 Interest pense Other Expenses (incomel 170.30 12 368.20) 92.50 (656.70) Profit Before Taxes Taxes Net Income 5,780.00 1,262.00 4,518.00 $ 4,31750 1.432.50 2.884.90 $ 199 EPS Dividends per Share Shares Outstanding $ $ 3.27 $ 132 $ 1382 70 1.05 1449.50 Depreciation Expense $ 1,247.00 $ 1,011.40 Market Price per Share $ 56.84 5 53.71 **EPS, Dividends per Share and Market Price per Share in Dollars 3 Starbucks Corporation Balance Sheet - in $ Millions 1 9/30/18 8,937.80 $ 693 10 1.400.50 3.462.80 12.494.20 101/17 2.690.90 870.40 1.364.00 358.10 5,283.40 2 3 Cash & Marketable Securities 4 Accounts Receivable, net 5 Inventory 6 Other Current Assets 17 Total Current Assets 18 19 Property, Plant, and Equipment, net 30 Other Long-Term Assets Total Assets 52 13 Accounts Payable 4 Current Debt 55 Total Current Liabilities 5,929.10 5,733 10 24 156.405 4,919,50 4.162.70 14365.60 $ 5 $ 1,179.30 4.504.90 5,654 20 782.50 2.438 10 4.220.70 9,090.20 8206,20 22 980.60 3,932.60 755.30 3.903.60 47 Long-Term Debt Other Long-Term Liabilities 49 Total sites 50 51 Total Stockholders' Equity 52 Total abilities Equity 53 1.175.80 24 156.40S 5.457.00 14.355.60 Dunkin' - $ Millions Starbucks - $ Millions 12/28/18 17/30/17 9/30/18 10/1/17 Liquidity Ratics Current Assets Current bildes Current Ratio Liquidity Ratios Ourrent Assets Current Liabilities Current Ratio Cash & Marketable Securities Accounts Receivable Cash, Market Sec & Acts Rec Current Liabilities Quick Ratio Cash & Marietable Securities Accounts Receivable Cash, Market Sec & Accts Rec Current abilities Quick Ratio DD Dunkin' - $ Millions 12/23/15 12/30/17 10/1/17 Asset Management Ratios Inventory Cost of Goods Sold / Day Days' Sales In Inventory Starbucks - $ Millions Asset Management Ratios 9/30/18 Inventory Cost of Goods Sold / Day Days' Sales In Inventory Accounts Receivable Sales / Day Average Collection Period Accounts Receivable Sales / Day Average Collection Period Accounts Payable Cost of Goods Sold/Day Average Payment Period Accounts Payable Cost of Goods Sold Day Average Payment Period Sales Total Assets Total Asset Turnover Sales Total Assets Total Asset Turnover Dunkin'- $ Millions Starbucks - $ Millions 12/29/18 12/30/17 9/30/18 Debit Management Batas Total Debt (Total abilities) Total Assets Debt Ratio 10/1/17 Debt Management Ratio Total Debt (Total Liabilities) Total Assets Debt Ratio Total Assets Total Stockholders' Equity Equity Multiplier Total Assets Total Stockholders' Equity Equity Multiplier EBIT (Operating Income) Interest Expense Times interest Eamed EBIT (Operating income) Interest Expense Times Interest Eamed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started