Answered step by step

Verified Expert Solution

Question

1 Approved Answer

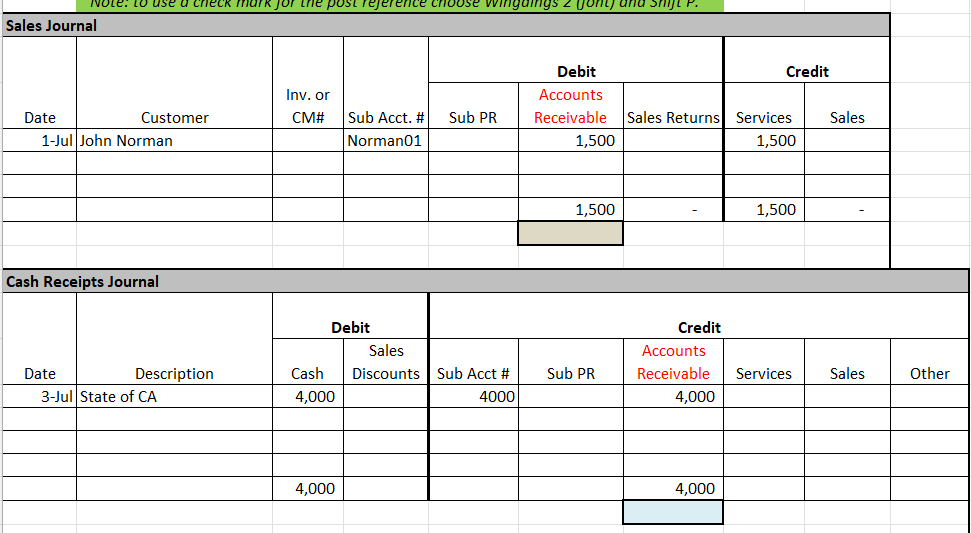

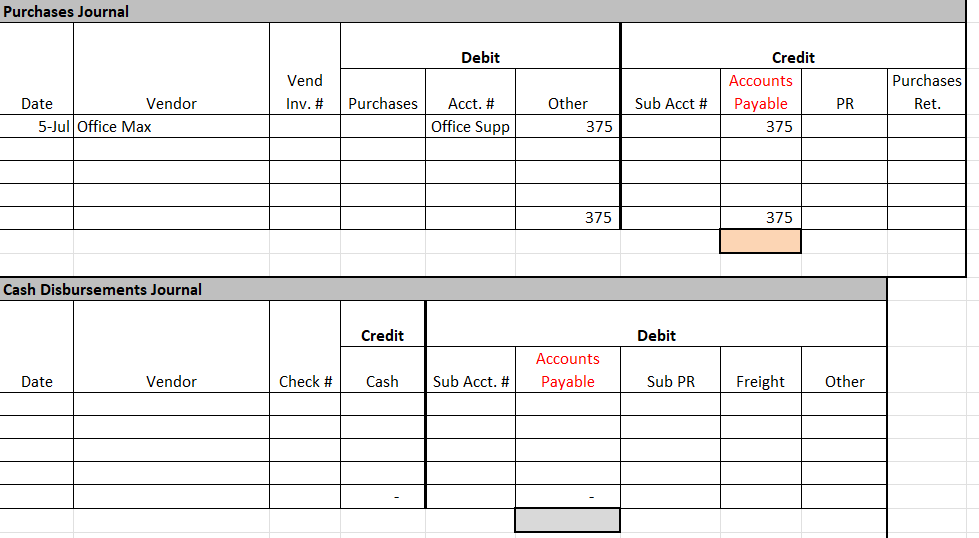

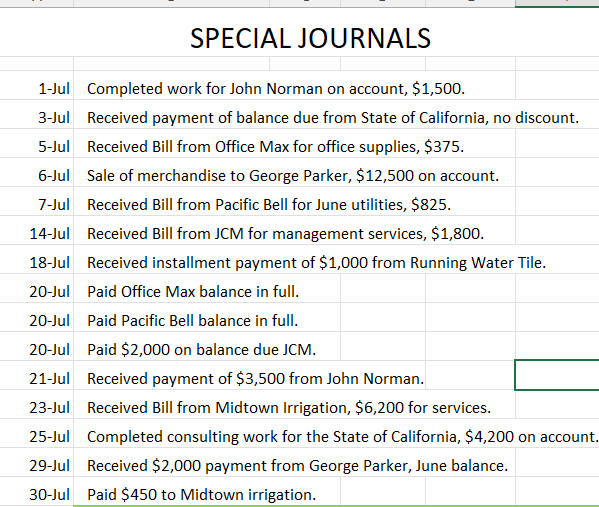

Please fill in the special journals with these transactions listed Note: to use a check mark or the postrejerence choose wingoings 2 von and snijp.

Please fill in the special journals with these transactions listed

Note: to use a check mark or the postrejerence choose wingoings 2 von and snijp. Sales Journal Credit Iny. or Debit Accounts Receivable 1,500 CM# Sub PR Sales Date Customer 1-Jul John Norman Sub Acct. # Norman01 Sales Returns Services 1,500 1,500 1,500 Cash Receipts Journal Debit Sales Cash Discounts Sub Acct # 4,000 4000 Credit Accounts Receivable 4,000 Sub PR Services Sales Other Date Description 3-Jul State of CA 4,000 4,000 Purchases Journal Debit Vend Credit Accounts Payable 375 Purchases Ret. Inv. # Purchases Sub Acct # PR Date Vendor 5-Jul Office Max Acct. # Office Supp Other 375 375 375 Cash Disbursements Journal Credit Debit Accounts Payable Date Vendor Check # Cash Sub Acct. # Sub PR Freight Other SPECIAL JOURNALS 1-Jul Completed work for John Norman on account, $1,500. 3-Jul Received payment of balance due from State of California, no discount. 5-Jul Received Bill from Office Max for office supplies, $375. 6-Jul Sale of merchandise to George Parker, $12,500 on account. 7-Jul Received Bill from Pacific Bell for June utilities, $825. 14-Jul Received Bill from JCM for management services, $1,800. 18-Jul Received installment payment of $1,000 from Running Water Tile. 20-Jul Paid Office Max balance in full. 20-Jul Paid Pacific Bell balance in full. 20-Jul Paid $2,000 on balance due JCM. 21-Jul Received payment of $3,500 from John Norman. 23-Jul Received Bill from Midtown Irrigation, $6,200 for services. 25-Jul Completed consulting work for the State of California, $4,200 on account. 29-Jul Received $2,000 payment from George Parker, June balance. 30-Jul Paid $450 to Midtown irrigationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started