Answered step by step

Verified Expert Solution

Question

1 Approved Answer

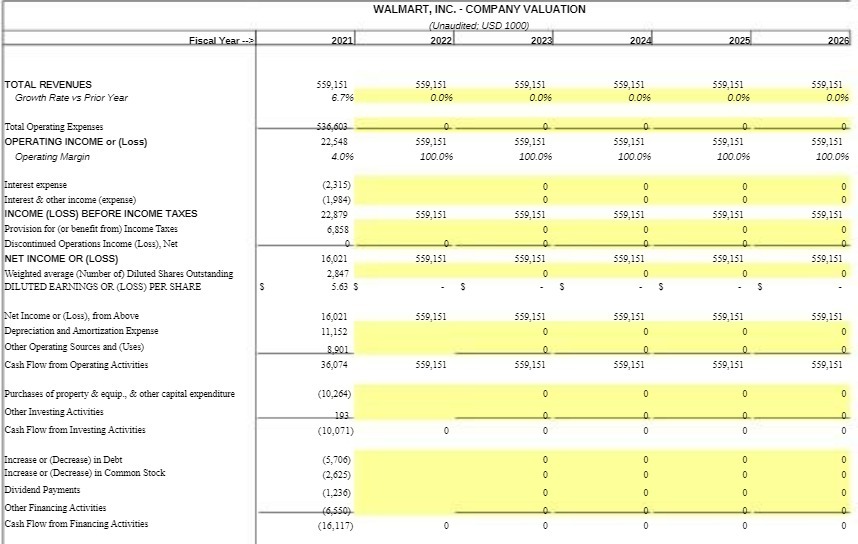

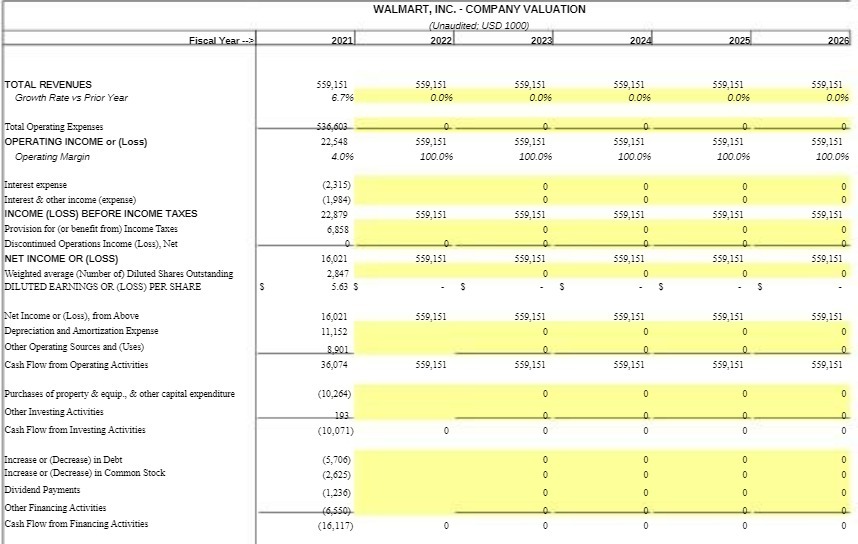

Please fill in the yellow cells Fiscal Year --> 2021 WALMART, INC. - COMPANY VALUATION (Unaudited; USD 1000) 2022 2023 2024 2025 2026 TOTAL REVENUES

Please fill in the yellow cells

Fiscal Year --> 2021 WALMART, INC. - COMPANY VALUATION (Unaudited; USD 1000) 2022 2023 2024 2025 2026 TOTAL REVENUES Growth Rate vs Prior Year Total Operating Expenses OPERATING INCOME or (Loss) Operating Margin Interest expense Interest & other income (expense) INCOME (LOSS) BEFORE INCOME TAXES 559,151 6.7% 559,151 0.0% 559,151 0.0% 559,151 0.0% 559,151 0.0% 559,151 0.0% 536,603 22,548 4.0% 559,151 100.0% 0 559,151 559,151 559,151 559,151 100.0% 100.0% 100.0% 100.0% Provision for (or benefit from) Income Taxes Discontinued Operations Income (Loss), Net NET INCOME OR (LOSS) 16,021 559,151 Weighted average (Number of) Diluted Shares Outstanding 2,847 DILUTED EARNINGS OR (LOSS) PER SHARE S 5.63 $ (2,315) 0 0 0 0 (1,984) 0 0 0 0 22,879 559,151 559,151 559,151 559,151 559,151 6,858 0 0 0 0 0 559,151 559,151 559,151 559,151 0 S S $ Net Income or (Loss), from Above 16,021 559,151 559,151 559,151 559,151 559,151 Depreciation and Amortization Expense 11,152 0 0 0 0 Other Operating Sources and (Uses) 8,901 0 0 0 0 Cash Flow from Operating Activities 36,074 559,151 559,151 559,151 559,151 559,151 Purchases of property & equip., & other capital expenditure (10,264) 0 Other Investing Activities 193 0 Cash Flow from Investing Activities (10,071) 0 0 0 0 0 0 do Increase or (Decrease) in Debt Increase or (Decrease) in Common Stock Dividend Payments Other Financing Activities Cash Flow from Financing Activities (5,706) (2,625) (1,236) (6,550) (16,117) 0 0 0 0 ooo do 0 0 0 0 0 0 opoo0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started