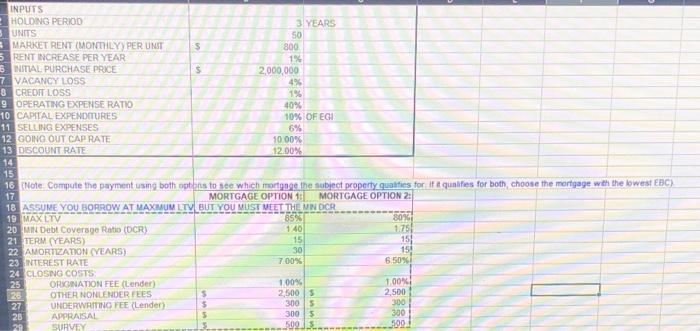

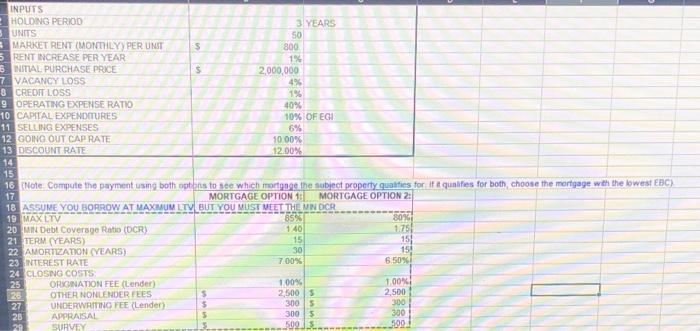

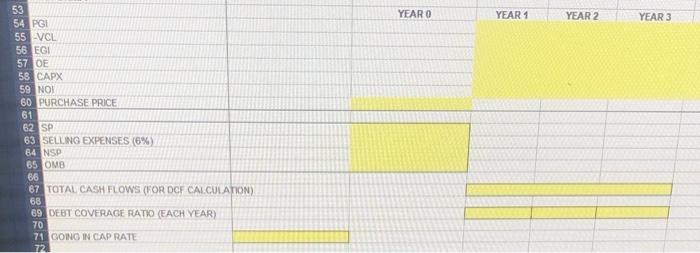

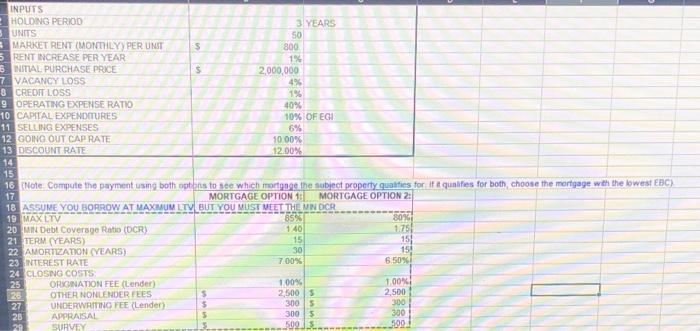

please fill in the yellow. i only need SP calcualtions and below, i dont need proforma.

INPUTS HOLDING PERIOD 3 YEARS UNITS 50 MARKET RENT (MONTHLY PERUNT $ 800 5 RENT INCREASE PER YEAR 1% B INITIAL PURCHASE PRICE 5 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 40% 10 CAPITAL EXPENDMURES 10% OF EGI 11 SELLING EXPENSES 6% 12 GOING OUT CAP RATE 10.00% 13 DISCOUNT RATE 12.00% 14 15 16 (Note: Compute the payment using both options to see which mortgage the subject property quotes for its qualities for both, choose the mortgage with the lowest EDC) 17 MORTGAGE OPTION 1: MORTGAGE OPTION 2: 18 ASSUME YOU BORROW AT MAXIMUM LTV BUT YOU MUST MEET THE MINDCR 19 MAX LTV 85% 80% 20 MIN Debt Coverage Ratio (DCR) 1:40 21 TERM YEARS) 15 15! 22 AMORTIZATION (YEARS) 30 194 23 INTEREST RATE 700% 6.5096 24 CLOSING COSTS 25 ORIGINATION FEE (Lender) 100% 1.009 26 OTHER NONLENDER FEES 2.500 5 2.500 27 UNDERWRITING FEE (Lender) 300s 300 28 APPRAISAL 5 300s 300 24 SURVEY 5095 5001 1.75 M YEAR O YEAR 1 YEAR 2 YEAR 3 53 54 PGI 55 VCL 56 EGI 57 OE 58 CAPX 59 NOI 60 PURCHASE PRICE 61 62 SP 63 SELLING EXPENSES (6%) 64 NSP 65 OME 66 67 TOTAL CASH FLOWS (FOR DCF CALCULATON) 68 69 DEBT COVERAGE RATIO (EACH YEAR) 70 71 GOING IN CAP RATE 72 INPUTS HOLDING PERIOD 3 YEARS UNITS 50 MARKET RENT (MONTHLY PERUNT $ 800 5 RENT INCREASE PER YEAR 1% B INITIAL PURCHASE PRICE 5 2,000,000 7 VACANCY LOSS 4% 8 CREDIT LOSS 1% 9 OPERATING EXPENSE RATIO 40% 10 CAPITAL EXPENDMURES 10% OF EGI 11 SELLING EXPENSES 6% 12 GOING OUT CAP RATE 10.00% 13 DISCOUNT RATE 12.00% 14 15 16 (Note: Compute the payment using both options to see which mortgage the subject property quotes for its qualities for both, choose the mortgage with the lowest EDC) 17 MORTGAGE OPTION 1: MORTGAGE OPTION 2: 18 ASSUME YOU BORROW AT MAXIMUM LTV BUT YOU MUST MEET THE MINDCR 19 MAX LTV 85% 80% 20 MIN Debt Coverage Ratio (DCR) 1:40 21 TERM YEARS) 15 15! 22 AMORTIZATION (YEARS) 30 194 23 INTEREST RATE 700% 6.5096 24 CLOSING COSTS 25 ORIGINATION FEE (Lender) 100% 1.009 26 OTHER NONLENDER FEES 2.500 5 2.500 27 UNDERWRITING FEE (Lender) 300s 300 28 APPRAISAL 5 300s 300 24 SURVEY 5095 5001 1.75 M YEAR O YEAR 1 YEAR 2 YEAR 3 53 54 PGI 55 VCL 56 EGI 57 OE 58 CAPX 59 NOI 60 PURCHASE PRICE 61 62 SP 63 SELLING EXPENSES (6%) 64 NSP 65 OME 66 67 TOTAL CASH FLOWS (FOR DCF CALCULATON) 68 69 DEBT COVERAGE RATIO (EACH YEAR) 70 71 GOING IN CAP RATE 72