please fill in with a correct answer! thanks!

please fill in with a correct answer! thanks!

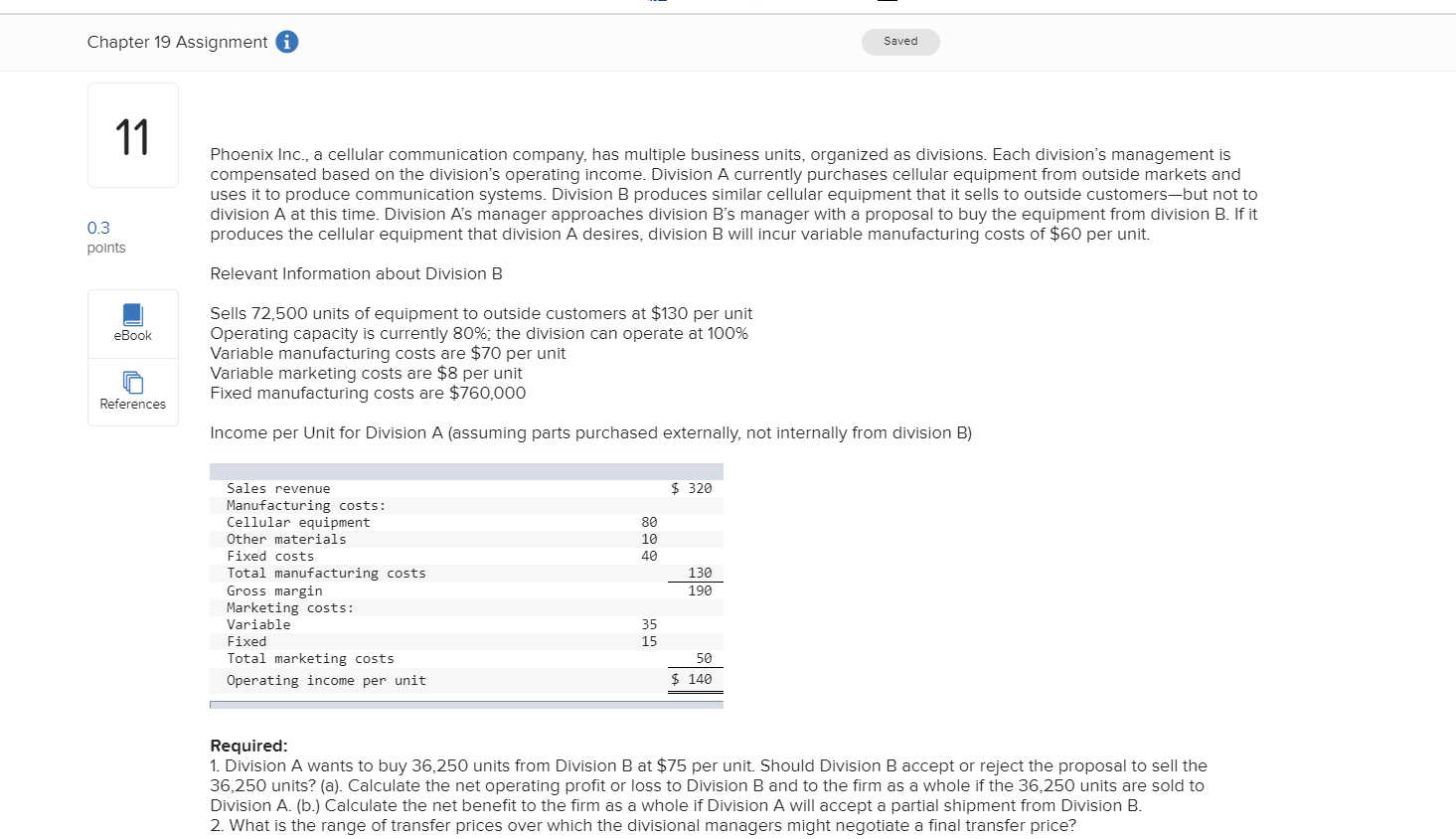

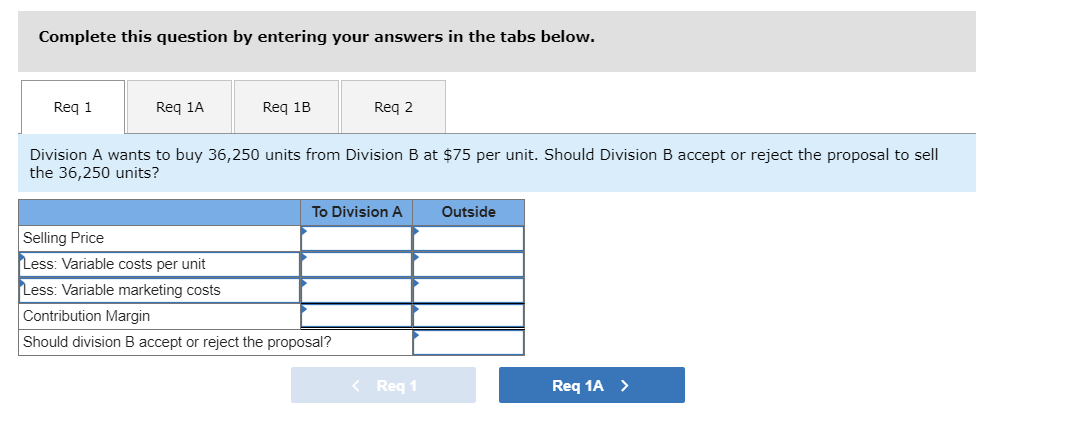

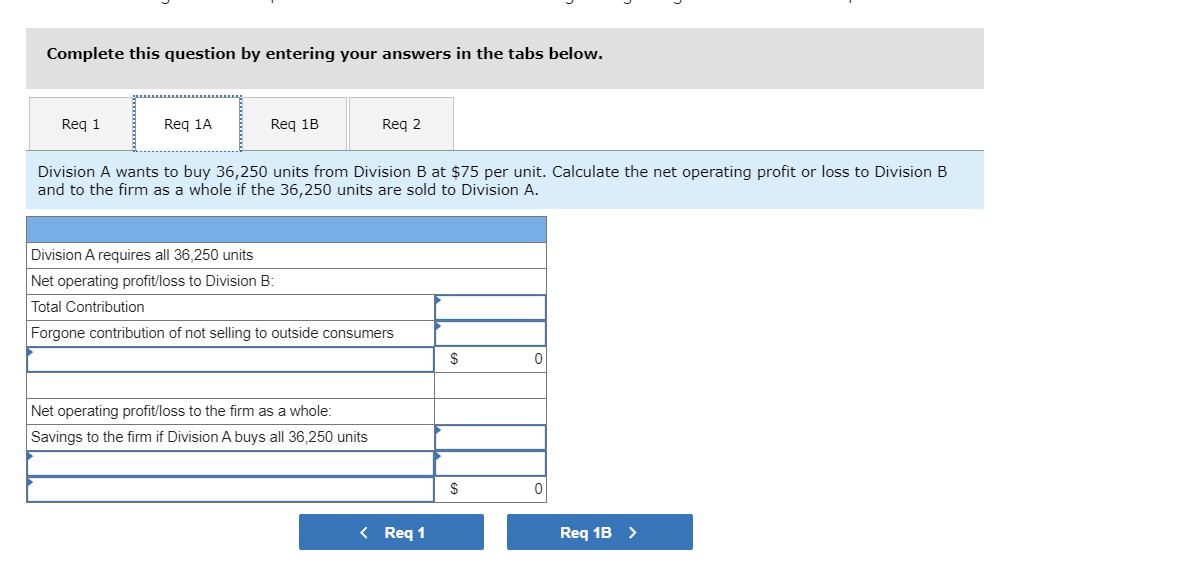

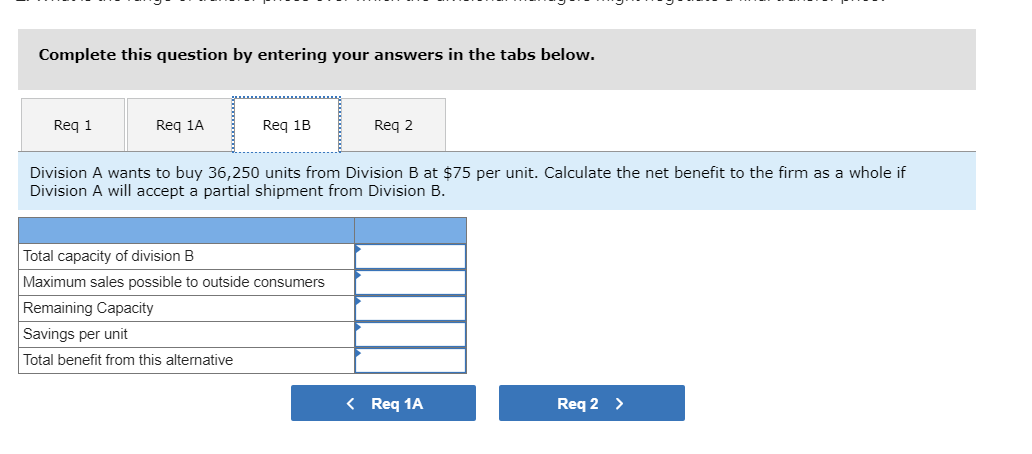

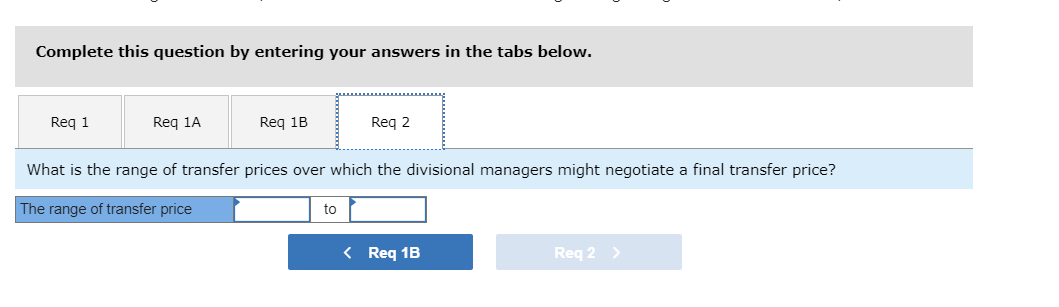

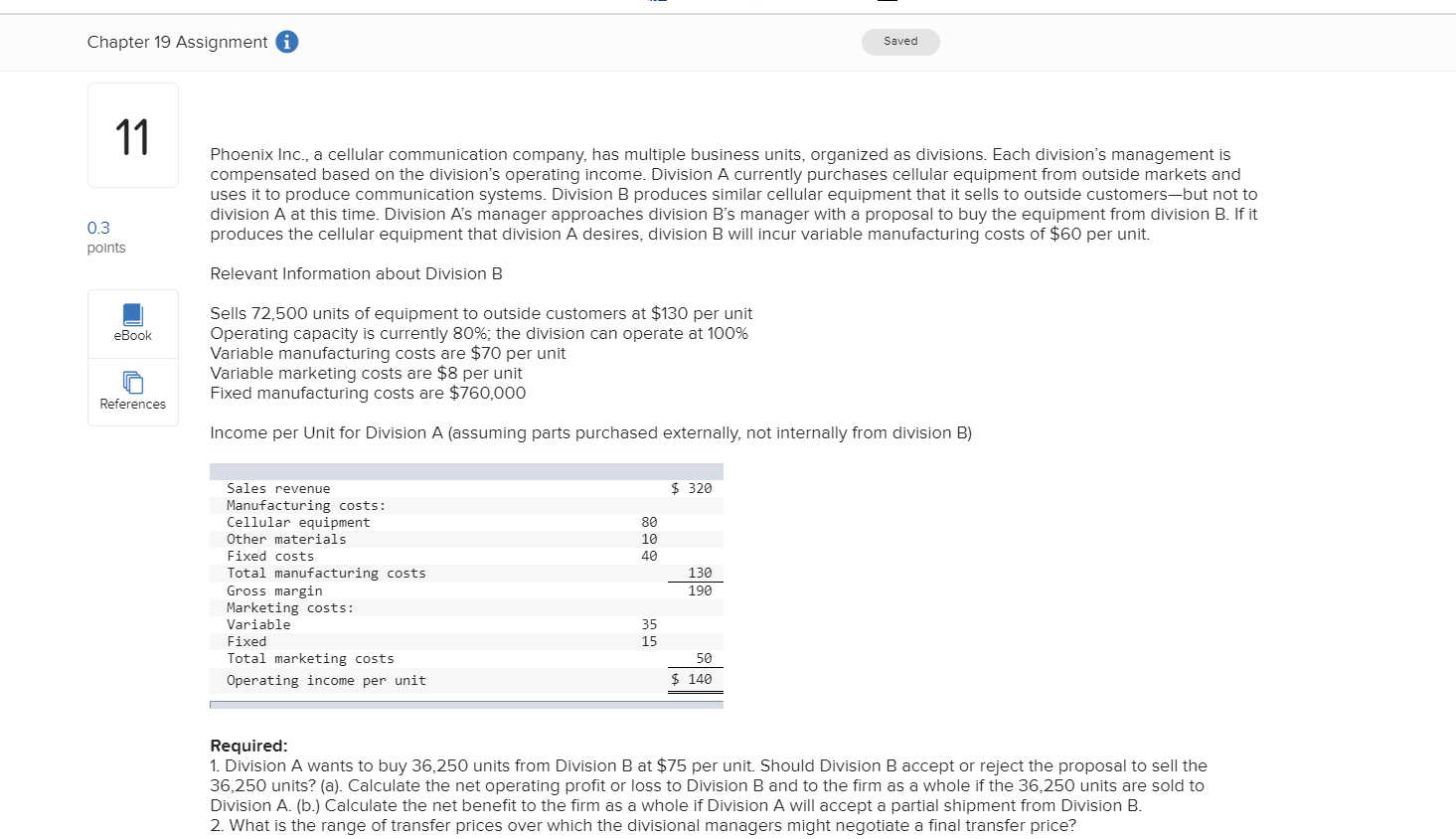

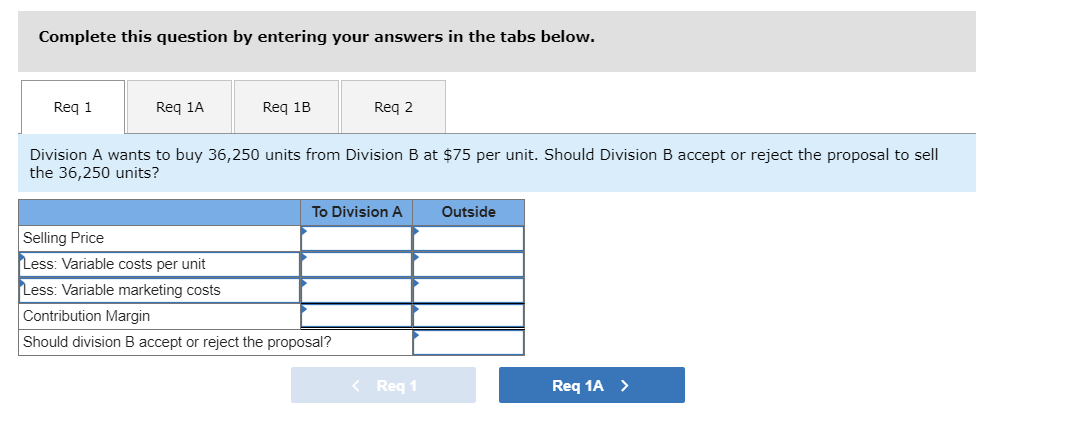

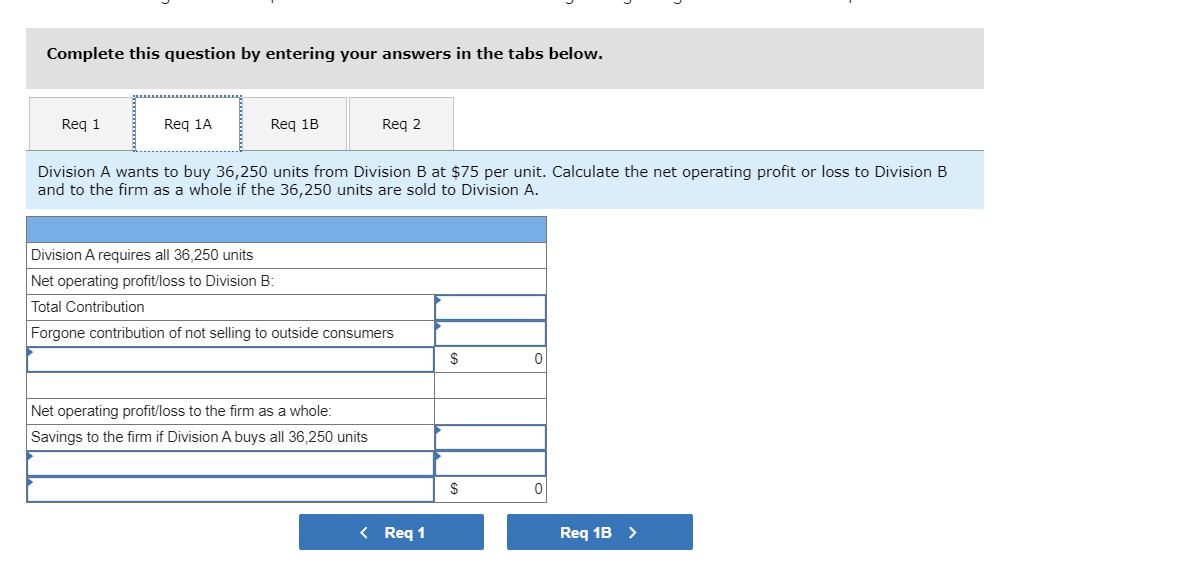

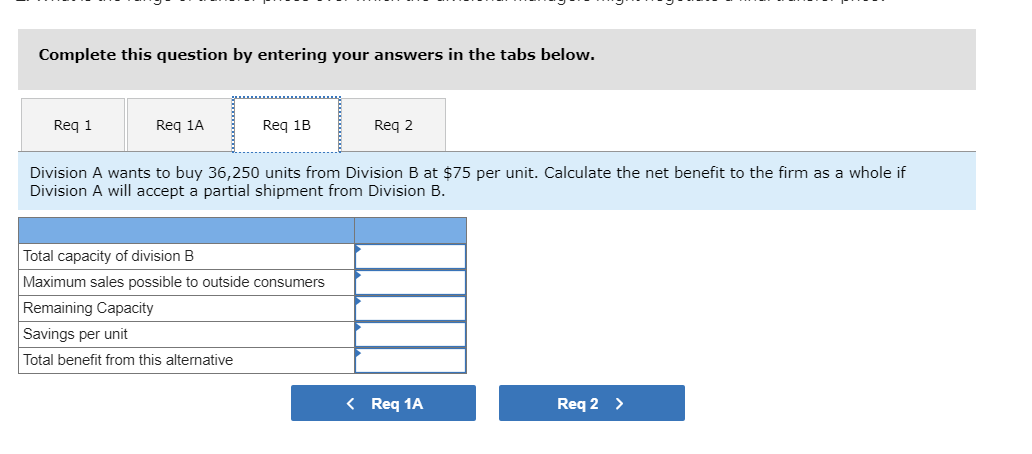

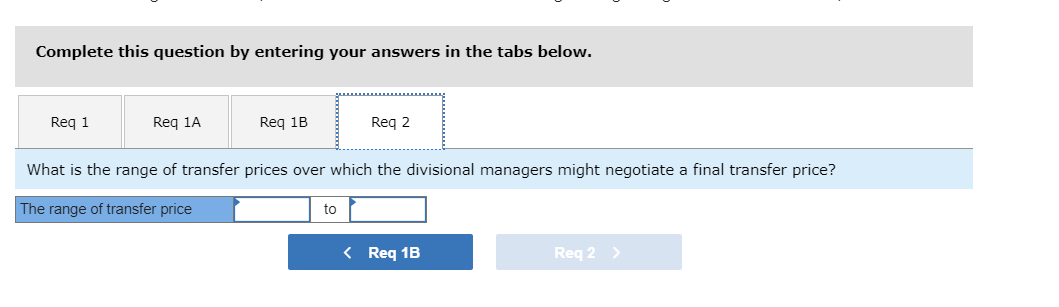

Chapter 19 Assignment A Saved Phoenix Inc., a cellular communication company, has multiple business units, organized as divisions. Each division's management is compensated based on the division's operating income. Division A currently purchases cellular equipment from outside markets and uses it to produce communication systems. Division B produces similar cellular equipment that it sells to outside customers-but not to division A at this time. Division A's manager approaches division B's manager with a proposal to buy the equipment from division B. If it produces the cellular equipment that division A desires, division B will incur variable manufacturing costs of $60 per unit. 0.3 points Relevant Information about Division B eBook Sells 72,500 units of equipment to outside customers at $130 per unit Operating capacity is currently 80%; the division can operate at 100% Variable manufacturing costs are $70 per unit Variable marketing costs are $8 per unit Fixed manufacturing costs are $760,000 References Income per Unit for Division A (assuming parts purchased externally, not internally from division B) $ 320 130 Sales revenue Manufacturing costs: Cellular equipment Other materials Fixed costs Total manufacturing costs Gross margin Marketing costs: Variable Fixed Total marketing costs Operating income per unit $ 140 Required: 1. Division A wants to buy 36,250 units from Division B at $75 per unit. Should Division B accept or reject the proposal to sell the 36,250 units? (a). Calculate the net operating profit or loss to Division B and to the firm as a whole if the 36,250 units are sold to Division A. (b.) Calculate the net benefit to the firm as a whole if Division A will accept a partial shipment from Division B. 2. What is the range of transfer prices over which the divisional managers might negotiate a final transfer price? Complete this question by entering your answers in the tabs below. Req 1 Req 1A Req 1B Req 2 Division A wants to buy 36,250 units from Division B at $75 per unit. Should Division B accept or reject the proposal to sell the 36,250 units? Outside To Division A Selling Price Less: Variable costs per unit Less: Variable marketing costs Contribution Margin Should division B accept or reject the proposal? Reg 1 Req 1A > Complete this question by entering your answers in the tabs below. Req 1 Req 1A Req 1B Req 2 Division A wants to buy 36,250 units from Division B at $75 per unit. Calculate the net operating profit or loss to Division B and to the firm as a whole if the 36,250 units are sold to Division A. Division Arequires all 36,250 units Net operating profit/loss to Division B: Total Contribution Forgone contribution of not selling to outside consumers Net operating profit/loss to the firm as a whole: Savings to the firm if Division A buys all 36,250 units Complete this question by entering your answers in the tabs below. Req 1 Req 1A Req 1B Req 2 Division A wants to buy 36,250 units from Division B at $75 per unit. Calculate the net benefit to the firm as a whole if Division A will accept a partial shipment from Division B. Total capacity of division B Maximum sales possible to outside consumers Remaining Capacity Savings per unit Total benefit from this alternative Complete this question by entering your answers in the tabs below. Req 1 Req 1A Req 1B Req 2 What is the range of transfer prices over which the divisional managers might negotiate a final transfer price? The range of transfer price to

please fill in with a correct answer! thanks!

please fill in with a correct answer! thanks!