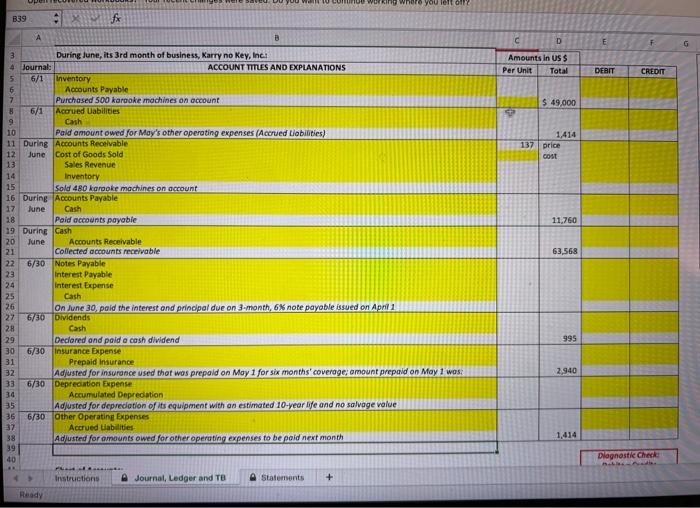

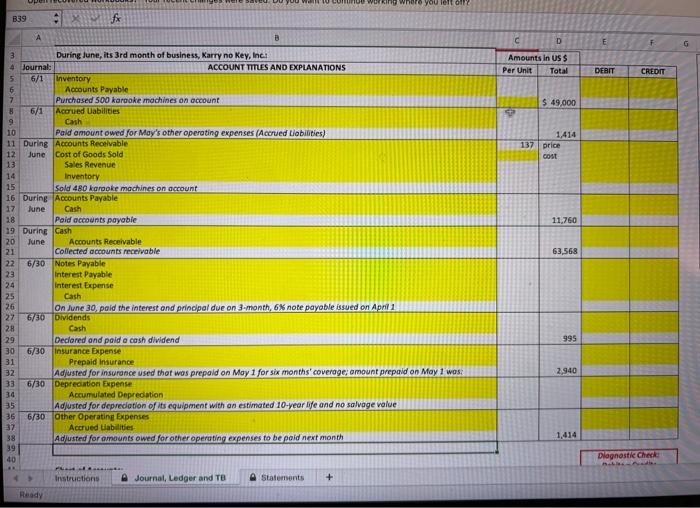

please fill in yellow areas and provide formulas.

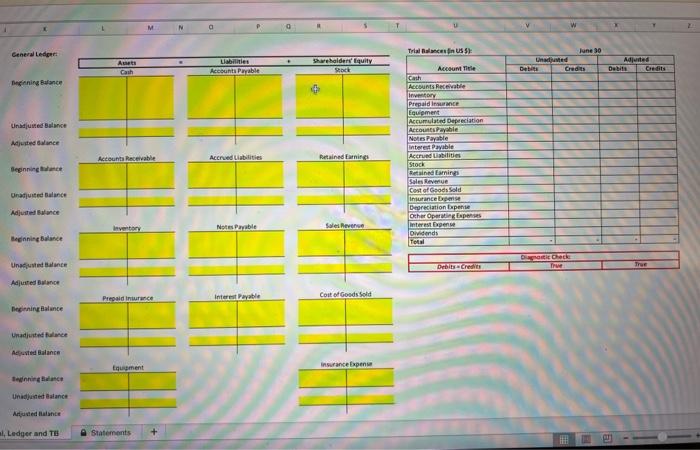

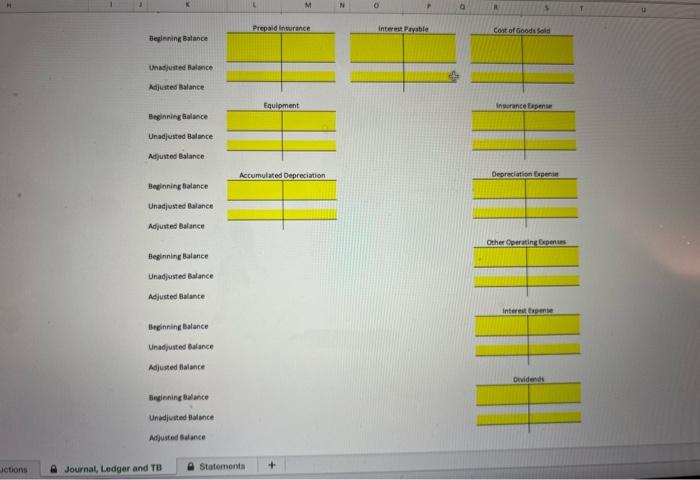

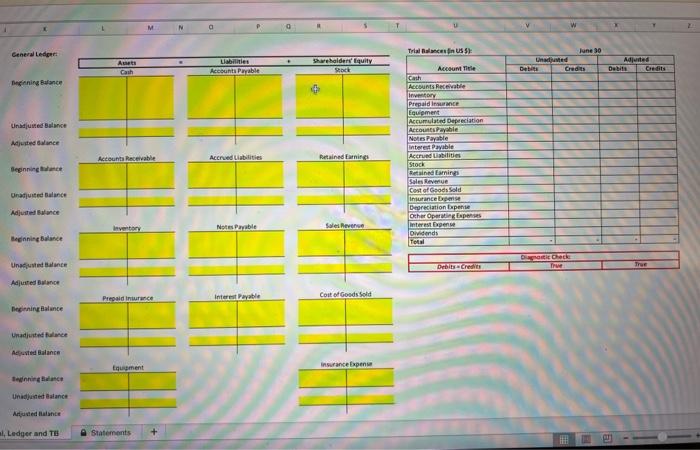

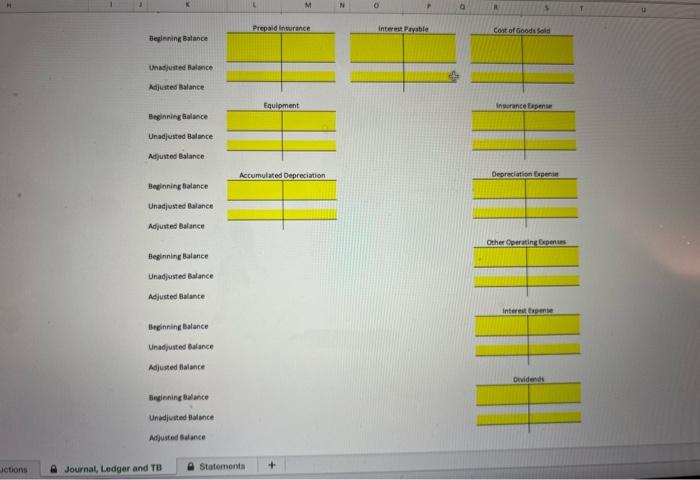

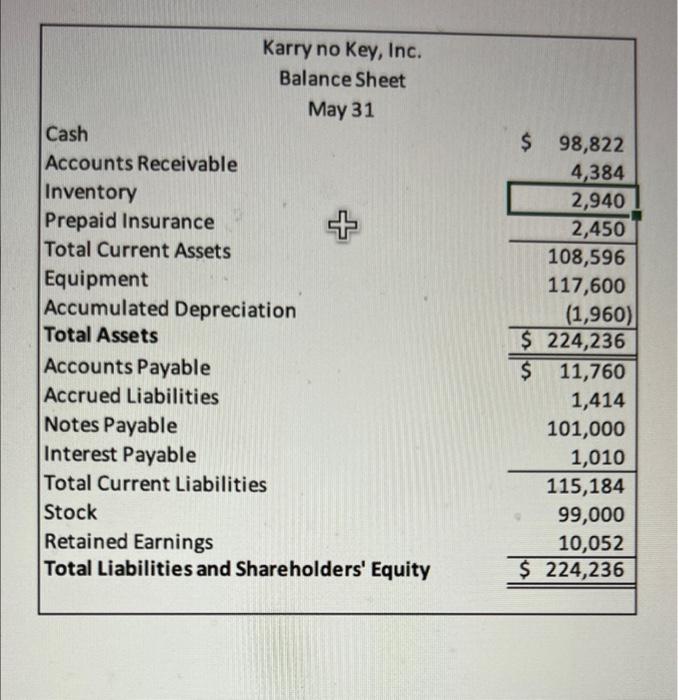

B39 A 3 4 Journal: 5 6/1 Inventory 6 7 8 9 10 11 During 12 June 13 14 15 16 During 17 June 18 During 20 June 21 22 6/30 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 INM4 in S :xfx B During June, its 3rd month of business, Karry no Key, Inc.: ACCOUNT TITLES AND EXPLANATIONS Accounts Payable Purchased 500 karaoke machines on account 6/1 Accrued Uabilities Cash Paid amount owed for May's other operating expenses (Accrued Liabilities) Accounts Receivable Cost of Goods Sold Sales Revenue Inventory Sold 480 karaoke machines on account Accounts Payable Cash Paid accounts payable Cash Accounts Receivable Collected accounts receivable Notes Payable Interest Payable Interest Expense Cash On June 30, paid the interest and principal due on 3-month, 6% note payable issued on April 1 Dividends 6/30 Cash Declared and paid a cash dividend 6/30 Insurance Expense Prepaid Insurance Adjusted for insurance used that was prepaid on May 1 for six months' coverage; amount prepaid on May 1 was: Depreciation Expense 6/30 Accumulated Depreciation Adjusted for depreciation of its equipment with an estimated 10-year life and no salvage value 6/30 Other Operating Expenses Accrued Liabilities Adjusted for amounts owed for other operating expenses to be paid next month Add Instructions A Journal, Ledger and TB Statements + working where you left off? Ready D Amounts in US $ Per Unit Total $ 49,000 SP 1,414 137 price cost 11,760 63,568 995 2,940 1,414 E DEBIT CREDIT Diagnostic Check Achten Puedias General Ledger Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Ajusted Balance al, Ledger and TB Assets Cash Accounts Receivable Inventory Prepaid Insurance Equipment Statements Liabilities Accounts Payable Accrued Liabilities Notes Payable Interest Payable 9 . Shareholders' Equity Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Trial Balance in US 5): Account Title Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Notes Payable interest Payable Accrued Liabilities Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Depreciation Expense Other Operating Expenses Interest Expense Dividends Total Debits Credits Unadjusted Debit W June 30 Credits Diagnostic Check True Adjusted Debits Credits True H actions Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Journal, Ledger and TB M Prepaid Insurance Equipment Accumulated Depreciation Statements 0 interest Payable 6 R $ Cost of Goods Sold insurance Expense Depreciation Expense Other Operating Expenses Interest Expense Dividends Karry no Key, Inc. Balance Sheet May 31 Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Equipment Accumulated Depreciation Total Assets Accounts Payable Accrued Liabilities Notes Payable Interest Payable Total Current Liabilities Stock Retained Earnings Total Liabilities and Shareholders' Equity $ 98,822 4,384 2,940 2,450 108,596 117,600 (1,960) $ 224,236 $ 11,760 1,414 101,000 1,010 115,184 99,000 10,052 $ 224,236 B39 A 3 4 Journal: 5 6/1 Inventory 6 7 8 9 10 11 During 12 June 13 14 15 16 During 17 June 18 During 20 June 21 22 6/30 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 INM4 in S :xfx B During June, its 3rd month of business, Karry no Key, Inc.: ACCOUNT TITLES AND EXPLANATIONS Accounts Payable Purchased 500 karaoke machines on account 6/1 Accrued Uabilities Cash Paid amount owed for May's other operating expenses (Accrued Liabilities) Accounts Receivable Cost of Goods Sold Sales Revenue Inventory Sold 480 karaoke machines on account Accounts Payable Cash Paid accounts payable Cash Accounts Receivable Collected accounts receivable Notes Payable Interest Payable Interest Expense Cash On June 30, paid the interest and principal due on 3-month, 6% note payable issued on April 1 Dividends 6/30 Cash Declared and paid a cash dividend 6/30 Insurance Expense Prepaid Insurance Adjusted for insurance used that was prepaid on May 1 for six months' coverage; amount prepaid on May 1 was: Depreciation Expense 6/30 Accumulated Depreciation Adjusted for depreciation of its equipment with an estimated 10-year life and no salvage value 6/30 Other Operating Expenses Accrued Liabilities Adjusted for amounts owed for other operating expenses to be paid next month Add Instructions A Journal, Ledger and TB Statements + working where you left off? Ready D Amounts in US $ Per Unit Total $ 49,000 SP 1,414 137 price cost 11,760 63,568 995 2,940 1,414 E DEBIT CREDIT Diagnostic Check Achten Puedias General Ledger Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Ajusted Balance al, Ledger and TB Assets Cash Accounts Receivable Inventory Prepaid Insurance Equipment Statements Liabilities Accounts Payable Accrued Liabilities Notes Payable Interest Payable 9 . Shareholders' Equity Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Trial Balance in US 5): Account Title Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Notes Payable interest Payable Accrued Liabilities Stock Retained Earnings Sales Revenue Cost of Goods Sold Insurance Expense Depreciation Expense Other Operating Expenses Interest Expense Dividends Total Debits Credits Unadjusted Debit W June 30 Credits Diagnostic Check True Adjusted Debits Credits True H actions Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Beginning Balance Unadjusted Balance Adjusted Balance Journal, Ledger and TB M Prepaid Insurance Equipment Accumulated Depreciation Statements 0 interest Payable 6 R $ Cost of Goods Sold insurance Expense Depreciation Expense Other Operating Expenses Interest Expense Dividends Karry no Key, Inc. Balance Sheet May 31 Cash Accounts Receivable Inventory Prepaid Insurance Total Current Assets Equipment Accumulated Depreciation Total Assets Accounts Payable Accrued Liabilities Notes Payable Interest Payable Total Current Liabilities Stock Retained Earnings Total Liabilities and Shareholders' Equity $ 98,822 4,384 2,940 2,450 108,596 117,600 (1,960) $ 224,236 $ 11,760 1,414 101,000 1,010 115,184 99,000 10,052 $ 224,236