please fill oit the t accounts

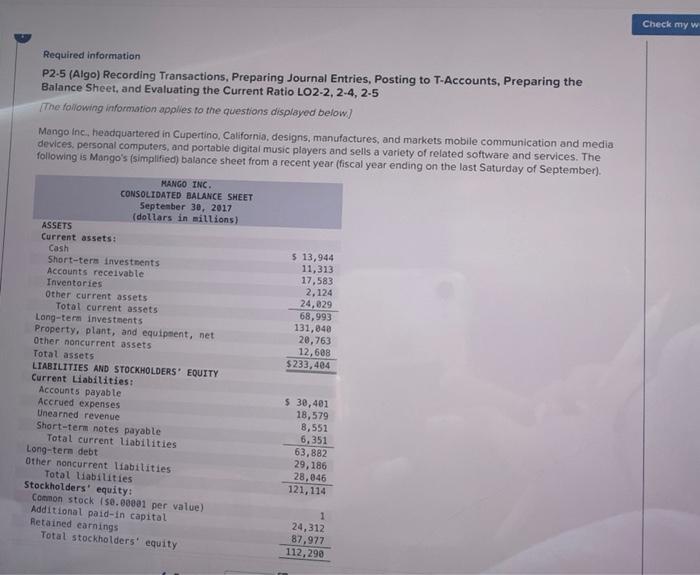

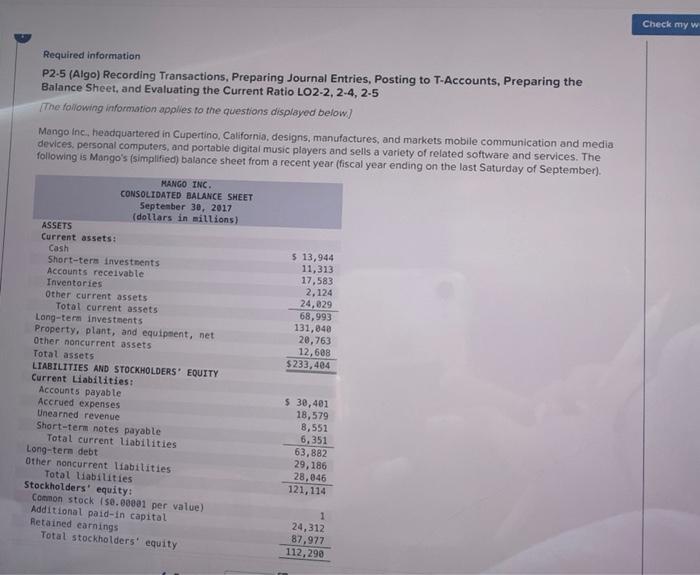

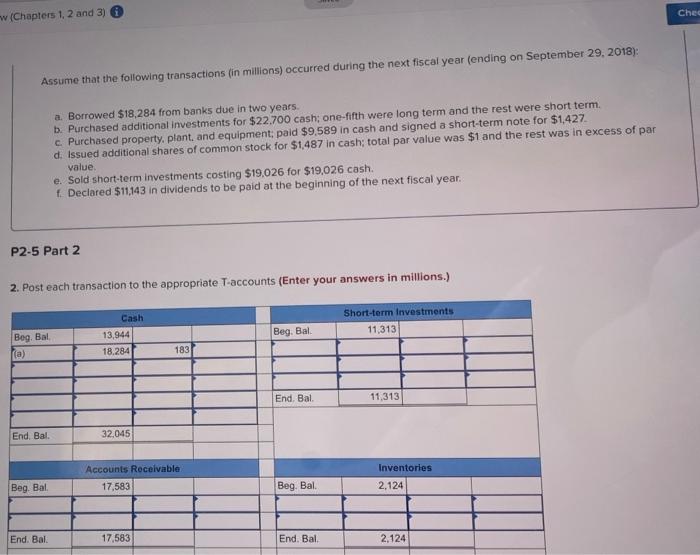

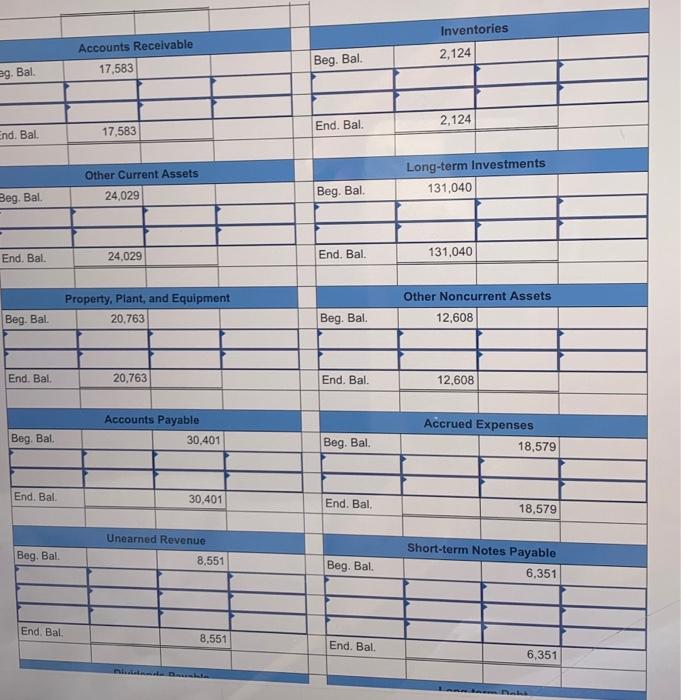

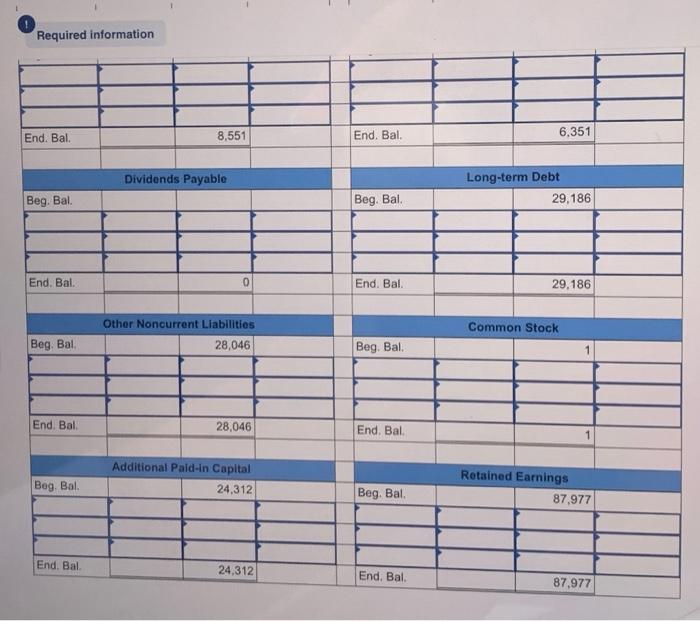

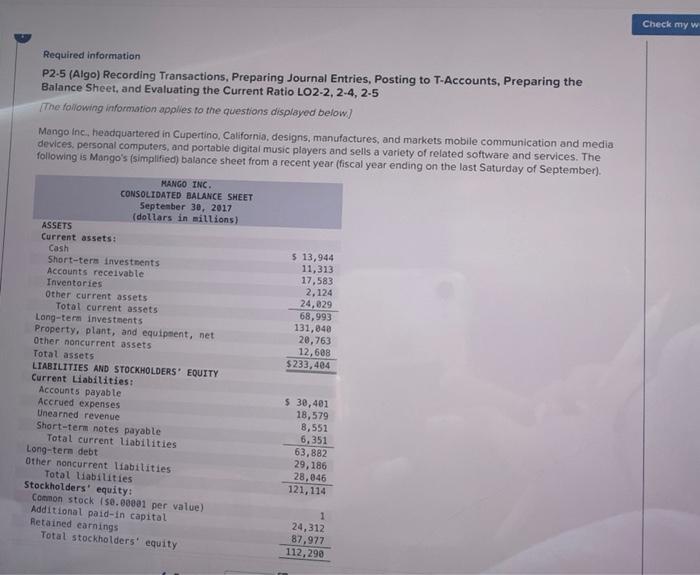

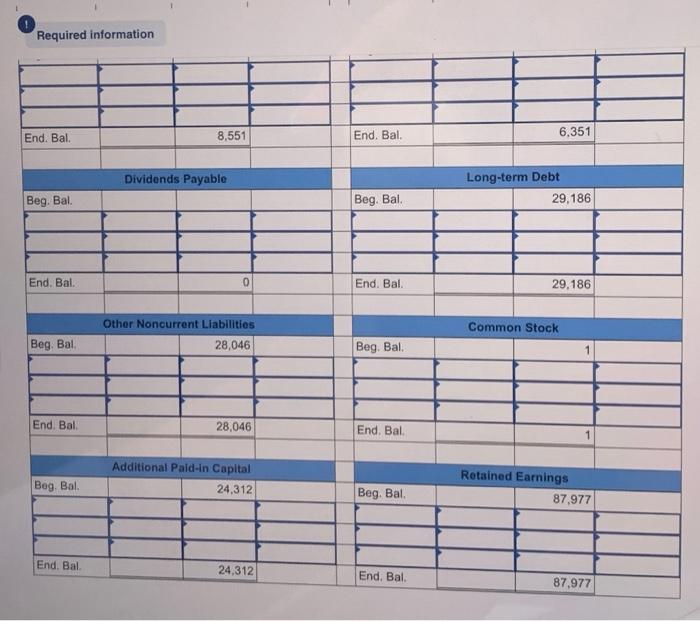

Check my w Required information P2-5 (Algo) Recording Transactions, Preparing Journal Entries, Posting to T-Accounts, Preparing the Balance Sheet, and Evaluating the Current Ratio LO2-2, 2-4, 2-5 The following information applies to the questions displayed below) Mango Inc, headquartered in Cupertino, California, designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players and sells a variety of related software and services. The following is Mango's (simplified) balance sheet from a recent year (fiscal year ending on the last Saturday of September). MANGO INC CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) ASSETS Current assets: Cash 5 13,944 Short-term investments 11,313 Accounts receivable 17,583 Inventories 2,124 Other current assets 24,029 Total current assets 68,993 Long-term investments 131,840 Property, plant, and equipment, net 20,763 Other noncurrent assets 12,608 Total assets 5233, 404 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable $ 30,401 Accrued expenses 18,579 Unearned revenue 8,551 Short-term notes payable 6,351 Total current liabilities 63,882 Long-term debt 29,186 Other noncurrent liabilities 28.046 Total liabilities Stockholders' equity: 121, 114 Coonon stock ise.e0001 per value) Additional paid-in capital Retained earnings 24,312 Total stockholders' equity 87,977 112,290 Cher w (Chapters 1, 2 and 3) Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018): a. Borrowed $18,284 from banks due in two years. b. Purchased additional investments for $22.700 cash; one-fifth were long term and the rest were short term. c. Purchased property, plant and equipment; paid $9.589 in cash and signed a short-term note for $1,427 d. Issued additional shares of common stock for $1.487 in cash; total par value was $1 and the rest was in excess of par value e. Sold short-term investments costing $19.026 for $19,026 cash. t. Declared $11,143 in dividends to be paid at the beginning of the next fiscal year. P2-5 Part 2 2. Post each transaction to the appropriate T-accounts (Enter your answers in millions.) Cash 13,944 18.284 Short-term Investments 11,313 Bog. Bal (a) Beg. Bal 183 End, Bal 11,313 End Bal. 32.045 Accounts Receivable 17,583 Inventories 2,124 Beg. Bal Beg. Bal End. Bal 17,583 End. Bal 2.124 Accounts Receivable 17,583 Inventories 2,124 Beg. Bal. eg. Bal End. Bal. 2,124 End. Bal. 17,583 Other Current Assets 24,029 Long-term Investments 131,040 Beg. Bal Beg. Bal. 24,029 End. Bal. 131,040 End. Bal Property. Plant, and Equipment 20,763 Other Noncurrent Assets 12,608 Beg. Bal Beg. Bal End. Bal 20,763 End. Bal. 12,608 Accounts Payable 30,401 Beg. Bal Accrued Expenses 18,579 Beg. Bal. End. Bal 30,401 End. Bal 18,579 Unearned Revenue 8,551 Beg. Bal. Short-term Notes Payable 6,351 Beg. Bal End. Bal. 8,551 End. Bal. 6,351 ... ha Required information End. Bal. 8,551 End. Bal. 6,351 Dividends Payable Long-term Debt 29.186 Beg. Bal Beg. Bal End. Bal. End. Bal 29.186 Other Noncurrent Liabilities Common Stock Beg. Bal 28,046 Beg. Bal. End. Bal 28,046 End. Bal Additional Paid-in Capital 24.312 Bog. Bal Retained Earnings 87,977 Beg. Bal End. Bal 24,312 End. Bal. 87,977