Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please fill out chart At December 31, the unadjusted trial balance of H&R Tacks reports Deferred Revenue of $4,900 and Service Revenues of $33,700. Obligations

Please fill out chart

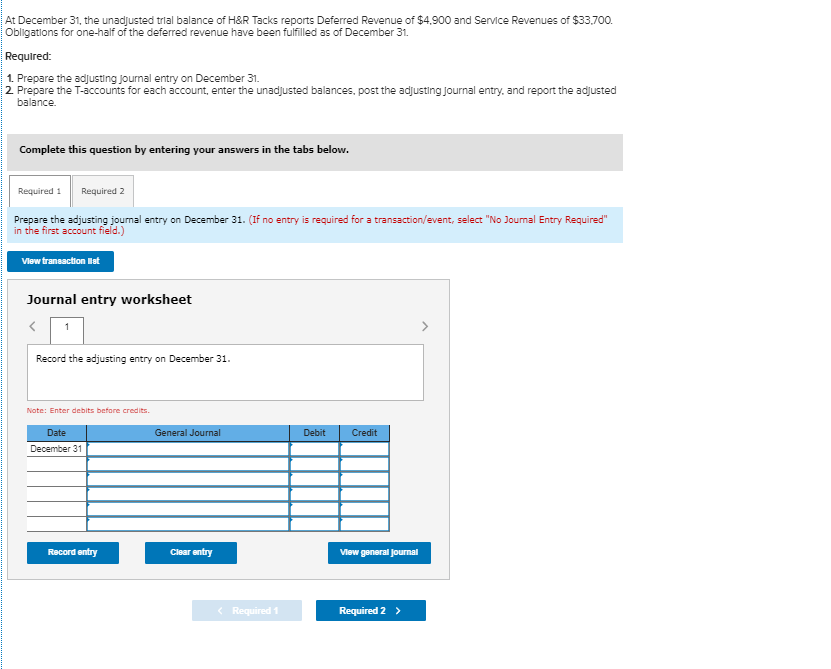

At December 31, the unadjusted trial balance of H&R Tacks reports Deferred Revenue of $4,900 and Service Revenues of $33,700. Obligations for one-half of the deferred revenue have been fulfilled as of December 31. Required: 1. Prepare the adjusting journal entry on December 31. 2 Prepare the T-accounts for each account, enter the unadjusted balances, post the adjusting Journal entry. and report the adjusted balance. Complete this question by entering your answers in the tabs below. Required Required 2 Prepare the adjusting journal entry on December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Vlew tranaaction Bat Journal entry worksheet Record the adjusting entry on December 31 Note: Enter debits before credits. Debit Record entry Clear entry Mew general journal Required 1 Required 2>Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started