Answered step by step

Verified Expert Solution

Question

1 Approved Answer

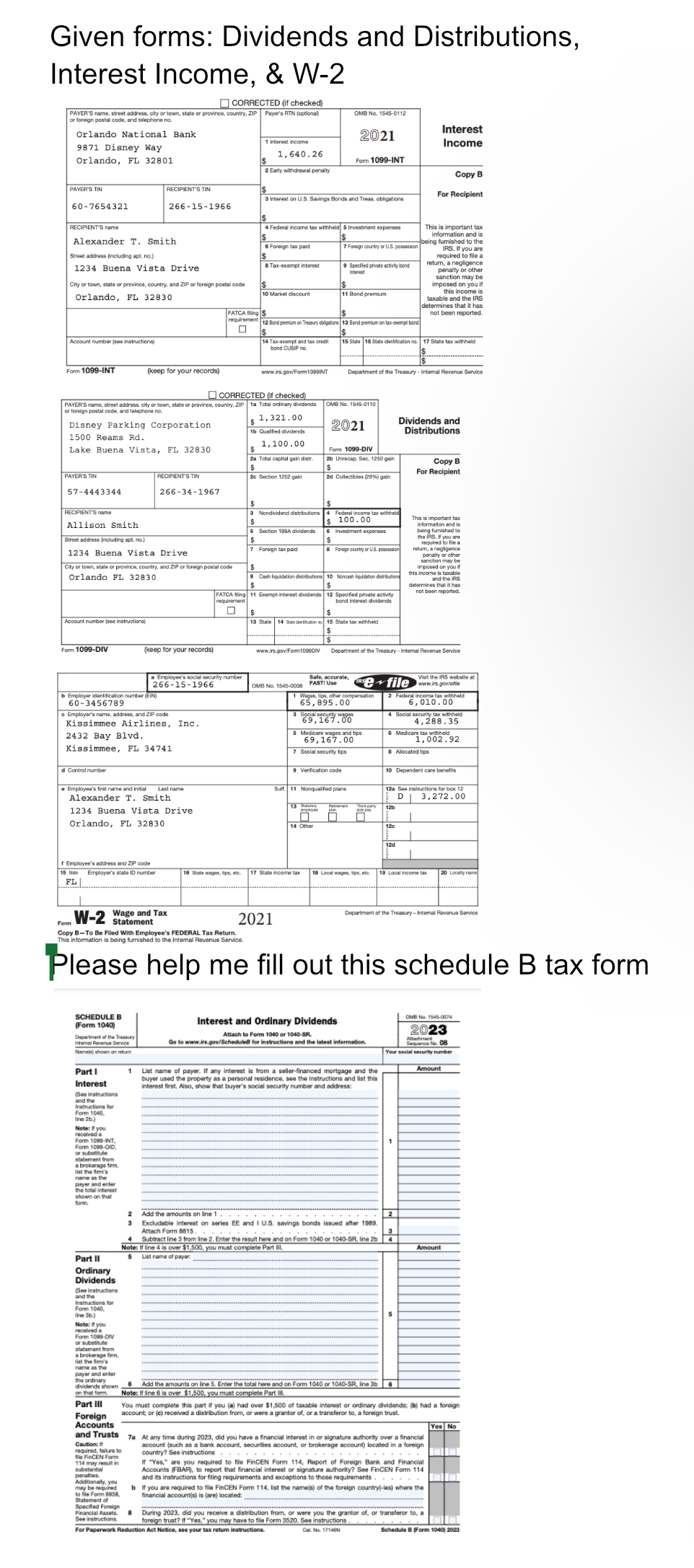

Please fill out schedule B form based on the given information. ( NO FURTHER INFORMATION IS NEEDED ) Alexander Smith and his wife Allison are

Please fill out schedule B form based on the given information. NO FURTHER INFORMATION IS NEEDED Alexander Smith and his wife Allison are married and will file a joint tax return for The Smiths live at Buena Vista Drive, Orlando, FL Alexander is a commuter airline pilot but took months off from his job in to obtain a higherlevel pilots license. The Smiths have an yearold son, Brad, who is enrolled in twelfth grade at the Walt Disney Prep School. The Smiths also have a yearold daughter, Angelina, who is a parttime firstyear student at Orange County Community College OCCC Five years ago, Alexander divorced Jennifer Amistad Social Security number Alexander pays Jennifer $ per month in alimony under the divorce decree. Not included with the Smiths tax forms was interest from State of Florida bonds of $

Alexander Smith Allison Smith Brad Smith

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started