Answered step by step

Verified Expert Solution

Question

1 Approved Answer

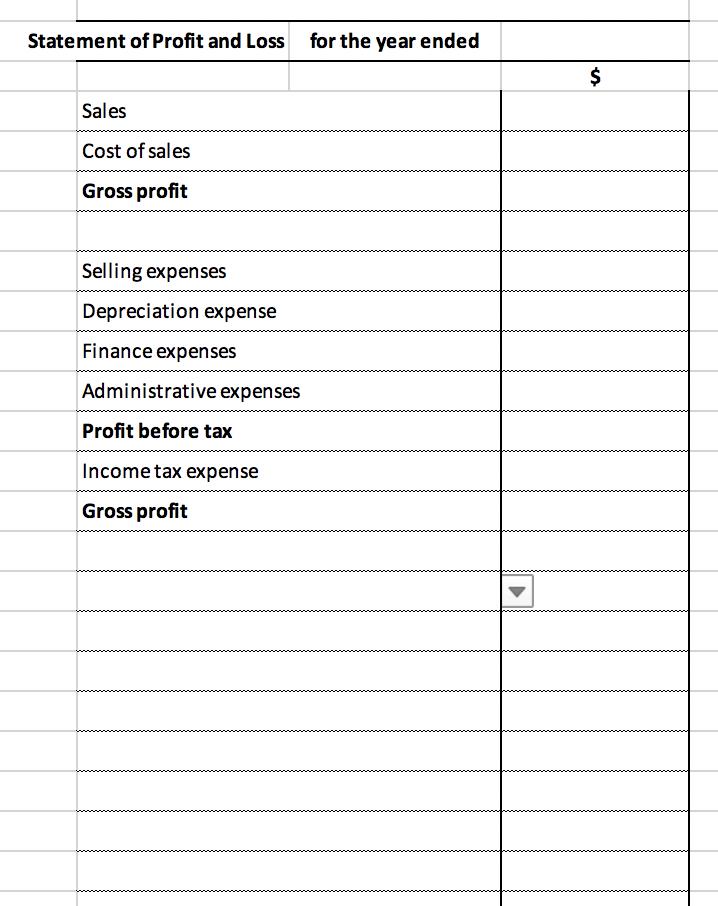

Please fill out statement of profit or loss using transaction worksheet and events listed above Event Transaction Event 1 The company repays $50326 of its

Please fill out statement of profit or loss using transaction worksheet and events listed above

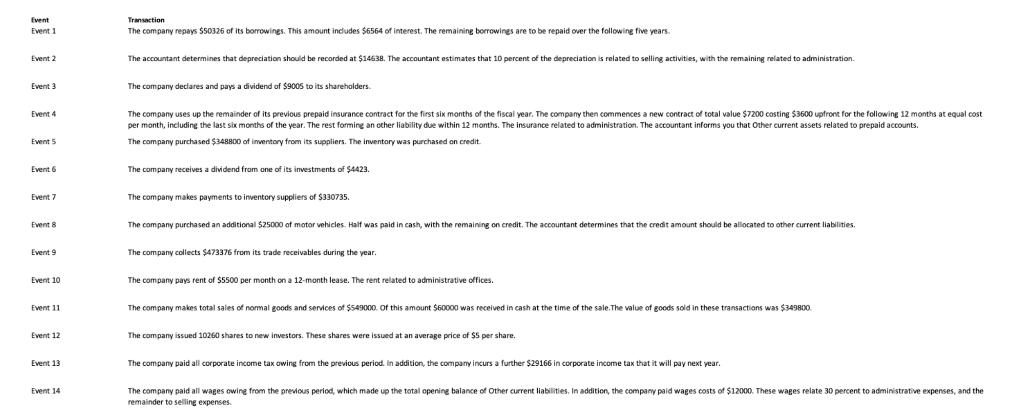

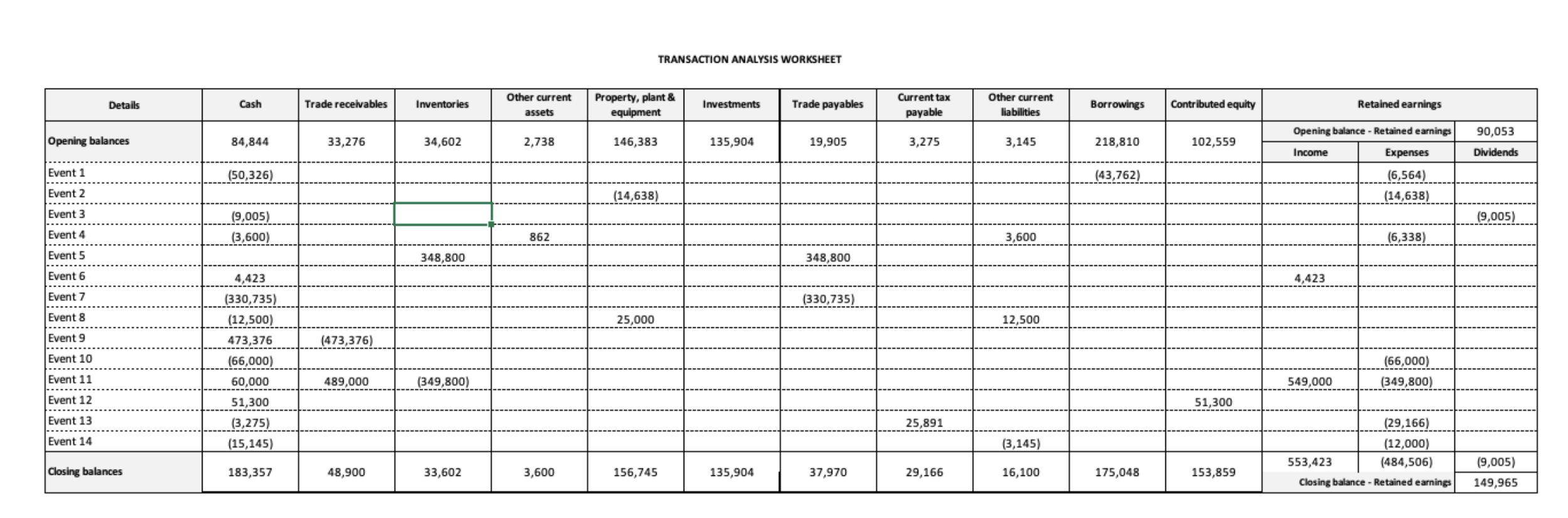

Event Transaction Event 1 The company repays $50326 of its borrowings. This amount includes $6564 of interest. The remaining borrowings are to be repaid over the following five years. Event 2 The accountant determines that depreciation should be recorded at $14638. The accountant estimates that 10 percent of the depreciation is related to selling activities, with the remaining related to administration. Event 3 The company declares and pays a dividend of $9005 to its shareholders. Event 4 The company uses up the remainder of its previous prepaid insurance contract for the first six months of the fiscai year. The company then commences a new contract of total value $7200 costing $3600 upfront for the following 12 months at equal cost per month, including the last six months of the year. The rest forming an other liability due within 12 months. The insurance related to administration. The accountant informs you that Other current assets related to prepaid accounts. Event 5 The company purchased $348800 of inventory from its suppliers. The inventory was purchased on credit. Eent 6 The company receives a dividend from ane of its investments of $4423. Event 7 The company makes payments to inventory suppliers of $330735. Event 8 The company purchased an additional $25000 of motor vehicles. Half was paid in cash, with the remaining on credit. The accountant determines that the credit amount shoulid be allocated to other current liabilities. Event 9 The company collects $473376 from its trade receivables during the year. Event 10 The company pays rent of $5500 per month on a 12-month lease. The rent related to administrative offices. Event 11 The company makes total sales of normal goods and services of $549000. Of this amount $60000 was received in cash at the time of the sale.The value of goods sold in these transactions was $349800. Event 12 The company issued 10260 shares to new investors. These shares were issued at an average price of $5 per share. Event 13 The company paid all corporate income tax owing from the previous period. In addition, the company incurs a further $29166 in corporate income t that it will pay next year. Event 14 The company paid all wages owing from the previous period, which made up the total opening balance of Other current liabilities, In addition, the company paid wages costs of $12000. These wages relate 30 percent to administrative expenses, and the remainder to selling expenses.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

answers Depreciation expense is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started