Answered step by step

Verified Expert Solution

Question

1 Approved Answer

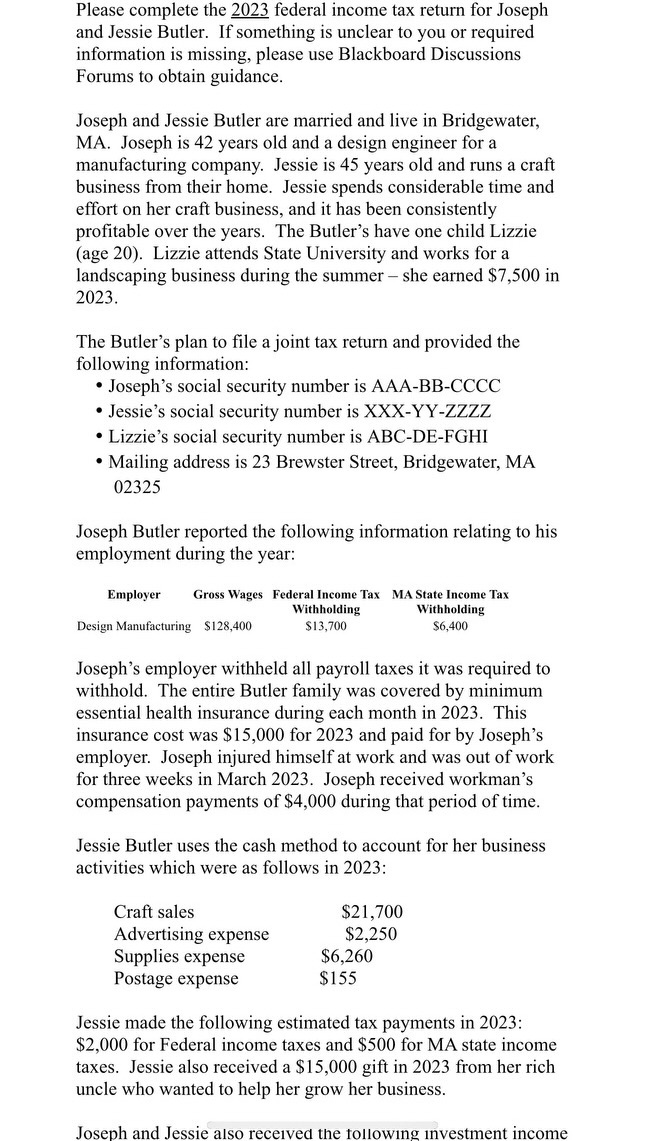

Please fill out the 2 0 2 3 Schedule 1 , based on the following information given. Jessie Butler uses the cash method to account

Please fill out the Schedule based on the following information given. Jessie Butler uses the cash method to account for her business activities which were as follows in :

Jessie made the following estimated tax payments in : $ for Federal income taxes and $ for MA state income taxes. Jessie also received a $ gift in from her rich uncle who wanted to help her grow her business.

Joseph and Jessie also received the following investment income during the year:

Interest income from Certificate of Deposit $

Interest income from US Treasury Bond $

Interest income from Municipal Bond $

The Butler's did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year.

In May of the Butler's received a Federal income tax refund of $ and a Massachusetts state income tax refund of $ because they had overpaid both their Federal and MA state individual income taxes in On their Federal income tax return, the Butler's itemized their deductions and received full tax benefit deduction for the state tax income taxes paid in

Joseph enjoys sports and wages bets on the local sports teams. Joseph had gambling winnings of $ during and gambling losses of $

Lizzie won an iPad valued at $ and a scholarship for $ towards tuition by competing in her University's technology contest.

The Butler's paid the following expenses during the year:

Mortgage interest on principal residence

$

Real property taxes on residence

$

Vehicle property tax based upon value

$

State sales tax

Unreimbursed medical expenses

$

Unreimbursed employee business expenses for

Joseph quad $

Interest on credit cards

$

Interest on loans to pay Lizzie's tuition

$

College tuition paid for Lizzie

$

College room & board paid for Lizzie

$

Cash contribution to American Red Cross

$ Joseph and Jessie also received the following investment income during the year:

Interest income from Certificate of Deposit quad $

Interest income from US Treasury Bond $

Interest income from Municipal Bond $

The Butler's did not own, control or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year.

In May of the Butler's received a Federal income tax refund of $ and a Massachusetts state income tax refund of $ because they had overpaid both their Federal and MA state individual income taxes in On their Federal income tax return, the Butler's itemized their deductions and received full tax benefit deduction for the state tax income taxes paid in

Joseph enjoys sports and wages bets on the local sports teams. Joseph had gambling winnings of $ during and gambling losses of $

Lizzie won an iPad valued at $ and a scholarship for $ towards tuition by competing in her University's technology contest.

The Butler's paid the following expenses during the year:

Mortgage interest on principal residence

$

Real property taxes on residence

$

Vehicle property tax based upon value

$

State sales tax $

Unreimbursed medical expenses

$

Unreimbursed employee business expenses for

Joseph quad $

Interest on credit cards

$

Interest on loans to pay Lizzie's tuition

$

College tuition paid for Lizzie

$

College room & board paid for Lizzie

$

Cash contribution to American Red Cross

$

The Butlers received a Form T from State University whose address and employer identification number EIN are as follows:

State University

Ivory Tower Road

Western, MA

EIN: RSTUVWXYZ SCHEDULE

Form

Department of the Treasury

Internal Revenue Service

Additional Income and Adjustments to Income

Attach to Form SR or NR

Go to wwwirs.govForm for instructions and the latest information.

OMB No

Attachment

Sequence No

Part I Additional Income

Part II Adjustments to Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started