Please fill out the boxes labelled X.

Please fill out the boxes labelled X.

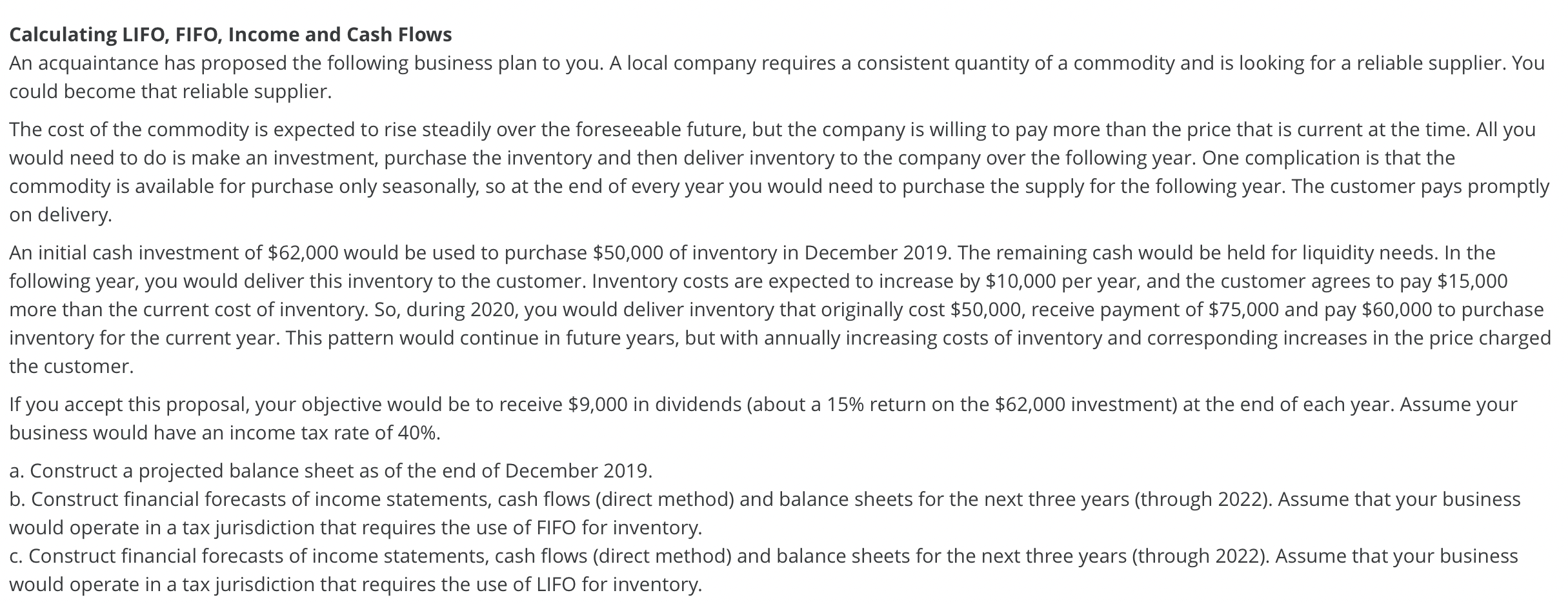

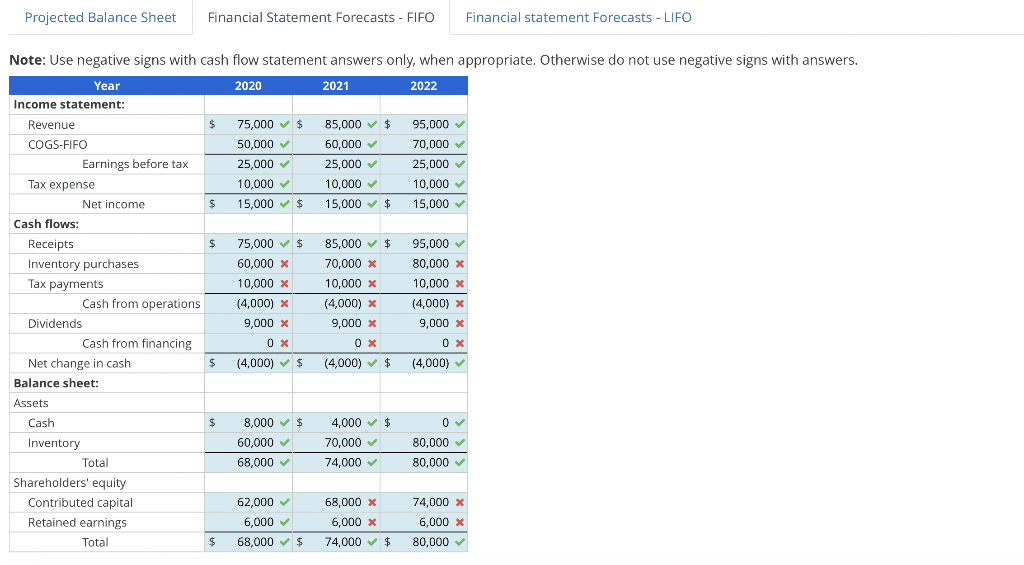

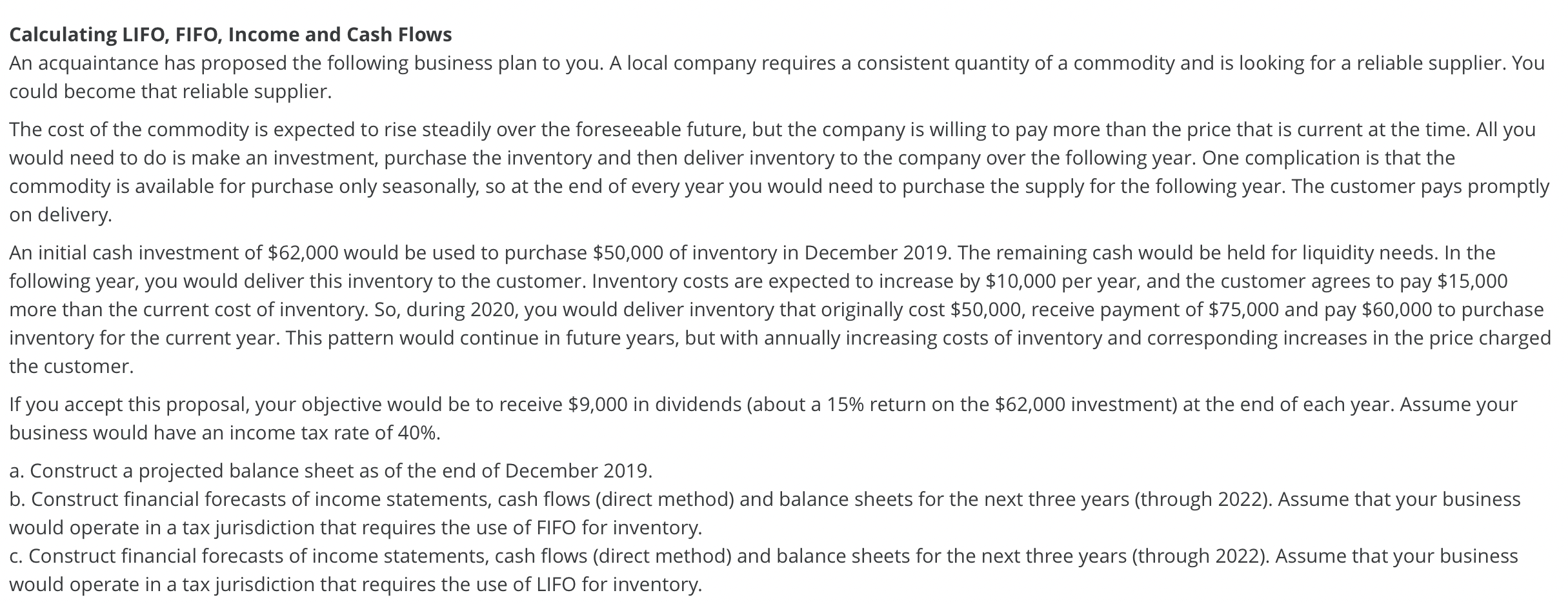

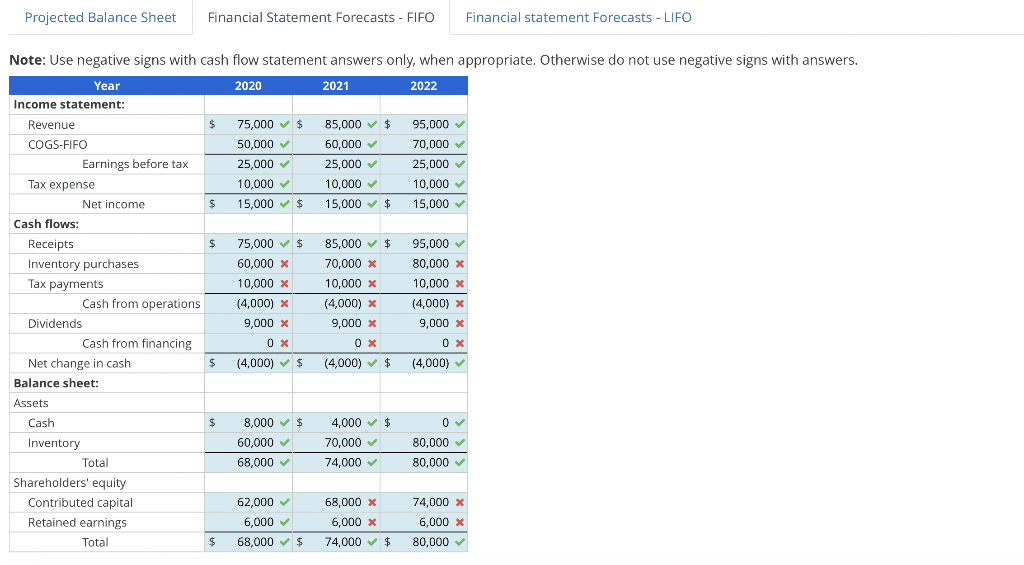

Calculating LIFO, FIFO, Income and Cash Flows An acquaintance has proposed the following business plan to you. A local company requires a consistent quantity of a commodity and is looking for a reliable supplier. You could become that reliable supplier. The cost of the commodity is expected to rise steadily over the foreseeable future, but the company is willing to pay more than the price that is current at the time. All you would need to do is make an investment, purchase the inventory and then deliver inventory to the company over the following year. One complication is that the commodity is available for purchase only seasonally, so at the end of every year you would need to purchase the supply for the following year. The customer pays promptly on delivery. An initial cash investment of $62,000 would be used to purchase $50,000 of inventory in December 2019. The remaining cash would be held for liquidity needs. In the following year, you would deliver this inventory to the customer. Inventory costs are expected to increase by $10,000 per year, and the customer agrees to pay $15,000 more than the current cost of inventory. So, during 2020, you would deliver inventory that originally cost $50,000, receive payment of $75,000 and pay $60,000 to purchase inventory for the current year. This pattern would continue in future years, but with annually increasing costs of inventory and corresponding increases in the price charged the customer. If you accept this proposal, your objective would be to receive $9,000 in dividends (about a 15% return on the $62,000 investment) at the end of each year. Assume your business would have an income tax rate of 40%. a. Construct a projected balance sheet as of the end of December 2019. b. Construct financial forecasts of income statements, cash flows (direct method) and balance sheets for the next three years (through 2022). Assume that your business would operate in a tax jurisdiction that requires the use of FIFO for inventory. c. Construct financial forecasts of income statements, cash flows (direct method) and balance sheets for the next three years (through 2022). Assume that your business would operate in a tax jurisdiction that requires the use of LIFO for inventory. Projected Balance Sheet Financial Statement Forecasts - FIFO Financial statement Forecasts - LIFO Note: Use negative signs with cash flow statement answers only, when appropriate. Otherwise do not use negative signs with answers. Year 2020 2021 2022 Income statement: Revenue $ 75,000 $ 50,000 25,000 COGS-FIFO 85,000 $ 60,000 25,000 95,000 70,000 Tax expense 10,000 10,000 15,000 $ 25,000 10,000 15,000 $ 15,000 $ $ 75,000 $ 60,000 * 85,000 $ 70,000 * 95,000 80,000 x 10,000 x 10,000 x 10,000 x (4,000) x (4,000) * (4,000) x 9,000 x 9,000 x 9,000 x 0x 0 x (4,000) $ 0 x (4,000) $ (4,000) 0 8,000 $ 60,000 68,000 4,000 $ 70,000 80,000 74,000 80,000 62,000 68,000 x 74,000 x 6,000 6,000 * 6,000 x $ 68,000 $ 74,000 $ 80,000 Earnings before tax Net income Cash flows: Receipts Inventory purchases Tax payments Dividends Net change in cash Balance sheet: Assets Cash Inventory Total Shareholders' equity Contributed capital Retained earnings Total Cash from operations Cash from financing $ $ Projected Balance Sheet Financial Statement Forecasts - FIFO Financial statement Forecasts - LIFO Note: Use negative signs with cash flow statement answers only, when appropriate. Otherwise do not use negative signs with answers. Year 2020 2021 2022 Income statement: $ Revenue COGS-LIFO 75,000 $ 60,000 85,000 $ 70,000 95,000 80,000 15,000 15,000 15,000 Tax expense 6,000 6,000 6,000 $ 9,000 $ 9,000 $ 9,000 $ 75,000 $ 95,000 85,000 $ 70,000 * 60,000 x 80,000 x 6,000 x 6,000 x 6,000 x 9,000 9,000 9,000 9,000 x 9,000 * 9,000 * (9,000) (9,000) (9,000) 0 Earnings before tax Net income Cash flows: Receipts Inventory purchases Tax payments Dividends Net change in cash Balance sheet: Assets Cash Inventory Total Shareholders' equity Contributed capital Retained earnings Total Cash from operations Cash from financing 0 $ 0 $ 12,000 $ 12,000 $ 50,000 50,000 62,000 62,000 62,000 0 62,000 0 $ 62,000 $ 62,000 $ $ $ 12,000 50,000 62,000 62,000 62,000 0

Please fill out the boxes labelled X.

Please fill out the boxes labelled X.