Answered step by step

Verified Expert Solution

Question

1 Approved Answer

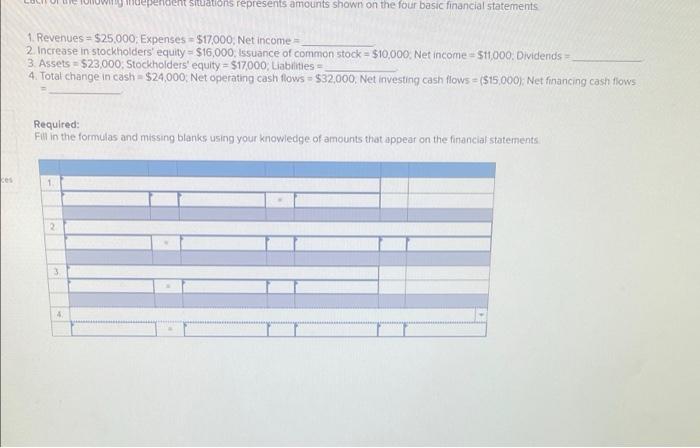

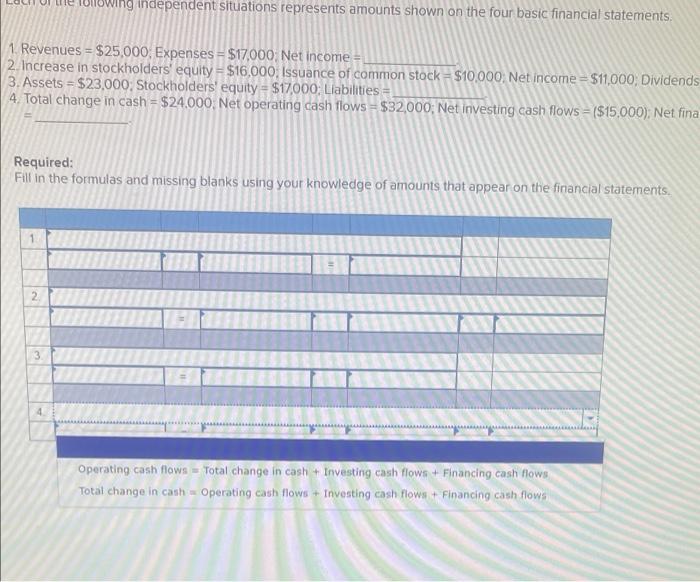

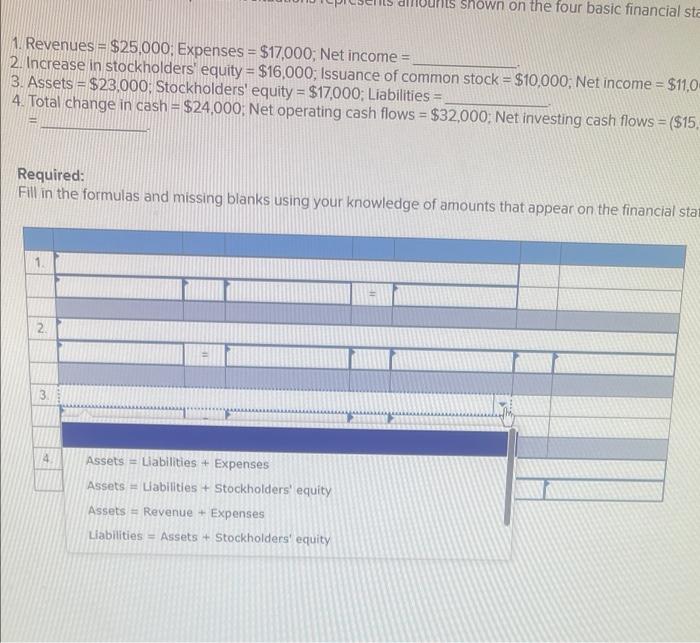

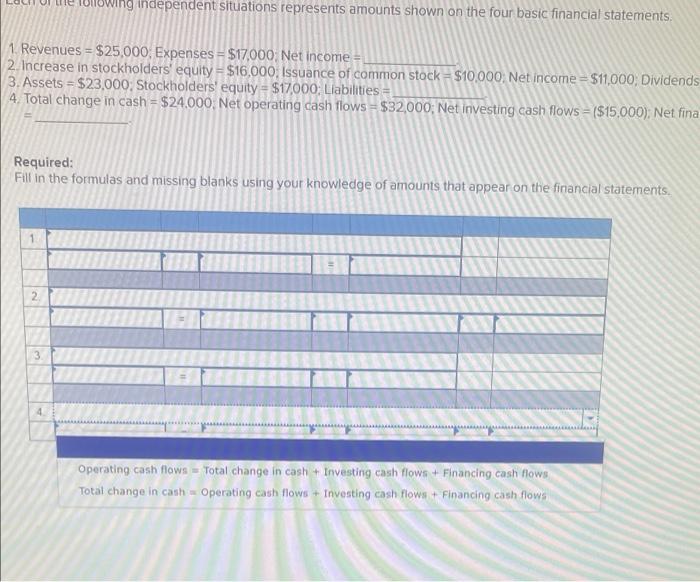

please fill out the in format it shows ependent situations represents amounts shown on the four basic financial statements 1. Revenues = $25,000 Expenses =

please fill out the in format it shows

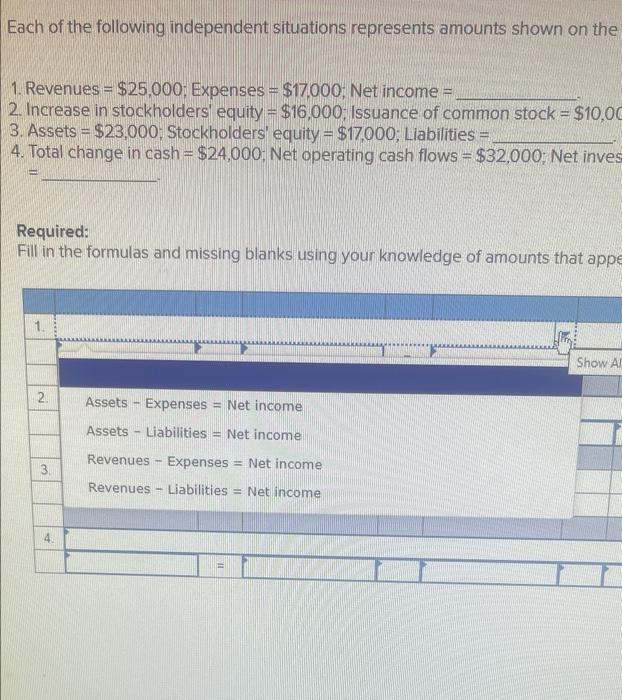

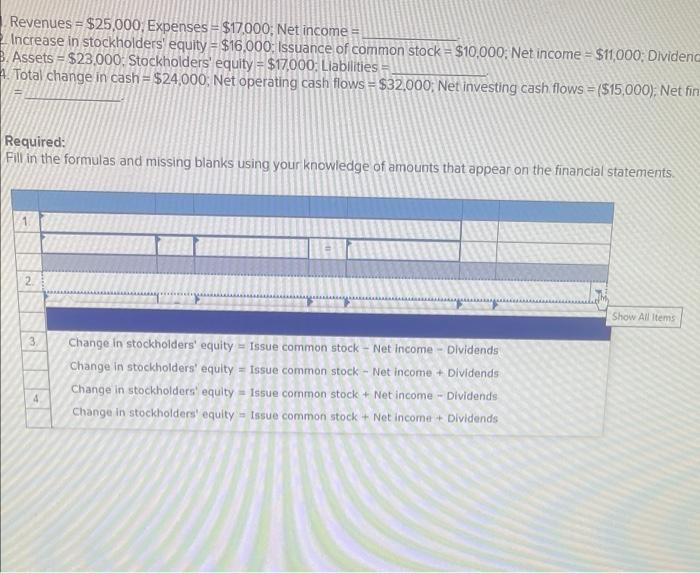

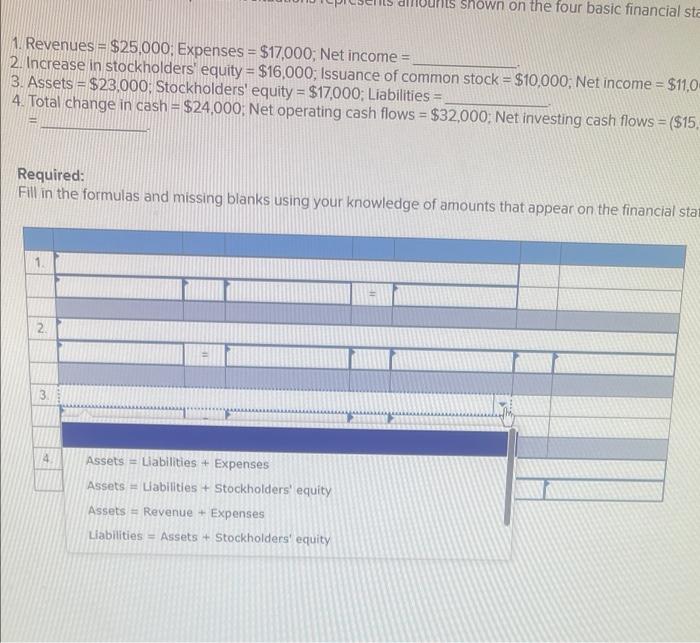

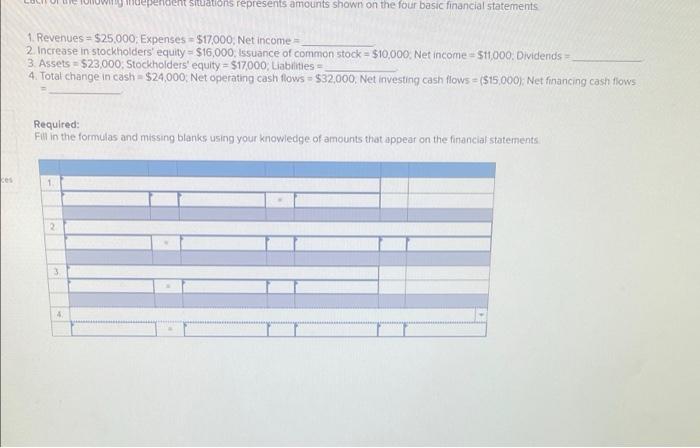

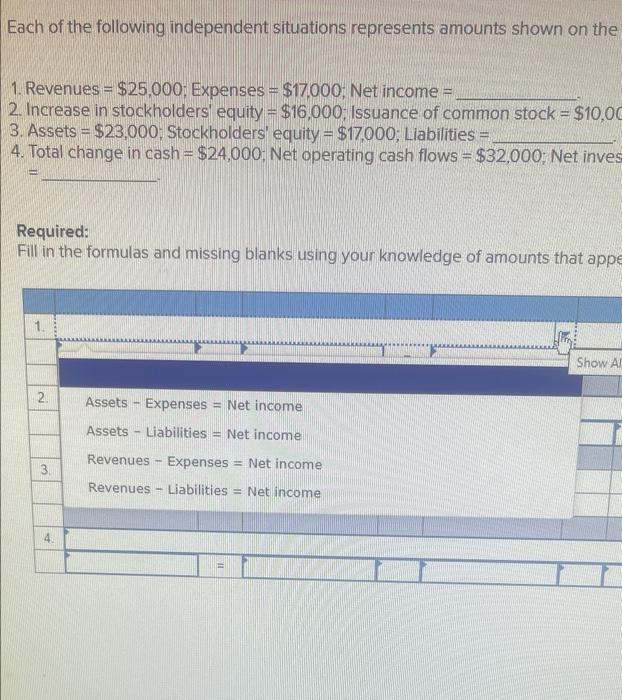

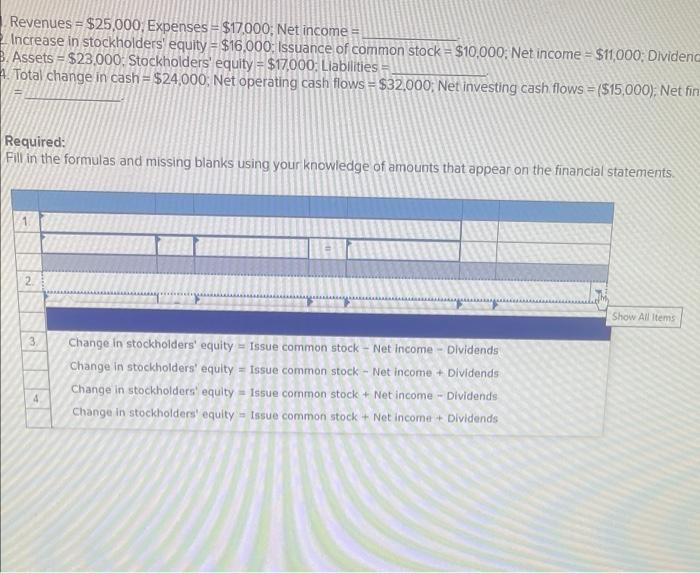

ependent situations represents amounts shown on the four basic financial statements 1. Revenues = $25,000 Expenses = $17000, Net income 2. Increase in stockholders' equity - $16,000, Issuance of common stock = $10,000 Net income = 511,000. Dividends 3. Assets $23,000, Stockholders' equity = $17000, Liabilities - 4. Total change in cash = $24,000, Net operating cash flows - $32,000, Net investing cash flows = ($15,000). Net financing cash flows Required: Fill in the formulas and missing blanks using your knowledge of amounts that appear on the financial statements es 1 2 3 8 Each of the following independent situations represents amounts shown on the - 1. Revenues = $25,000: Expenses = $17.000; Net income = 2. Increase in stockholders equity = $16.000; Issuance of common stock = $10,00 3. Assets = $23,000. Stockholders' equity = $17000; Liabilities = 4. Total change in cash = $24,000: Net operating cash flows = $32,000; Net inves Required: Fill in the formulas and missing blanks using your knowledge of amounts that appe Show All 2 Assets Expenses = Net income Assets - Liabilities Net income Revenues - Expenses = Net income 3. Revenues - Liabilities = Net income Revenues = $25,000. Expenses = $17,000; Net income = Increase in stockholders' equity = $16,000: Issuance of common stock = $10,000. Net income = $11,000: Dividenc B. Assets = $23,000. Stockholders' equity = $17,000: Liabilities 1. Total change in cash = $24,000. Net operating cash flows = $32,000. Net investing cash flows = ($15,000). Net fin Required: Fill in the formulas and missing blanks using your knowledge of amounts that appear on the financial statements 2 Show All Items 3 Change in stockholders' equity - Issue common stock - Net Income - Dividends Change in stockholders' equity = Issue common stock - Net income + Dividends Change in stockholders' equity = Issue common stock + Net income - Dividends Change in stockholders' equity = Issue common stock + Net income + Dividends 4 Shown on the four basic financial sta 1. Revenues = $25.000; Expenses = $17,000; Net income = 2. Increase in stockholders' equity = $16,000; Issuance of common stock = $10,000. Net income = $11,0 3. Assets = $23,000: Stockholders' equity = $17,000; Liabilities = 4. Total change in cash = $24.000; Net operating cash flows = $32,000, Net investing cash flows = ($15. Required: Fill in the formulas and missing blanks using your knowledge of amounts that appear on the financial sta 2 3 4 Assets = Liabilities + Expenses Assets = Llabilities + Stockholders' equity Assets = Revenue + Expenses Liabilities = Assets + Stockholders' equity - Tullowing independent situations represents amounts shown on the four basic financial statements 1. Revenues = $25,000, Expenses = $17.000 Net income = 2. Increase in stockholders' equity = $16,000; Issuance of common stock = $10,000 Net income = $11,000, Dividends 3. Assets = $23,000, Stockholders' equity = $17,000: Llabilities = 4 Total change in cash = $24.000 Net operating cash flows = $32,000; Net investing cash flows = ($15,000): Net fina Required: Fill in the formulas and missing blanks using your knowledge of amounts that appear on the financial statements 2 3. 4 Operating cash flows - Total change in cash + Investing cash flows + Financing cash flows Total change in cash Operating cash flows + Investing cash flows + Financing cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started