Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please fill out the yellow boxes WITH THE ANSWER. everytime i post, i get no answers just explanations. if youre not going to answer the

please fill out the yellow boxes WITH THE ANSWER. everytime i post, i get no answers just explanations. if youre not going to answer the question then please dont attemt it. but thank you in advance for fulling up the yellow blanks.

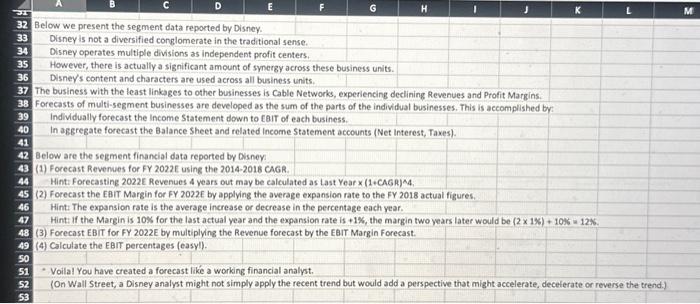

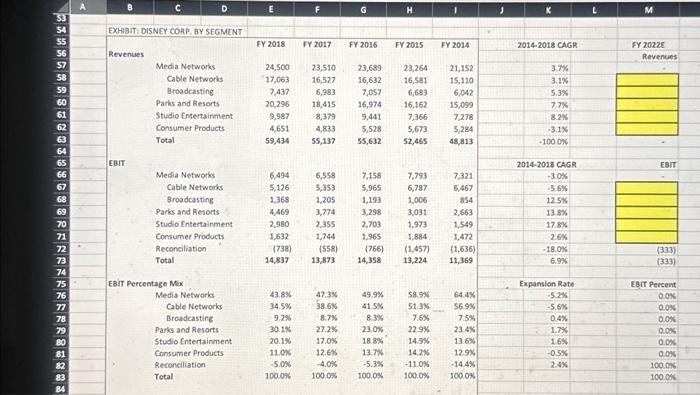

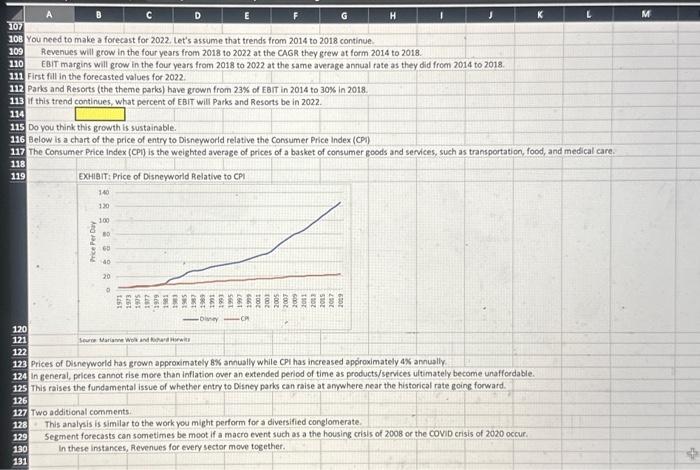

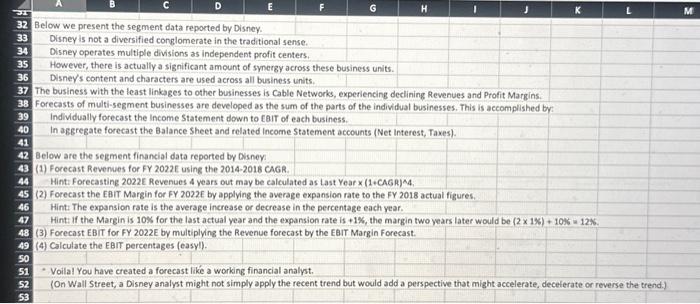

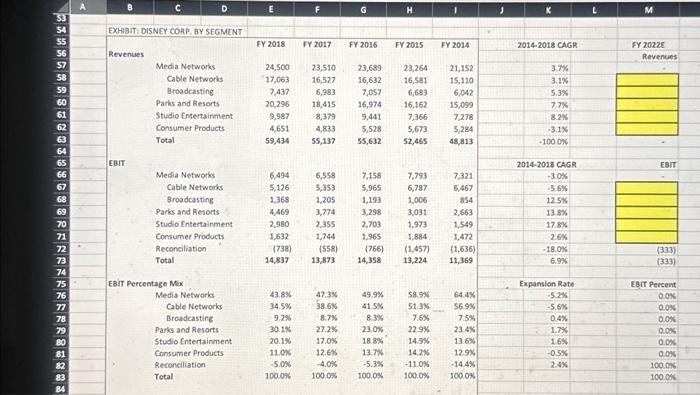

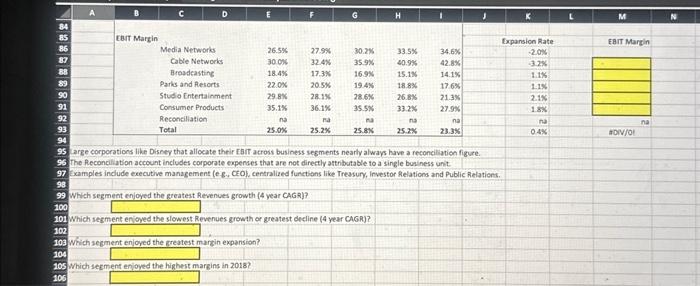

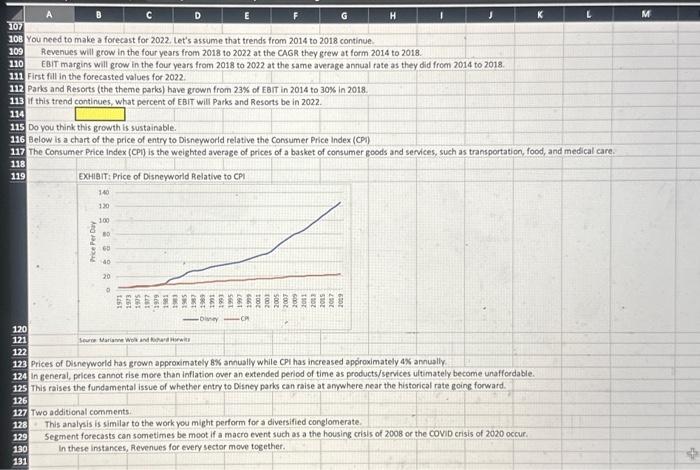

Below we present the segment data reported by Disney. Disney is not a diversified conglomerate in the traditional sense. Disney operates multiple divisions as independent profit centers. However, there is actually a significant amount of synergy across these business units. Disney's content and characters are used across all business units. The business with the least linkages to other businesses is Cable Networks, experiencing declining Revenues and Profit Margins. Forecasts of multi-segment businesses are developed as the sum of the parts of the individual businesses. This is accomplished by: Individually forecast the Income Statement down to tair of each business. In aggregate forecast the Balance Sheet and related income Statement accounts (Net interest, Taxes). Below are the segment financial data reported by Disney (1) Forecast Revenues for FY 2022E using the 2014-2018 CAGR. Hint: Forecasting 2022E Revenues 4 vears out may be calculated as Last Year (1+C CAG )4. (2) Forecast the EBIT Margin for FY 2022E by applying the average expansion rate to the FY 2018 actual figures. Hint: The expansion rate is the average increase or decrease in the percentage each year. Hint: If the Margin is 10% for the last actual year and the expansion rate is +1%, the margin two years later would be (21)+10%=12K. (3) Forecast EBIT for FY 2022E by multiplying the Revenue forecast by the EaIT Margin Forecast. (4) Calculate the EBIT percentages (easyl). - Voilal You have created a forecast lik a working financial analyst. (On Wall Street, a Disney analyst might not simply apply the recent trend but would add a perspective that might accelerate, deceierate or reverse the trend.) arge corporations like Disney that allocate their rart across business segments nearly always have a reconciliation figure. The feconcitiation account includes corporate copences that are not directly artribufable to a single bualness unit. Eamples include executhe management (e.g. CEO), centralized functions like Treasury, investor Relations and Public Relations. Which segment enioved the ereatest Revenues growth (4 year CAGR)? Which segment enioved the slowest Revenues growth or greatest decline (4 year CAGR)? Which segment enioved the areatest margin expansion? Which segment enioved the highest margins in 2018? ou need to make a forecast for 2022 . Let's assume that trends from 2014 to 2018 continue. Revenues will grow in the four years from 2018 to 2022 at the CAGR they grew at form 2014 to 2018. EBIT margins will grow in the four vears from 2018 to 2022 at the same average annual rate as they did from 2014 to 2018. irst fill in the forecasted values for 2022. arks and Resorts (the theme parks) have grown from 23% of Eart in 2014 to 30% in 2018 . this trend continues, what percent of EBit will Parks and Resorts be in 2022. So you think this growth is sustainable. lelow is a chart of the price of entry to Disneyworld relative the Consumer Price index (CPI) he Consumer Price infex (CPI) is the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. Prices of Disneyworld has grown approximately 8W annually while CPI has increased approximately 4X annually. in general, prices cannot rise more than inflation over an extended period of time as products/services ultimately become unaffordable. This raises the fundamental issue of whether entry to Disney paris can raise at amwhere near the historical rate going forward. Two additional comments: 4his analysis is similar to the work you might perform for a diversified conglomerate. Segment forecasts can sometimes be moot if a macro event such as a the housing crisis of 2008 or the COViD crisis of 2020 occur. In these instances, Revenues for every sector move together

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started