Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please find a through d Problem 7-15 (algorithmic) = Question Help A manufacturer of aerospace products purchased five flexible assembly cells for $490.000 each. Delivery

please find a through d

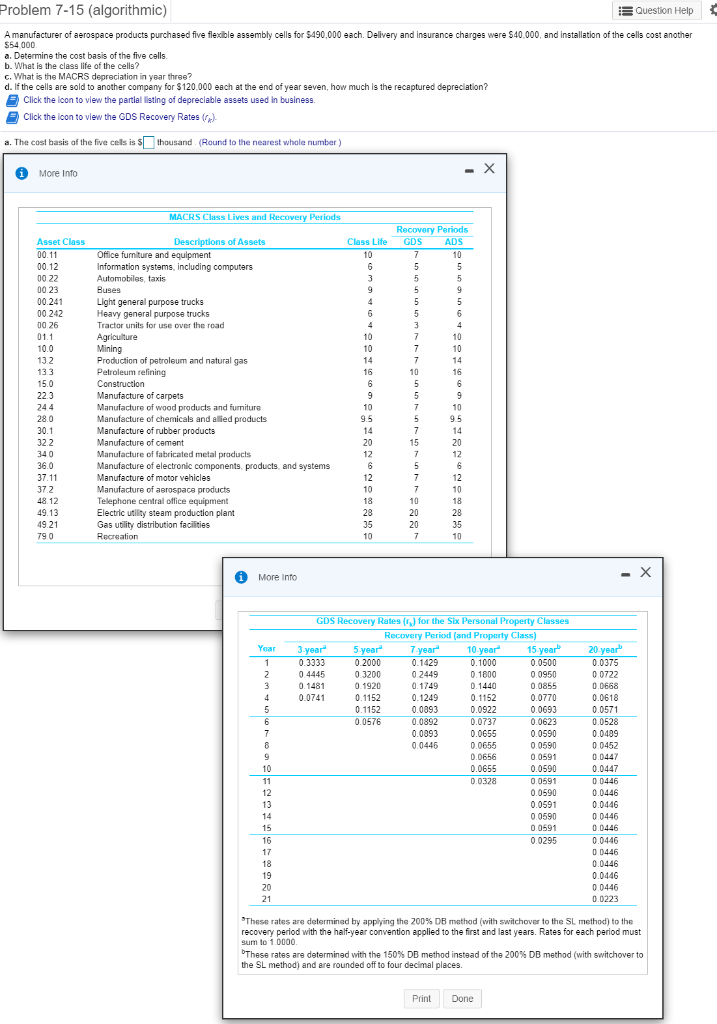

Problem 7-15 (algorithmic) = Question Help A manufacturer of aerospace products purchased five flexible assembly cells for $490.000 each. Delivery and insurance charges were $40.000, and installation of the cells cost another $54000 a. Determine the cost basis of the five cells b. What is the class life of the cells? c. What is the MACRS depreciation in year three? d. If the cells are sold to another company for $120.000 each at the end of year seven, how much is the recaptured depreciation? Click the icon to view the partial listing of depreciable assets used in business Click the loon to view the GDS Recovery Rates (7) a. The cost basis of the five cells is thousand (Round to the nearest whole number) More Info MACRS Class Lives and Recovery Periods 5 un Recovery Periods GDS ADS 10 5 5 5 9 5 5. 5 3 4 10 7 10 7 14 10 6 un Asset Class 00.11 00.12 00.22 00.23 00.241 00.242 00 26 01.1 10.0 13.2 13.3 15.0 22.3 244 28.0 30.1 322 340 36.0 37.11 37.2 48.12 49.13 49.21 790 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products and systems Manufacture of motor vehicles Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities Recreation 6 Class Life 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 18 28 35 10 5 7 5 7 15 7 5 9 10 95 14 20 12 6 12 10 18 28 35 10 7 7 10 20 20 7 More Info -X Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3 year 5 year 7 year 10 year 15 year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0 3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0093 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0445 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0 0591 0.0590 0.0591 0.0590 0.0591 0.0295 20 year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000 These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started