Answered step by step

Verified Expert Solution

Question

1 Approved Answer

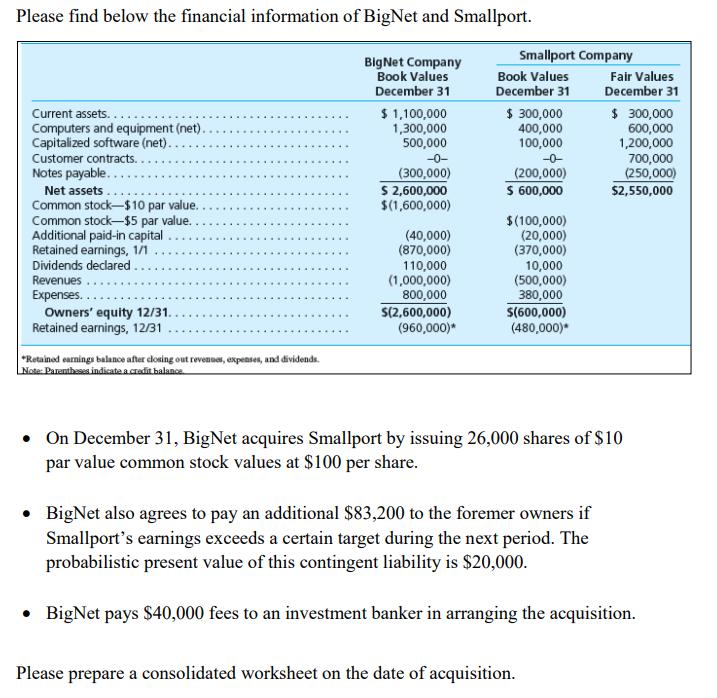

Please find below the financial information of BigNet and Smallport. Smallport Company BigNet Company Book Values Book Values December 31 Fair Values December 31

Please find below the financial information of BigNet and Smallport. Smallport Company BigNet Company Book Values Book Values December 31 Fair Values December 31 December 31 $ 300,000 400,000 100,000 Current assets.. Computers and equipment (net). Capitalized software (net). Customer contracts... Notes payable.... Net assets. Common stock-$10 par value. Common stock-$5 par value. Additional paid-in capital Retained earnings, 1/1 Dividends declared Revenues $ 300,000 600,000 1,200,000 700,000 (250,000) 52,550,000 $1,100,000 1,300,000 500,000 (300,000) S 2,600,000 $(1,600,000) (200,000) S 600,000 (40,000) (870,000) 110,000 (1,000,000) 800,000 S(2,600,000) (960,000)* $(100,000) (20,000) (370,000) 10,000 (500,000) 380,000 Expenses.. Owners' equity 12/31. Retained earnings, 12/31 S(600,000) (480,000)* *Retained earnings balance after dlosing out revennes, expenses, and dividends. Note: Parentheses indicate acradit balance On December 31, BigNet acquires Smallport by issuing 26,000 shares of $10 par value common stock values at $100 per share. BigNet also agrees to pay an additional $83,200 to the foremer owners if Smallport's earnings exceeds a certain target during the next period. The probabilistic present value of this contingent liability is $20,000. BigNet pays $40,000 fees to an investment banker in arranging the acquisition. Please prepare a consolidated worksheet on the date of acquisition. ... ... . ... ... ... ... ... ... ... ... ... .... .. :: : :

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Below is the financial statement of B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started