Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find breakeven as well You work at an avionics manufacturing company and you are selected to be part of a team that will evaluate

Please find breakeven as well

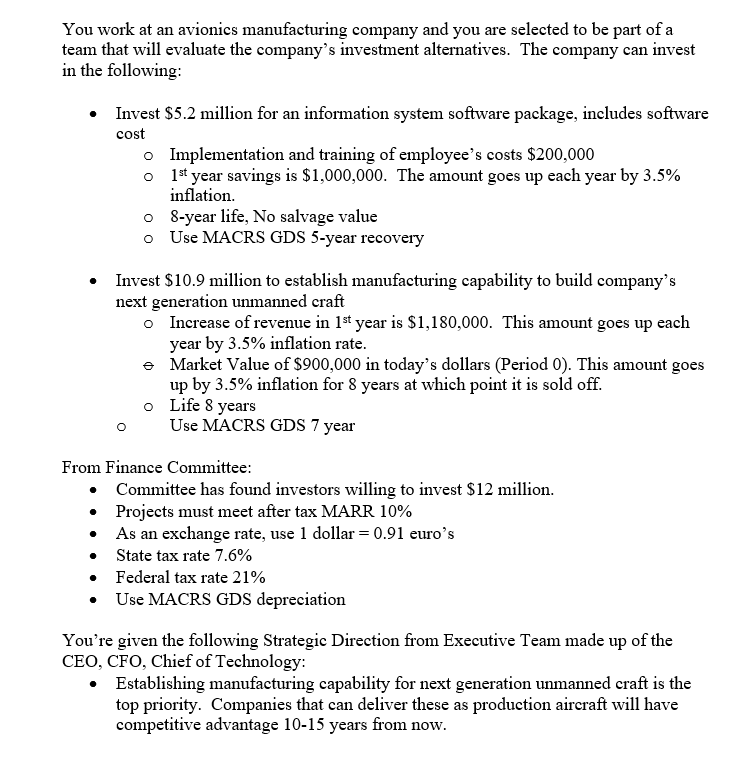

You work at an avionics manufacturing company and you are selected to be part of a team that will evaluate the company's investment alternatives. The company can invest in the following: Invest $5.2 million for an information system software package, includes software cost o Implementation and training of employee's costs $200,000 o 1st year savings is $1,000,000. The amount goes up each year by 3.5% inflation. o 8-year life, No salvage value o Use MACRS GDS 5-year recovery Invest $10.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 1st year is $1,180,000. This amount goes up each year by 3.5% inflation rate. Market Value of $900,000 in today's dollars (Period 0). This amount goes up by 3.5% inflation for 8 years at which point it is sold off. o Life 8 years Use MACRS GDS 7 year From Finance Committee: Committee has found investors willing to invest $12 million. Projects must meet after tax MARR 10% As an exchange rate, use 1 dollar = 0.91 euro's State tax rate 7.6% Federal tax rate 21% Use MACRS GDS depreciation You're given the following Strategic Direction from Executive Team made up of the CEO, CFO, Chief of Technology: Establishing manufacturing capability for next generation unmanned craft is the top priority. Companies that can deliver these as production aircraft will have competitive advantage 10-15 years from now. You work at an avionics manufacturing company and you are selected to be part of a team that will evaluate the company's investment alternatives. The company can invest in the following: Invest $5.2 million for an information system software package, includes software cost o Implementation and training of employee's costs $200,000 o 1st year savings is $1,000,000. The amount goes up each year by 3.5% inflation. o 8-year life, No salvage value o Use MACRS GDS 5-year recovery Invest $10.9 million to establish manufacturing capability to build company's next generation unmanned craft o Increase of revenue in 1st year is $1,180,000. This amount goes up each year by 3.5% inflation rate. Market Value of $900,000 in today's dollars (Period 0). This amount goes up by 3.5% inflation for 8 years at which point it is sold off. o Life 8 years Use MACRS GDS 7 year From Finance Committee: Committee has found investors willing to invest $12 million. Projects must meet after tax MARR 10% As an exchange rate, use 1 dollar = 0.91 euro's State tax rate 7.6% Federal tax rate 21% Use MACRS GDS depreciation You're given the following Strategic Direction from Executive Team made up of the CEO, CFO, Chief of Technology: Establishing manufacturing capability for next generation unmanned craft is the top priority. Companies that can deliver these as production aircraft will have competitive advantage 10-15 years from now

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started