Answered step by step

Verified Expert Solution

Question

1 Approved Answer

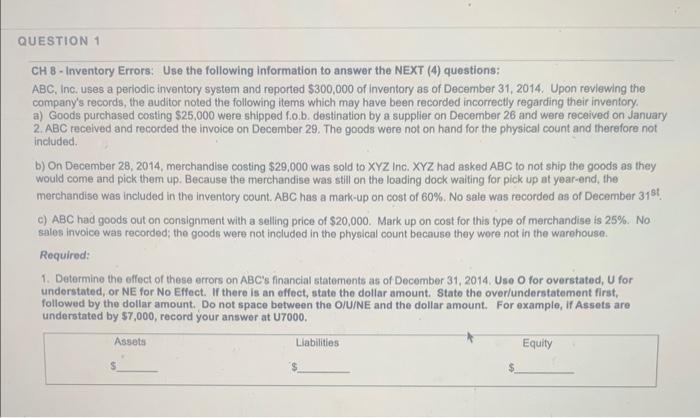

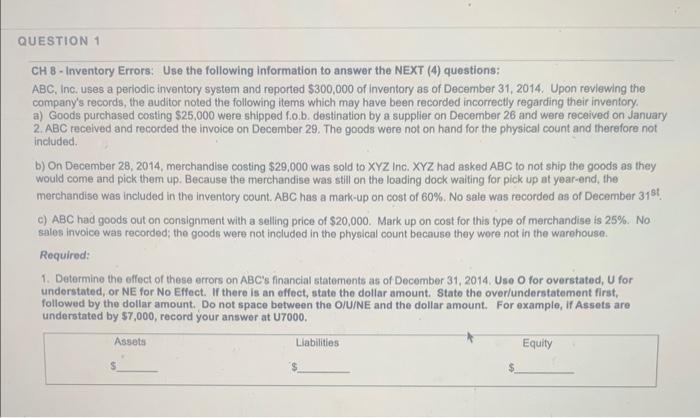

please find effect on Assets, Liabilities, Equity, and the correct ending inventory CH 8 - Inventory Errors: Use the following information to answer the NEXT

please find effect on Assets, Liabilities, Equity, and the correct ending inventory

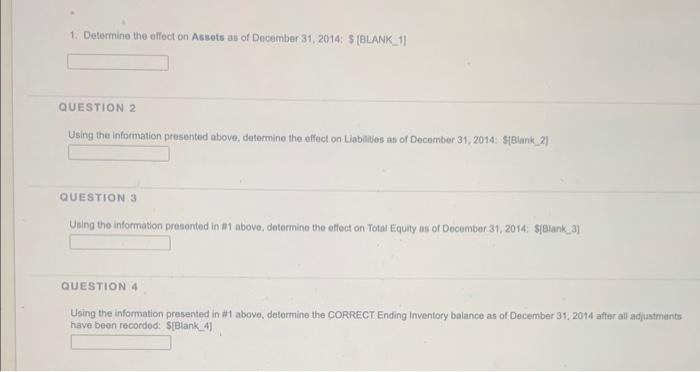

CH 8 - Inventory Errors: Use the following information to answer the NEXT (4) questions: ABC, Inc. uses a periodic inventory system and reported $300,000 of inventory as of December 31, 2014. Upon reviewing the company's records, the auditor noted the following items which may have been recorded incorrectly regarding their inventory. a) Goods purchased costing $25,000 were shipped fo.b. destination by a supplier on December 26 and were received on January 2. ABC received and recorded the invoice on December 29 . The goods were not on hand for the physical count and therefore not included. b) On December 28, 2014, merchandise costing $29,000 was sold to XYZ Inc. XYZ had asked ABC to not ship the goods as they would come and pick them up. Because the merchandise was still on the loading dock waiting for pick up at year-end, the merchandise was included in the inventory count. ABC has a mark-up on cost of 60%. No sale was recorded as of December 31st c) ABC had goods out on consignment with a selling price of $20,000. Mark up on cost for this type of merchandise is 25%. No sales invoice was recorded; the goods were not included in the physical count because they wore not in the warehouse. Required: 1. Determine the effect of these errors on ABC's financial statements as of December 31, 2014. Use O for overstated, U for understated, or NE for No Effect. If there is an effoct, state the dollar amount. Stato the over/understatement first, followed by the dollar amount. Do not space between the O/U/NE and the dollar amount. For example, If Assets are understated by $7,000, record your answer at U7000. 1. Determine the effect on Assets as of December 31, 2014: \$ BBLANK_1] QUESTION 2 Using the Information presented above, determine the effect on Llabilities as of December 31, 2014: \$|Blank 2] QUESTION 3 Using the information presonted in 111 above, determine the effect on Totat Equity as of December 31, 2014: \$[6tank_3] QUESTION 4 Using the information presented in \#1 abovo, detormine the CORRECT Ending Inventory bolance as of December 31; 2014 after all adiustments have beon recorded: SiBlank_4] CH 8 - Inventory Errors: Use the following information to answer the NEXT (4) questions: ABC, Inc. uses a periodic inventory system and reported $300,000 of inventory as of December 31, 2014. Upon reviewing the company's records, the auditor noted the following items which may have been recorded incorrectly regarding their inventory. a) Goods purchased costing $25,000 were shipped fo.b. destination by a supplier on December 26 and were received on January 2. ABC received and recorded the invoice on December 29 . The goods were not on hand for the physical count and therefore not included. b) On December 28, 2014, merchandise costing $29,000 was sold to XYZ Inc. XYZ had asked ABC to not ship the goods as they would come and pick them up. Because the merchandise was still on the loading dock waiting for pick up at year-end, the merchandise was included in the inventory count. ABC has a mark-up on cost of 60%. No sale was recorded as of December 31st c) ABC had goods out on consignment with a selling price of $20,000. Mark up on cost for this type of merchandise is 25%. No sales invoice was recorded; the goods were not included in the physical count because they wore not in the warehouse. Required: 1. Determine the effect of these errors on ABC's financial statements as of December 31, 2014. Use O for overstated, U for understated, or NE for No Effect. If there is an effoct, state the dollar amount. Stato the over/understatement first, followed by the dollar amount. Do not space between the O/U/NE and the dollar amount. For example, If Assets are understated by $7,000, record your answer at U7000. 1. Determine the effect on Assets as of December 31, 2014: \$ BBLANK_1] QUESTION 2 Using the Information presented above, determine the effect on Llabilities as of December 31, 2014: \$|Blank 2] QUESTION 3 Using the information presonted in 111 above, determine the effect on Totat Equity as of December 31, 2014: \$[6tank_3] QUESTION 4 Using the information presented in \#1 abovo, detormine the CORRECT Ending Inventory bolance as of December 31; 2014 after all adiustments have beon recorded: SiBlank_4]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started