Answered step by step

Verified Expert Solution

Question

1 Approved Answer

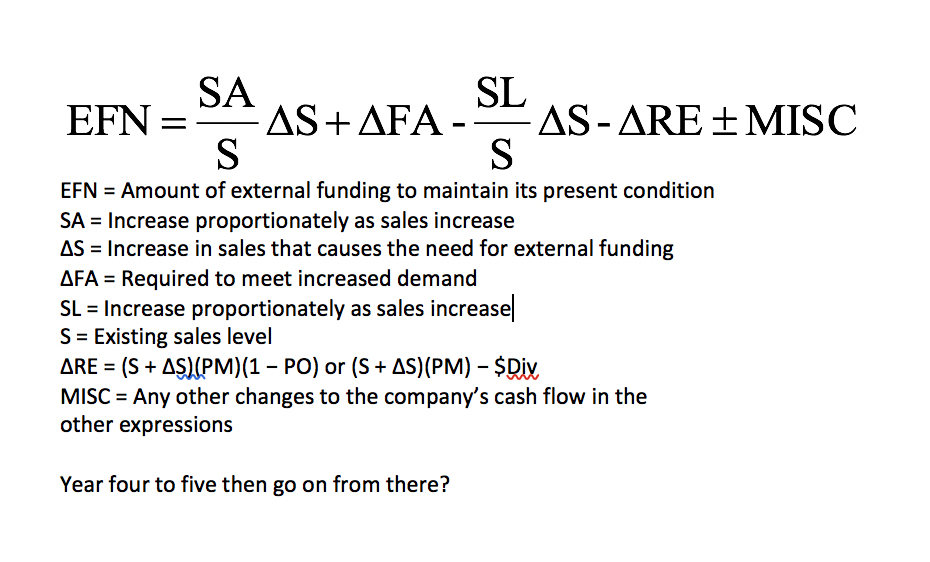

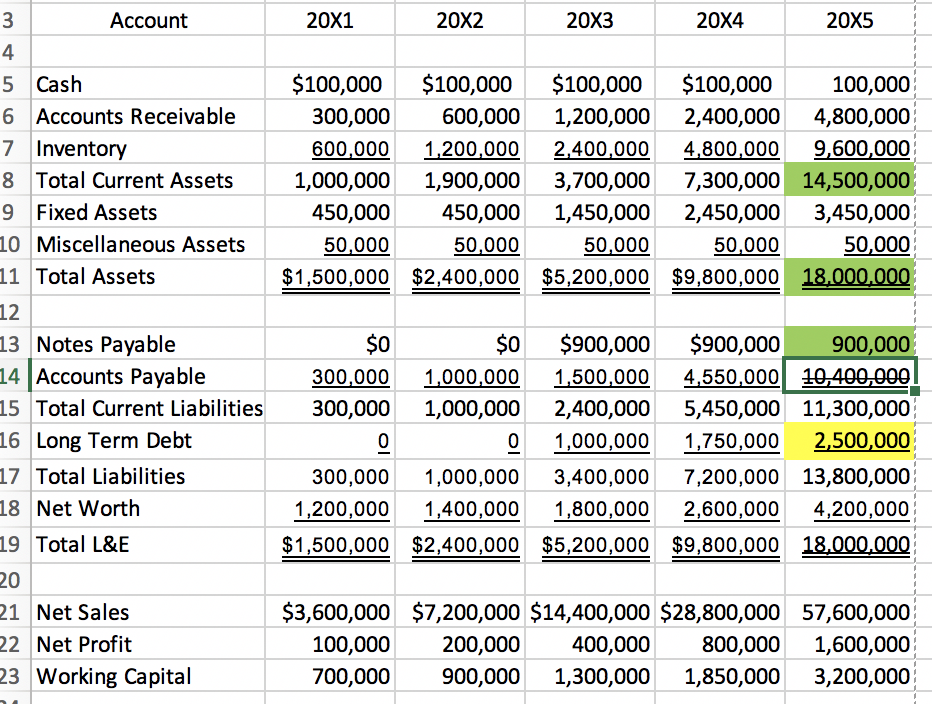

Please find the EFN for year 20X5, and explain what it means please. (using the equation below) SA EFN = AS+AFA- AS-ARE + MISC S

Please find the EFN for year 20X5, and explain what it means please. (using the equation below)

SA EFN = AS+AFA- AS-ARE + MISC S EFN = Amount of external funding to maintain its present condition SA = Increase proportionately as sales increase AS = Increase in sales that causes the need for external funding AFA = Required to meet increased demand SL = Increase proportionately as sales increase S = Existing sales level ARE = (S + AS (PM)(1 - PO) or (S + AS)(PM) - $Diy MISC = Any other changes to the company's cash flow in the other expressions Year four to five then go on from there? Account 20X1 20X2 20X3 20X4 20X5 5 Cash 6 Accounts Receivable 7 Inventory 8 Total Current Assets 9 Fixed Assets 10 Miscellaneous Assets 11 Total Assets $100,000 300,000 600,000 1,000,000 450,000 50,000 $1,500,000 $100,000 600,000 1,200,000 1,900,000 450,000 50,000 $2,400,000 $100,000 1,200,000 2,400,000 3,700,000 1,450,000 50,000 $5,200,000 $100,000 2,400,000 4,800,000 7,300,000 2,450,000 50,000 $9,800,000 100,000 4,800,000 9,600,000 14,500,000 3,450,000 50,000 18.000.000 $0 13 Notes Payable 14 Accounts Payable 15 Total Current Liabilities 16 Long Term Debt 17 Total Liabilities 18 Net Worth 19 Total L&E $0 300,000 1,000,000 300,000 1,000,000 O 300,000 1,000,000 1,200,000 1,400,000 $1,500,000 $2,400,000 $900,000 $900,000 900,000 1,500,000 4,550,000 10,400,000 2,400,000 5,450,000 11,300,000 1,000,000 1,750,000 2,500,000 3,400,000 7,200,000 13,800,000 1,800,000 2,600,000 4,200,000 $5,200,000 $9,800,000 18.000.000 20 21 Net Sales 22 Net Profit 23 Working Capital $3,600,000 $7,200,000 $14,400,000 $28,800,000 57,600,000 100,000 200,000 400,000 800,000 1,600,000 700,000 900,000 1,300,000 1,850,000 3,200,000 SA EFN = AS+AFA- AS-ARE + MISC S EFN = Amount of external funding to maintain its present condition SA = Increase proportionately as sales increase AS = Increase in sales that causes the need for external funding AFA = Required to meet increased demand SL = Increase proportionately as sales increase S = Existing sales level ARE = (S + AS (PM)(1 - PO) or (S + AS)(PM) - $Diy MISC = Any other changes to the company's cash flow in the other expressions Year four to five then go on from there? Account 20X1 20X2 20X3 20X4 20X5 5 Cash 6 Accounts Receivable 7 Inventory 8 Total Current Assets 9 Fixed Assets 10 Miscellaneous Assets 11 Total Assets $100,000 300,000 600,000 1,000,000 450,000 50,000 $1,500,000 $100,000 600,000 1,200,000 1,900,000 450,000 50,000 $2,400,000 $100,000 1,200,000 2,400,000 3,700,000 1,450,000 50,000 $5,200,000 $100,000 2,400,000 4,800,000 7,300,000 2,450,000 50,000 $9,800,000 100,000 4,800,000 9,600,000 14,500,000 3,450,000 50,000 18.000.000 $0 13 Notes Payable 14 Accounts Payable 15 Total Current Liabilities 16 Long Term Debt 17 Total Liabilities 18 Net Worth 19 Total L&E $0 300,000 1,000,000 300,000 1,000,000 O 300,000 1,000,000 1,200,000 1,400,000 $1,500,000 $2,400,000 $900,000 $900,000 900,000 1,500,000 4,550,000 10,400,000 2,400,000 5,450,000 11,300,000 1,000,000 1,750,000 2,500,000 3,400,000 7,200,000 13,800,000 1,800,000 2,600,000 4,200,000 $5,200,000 $9,800,000 18.000.000 20 21 Net Sales 22 Net Profit 23 Working Capital $3,600,000 $7,200,000 $14,400,000 $28,800,000 57,600,000 100,000 200,000 400,000 800,000 1,600,000 700,000 900,000 1,300,000 1,850,000 3,200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started