Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find the ending balance sheet amounts for year 1 and year 3. Year 1 Year 2 Year 3 = Year 1 Year 2 Year

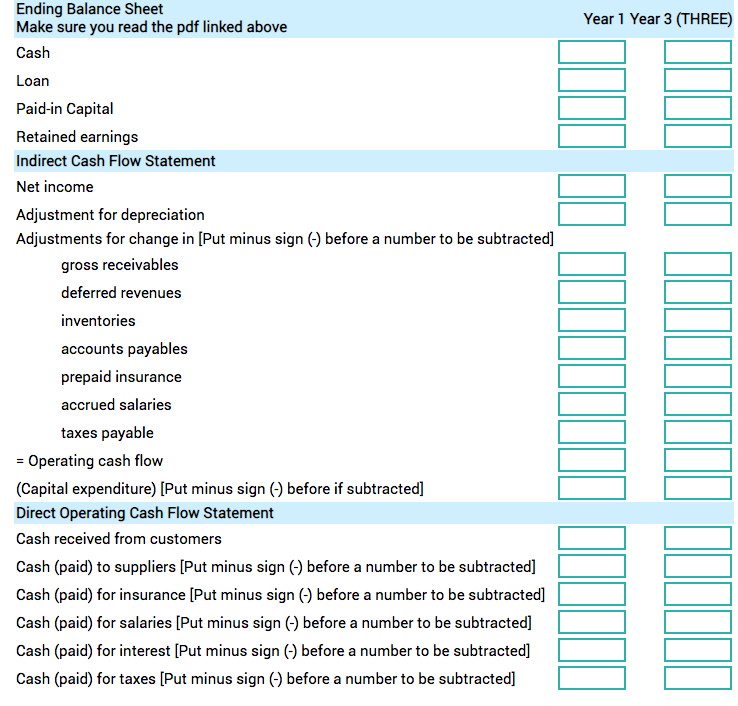

Please find the ending balance sheet amounts for year 1 and year 3.

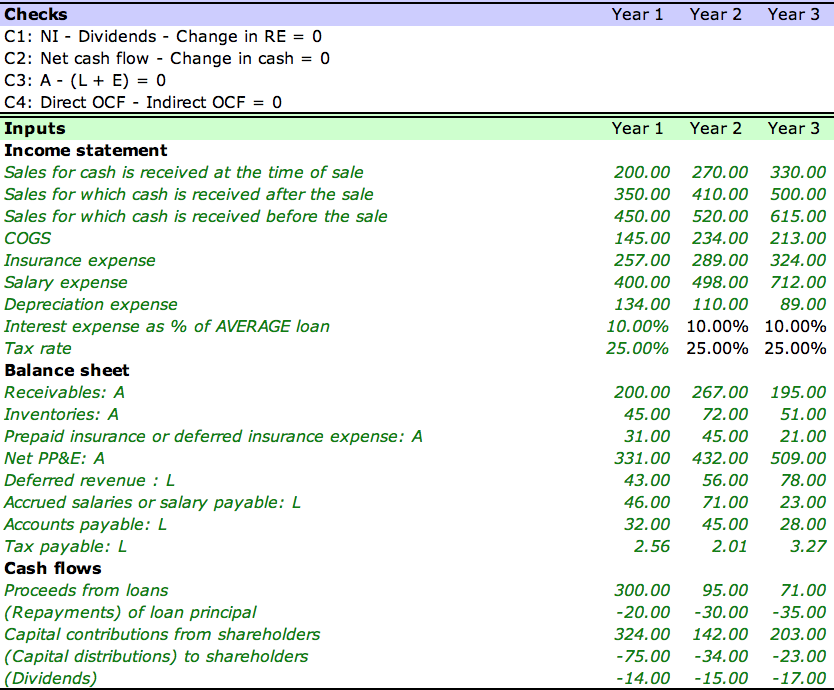

Year 1 Year 2 Year 3 = Year 1 Year 2 Year 3 Checks C1: NI - Dividends - Change in RE = 0 C2: Net cash flow - Change in cash 0 C3: A - (L + E) = 0 C4: Direct OCF - Indirect OCF = 0 Inputs Income statement Sales for cash is received at the time of sale Sales for which cash is received after the sale Sales for which cash is received before the sale COGS Insurance expense Salary expense Depreciation expense Interest expense as % of AVERAGE loan Tax rate Balance sheet Receivables: A Inventories: A Prepaid insurance or deferred insurance expense: A Net PP&E: A Deferred revenue : L Accrued salaries or salary payable: L Accounts payable: L Tax payable: L Cash flows Proceeds from loans (Repayments) of loan principal Capital contributions from shareholders (Capital distributions) to shareholders (Dividends) 200.00 270.00 330.00 350.00 410.00 500.00 450.00 520.00 615.00 145.00 234.00 213.00 257.00 289.00 324.00 400.00 498.00 712.00 134.00 110.00 89.00 10.00% 10.00% 10.00% 25.00% 25.00% 25.00% 200.00 267.00 45.00 72.00 31.00 45.00 331.00 432.00 43.00 56.00 46.00 71.00 32.00 45.00 2.56 2.01 195.00 51.00 21.00 509.00 78.00 23.00 28.00 3.27 300.00 -20.00 324.00 -75.00 -14.00 95.00 71.00 -30.00 -35.00 142.00 203.00 -34.00 -23.00 -15.00 -17.00 Year 1 Year 3 (THREE) II III Ending Balance Sheet Make sure you read the pdf linked above Cash Loan Paid-in Capital Retained earnings Indirect Cash Flow Statement Net income Adjustment for depreciation Adjustments for change in (Put minus sign (-) before a number to be subtracted] gross receivables deferred revenues inventories accounts payables prepaid insurance accrued salaries taxes payable = Operating cash flow (Capital expenditure) [Put minus sign (-) before if subtracted] Direct Operating Cash Flow Statement Cash received from customers Cash (paid) to suppliers (Put minus sign (-) before a number to be subtracted] Cash (paid) for insurance (Put minus sign (-) before a number to be subtracted] Cash (paid) for salaries (Put minus sign (-) before a number to be subtracted] Cash (paid) for interest [Put minus sign (-) before a number to be subtracted] Cash (paid) for taxes [Put minus sign (-) before a number to be subtracted] Year 1 Year 2 Year 3 = Year 1 Year 2 Year 3 Checks C1: NI - Dividends - Change in RE = 0 C2: Net cash flow - Change in cash 0 C3: A - (L + E) = 0 C4: Direct OCF - Indirect OCF = 0 Inputs Income statement Sales for cash is received at the time of sale Sales for which cash is received after the sale Sales for which cash is received before the sale COGS Insurance expense Salary expense Depreciation expense Interest expense as % of AVERAGE loan Tax rate Balance sheet Receivables: A Inventories: A Prepaid insurance or deferred insurance expense: A Net PP&E: A Deferred revenue : L Accrued salaries or salary payable: L Accounts payable: L Tax payable: L Cash flows Proceeds from loans (Repayments) of loan principal Capital contributions from shareholders (Capital distributions) to shareholders (Dividends) 200.00 270.00 330.00 350.00 410.00 500.00 450.00 520.00 615.00 145.00 234.00 213.00 257.00 289.00 324.00 400.00 498.00 712.00 134.00 110.00 89.00 10.00% 10.00% 10.00% 25.00% 25.00% 25.00% 200.00 267.00 45.00 72.00 31.00 45.00 331.00 432.00 43.00 56.00 46.00 71.00 32.00 45.00 2.56 2.01 195.00 51.00 21.00 509.00 78.00 23.00 28.00 3.27 300.00 -20.00 324.00 -75.00 -14.00 95.00 71.00 -30.00 -35.00 142.00 203.00 -34.00 -23.00 -15.00 -17.00 Year 1 Year 3 (THREE) II III Ending Balance Sheet Make sure you read the pdf linked above Cash Loan Paid-in Capital Retained earnings Indirect Cash Flow Statement Net income Adjustment for depreciation Adjustments for change in (Put minus sign (-) before a number to be subtracted] gross receivables deferred revenues inventories accounts payables prepaid insurance accrued salaries taxes payable = Operating cash flow (Capital expenditure) [Put minus sign (-) before if subtracted] Direct Operating Cash Flow Statement Cash received from customers Cash (paid) to suppliers (Put minus sign (-) before a number to be subtracted] Cash (paid) for insurance (Put minus sign (-) before a number to be subtracted] Cash (paid) for salaries (Put minus sign (-) before a number to be subtracted] Cash (paid) for interest [Put minus sign (-) before a number to be subtracted] Cash (paid) for taxes [Put minus sign (-) before a number to be subtracted]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started