Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please find the NPV of the duffel bag. Please find the NPV Break-even quantity as well. Show steps. Thank you Jack Tar, CFO of We

Please find the NPV of the duffel bag.

Please find the NPV of the duffel bag.

Please find the NPV Break-even quantity as well.

Show steps.

Thank you

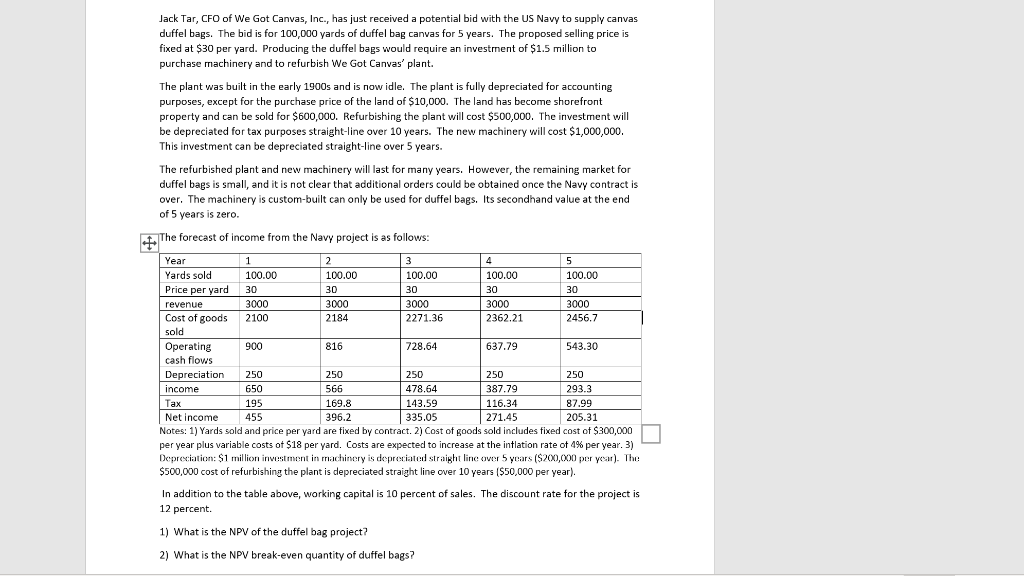

Jack Tar, CFO of We Got Canvas, Inc., has just received a potential bid with the US Navy to supply canvas duffel bags. The bid is for 100,000 yards of duffel bag canvas for 5 years. The proposed selling price is fixed at $30 per yard. Producing the duffel bags would require an investment of $1.5 million to purchase machinery and to refurbish We Got Canvas' plant. The plant was built in the early 1900s and is now idle. The plant is fully depreciated for accounting purposes, except for the purchase price of the land of $10,000. The land has become shorefront property and can be sold for $600,000. Refurbishing the plant will cost $500,000. The investment will be depreciated for tax purposes straight-line over 10 years. The new machinery will cost $1,000,000. This investment can be depreciated straight-line over 5 years. The refurbished plant and new machinery will last for many years. However, the remaining market for duffel bags is small, and it is not clear that additional orders could be obtained once the Navy contract is over. The machinery is custom-built can only be used for duffel bags. Its secondhand value at the end of 5 years is zero. The forecast of income from the Navy project is as follows: Year 1 2 3 4 5 Yards sold 100.00 100.00 100.00 100.00 100.00 Price per yard 30 30 30 30 30 revenue 3000 3000 3000 3000 3000 Cost of goods 2100 2184 2271.36 2362.21 2456.7 sold Operating 900 816 728.64 637.79 543.30 cash flows Depreciation 250 250 250 250 250 income 650 566 478.64 387.79 293.3 Tax 195 169.8 143.59 116.34 87.99 Net income 455 396.2 335.05 271.45 205.31 Notes: 1) Yards sold and price per yard are fixed by contract. 2) Cost of goods sold includes fixed cost of $300,000 per year plus variable costs of $18 per yard. Costs are expected to increase at the intlation rate of 4% per year. 3) Depreciation: $1 million investment in machinery is depreciated straight line over 5 years ($200,000 per year). The $500,000 cost of refurbishing the plant is depreciated straight line over 10 years ($50,000 per year). In addition to the table above, working capital is 10 percent of sales. The discount rate for the project is 12 percent 1) What is the NPV of the duffel bag project? 2) What is the NPV break-even quantity of duffel bagsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started