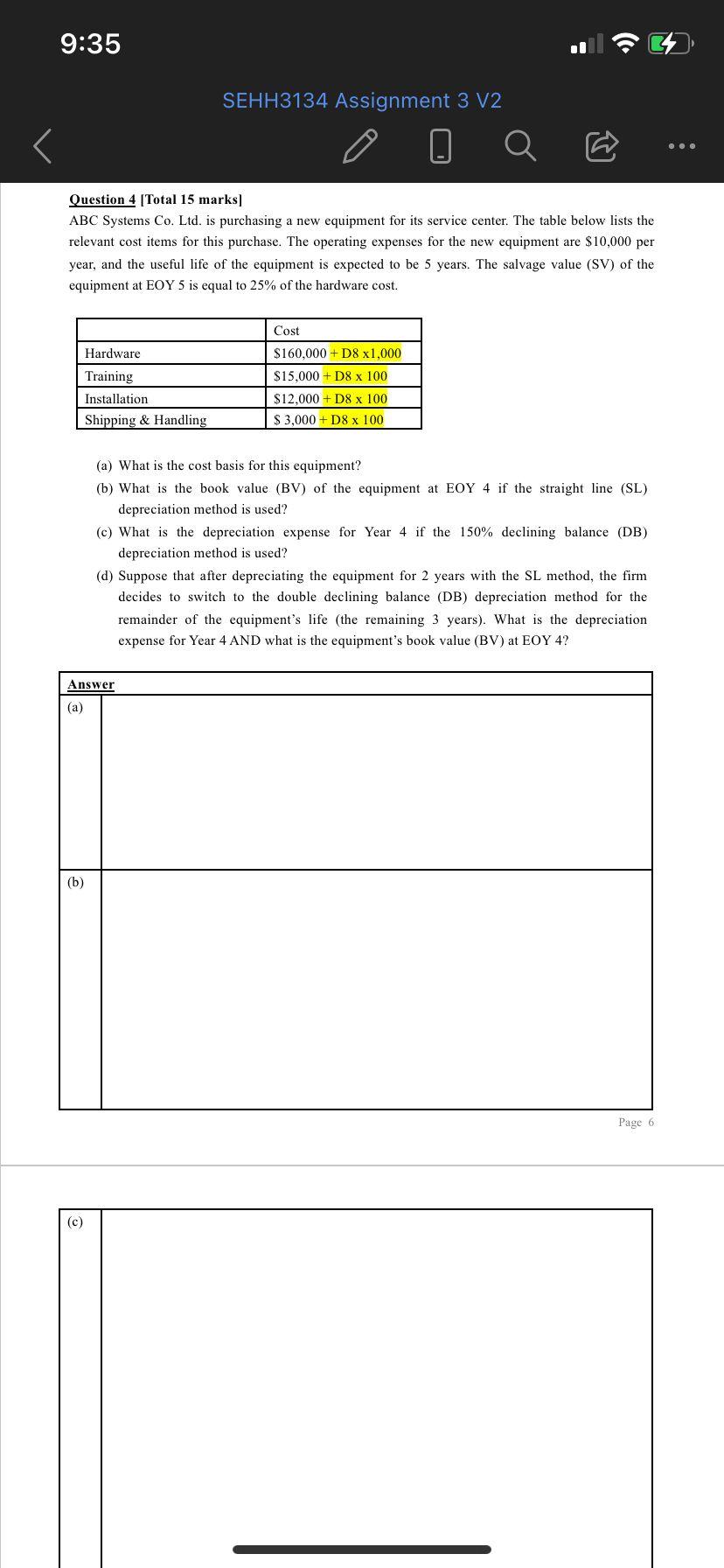

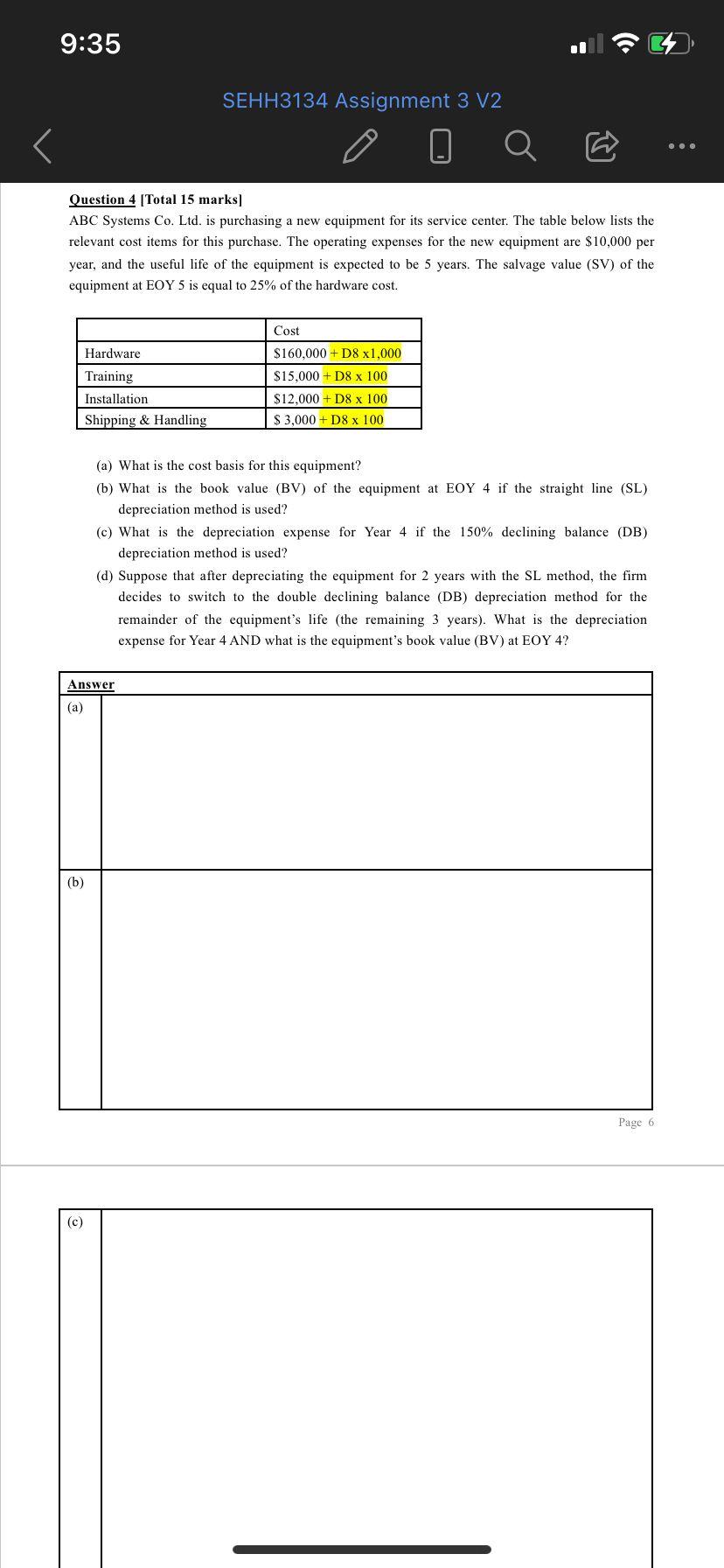

please finish all part in question 4,my d8=1

9:35 SEHH3134 Assignment 3 V2 O Question 4 [Total 15 marks] ABC Systems Co. Ltd. is purchasing a new equipment for its service center. The table below lists the relevant cost items for this purchase. The operating expenses for the new equipment are $10,000 per year, and the useful life of the equipment is expected to be 5 years. The salvage value (SV) of the equipment at EOY 5 is equal to 25% of the hardware cost. Hardware Training Installation Shipping & Handling Cost $160,000 + D8 x1,000 $15,000 + D8 x 100 $12,000 + D8 x 100 $ 3.000 + D8 x 100 (a) What is the cost basis for this equipment? (b) What is the book value (BV) of the equipment at EOY 4 if the straight line (SL) depreciation method is used? (c) What is the depreciation expense for Year 4 if the 150% declining balance (DB) depreciation method is used? (d) Suppose that after depreciating the equipment for 2 years with the SL method, the firm decides to switch to the double declining balance (DB) depreciation method for the remainder of the equipment's life (the remaining 3 years). What is the depreciation expense for Year 4 AND what is the equipment's book value (BV) at EOY 4? Answer (a) (b) Page 6 (c) 9:35 SEHH3134 Assignment 3 V2 O Question 4 [Total 15 marks] ABC Systems Co. Ltd. is purchasing a new equipment for its service center. The table below lists the relevant cost items for this purchase. The operating expenses for the new equipment are $10,000 per year, and the useful life of the equipment is expected to be 5 years. The salvage value (SV) of the equipment at EOY 5 is equal to 25% of the hardware cost. Hardware Training Installation Shipping & Handling Cost $160,000 + D8 x1,000 $15,000 + D8 x 100 $12,000 + D8 x 100 $ 3.000 + D8 x 100 (a) What is the cost basis for this equipment? (b) What is the book value (BV) of the equipment at EOY 4 if the straight line (SL) depreciation method is used? (c) What is the depreciation expense for Year 4 if the 150% declining balance (DB) depreciation method is used? (d) Suppose that after depreciating the equipment for 2 years with the SL method, the firm decides to switch to the double declining balance (DB) depreciation method for the remainder of the equipment's life (the remaining 3 years). What is the depreciation expense for Year 4 AND what is the equipment's book value (BV) at EOY 4? Answer (a) (b) Page 6 (c)