Question

please finish cash flows worksheet, direct method activities during FY B : a1. sales,all on credit 813,000 a2. the only decreases in accounts receivable were

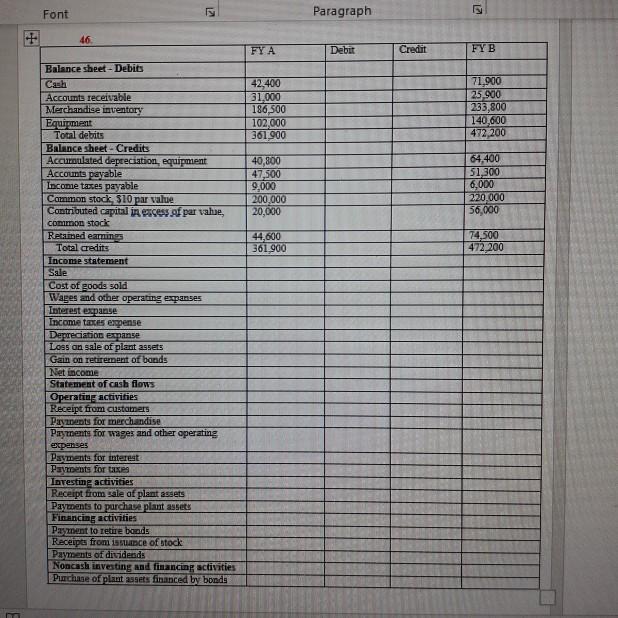

please finish cash flows worksheet, direct method activities during FY B : a1. sales,all on credit 813,000 a2. the only decreases in accounts receivable were receipts from customers b1. cost of goods sold 372,000 b2. purchases of merchandise were on credit b3.debits to accounts payable during the period resulted from payments for merchandise c. depreciation expense 23,600 d. other operating expenses that were paid with cash 239,700 e1. income taxes expense 59,800 e2. the only decreases in income taxes payable were payments of taxes f. net income 117,900 g. equipment was purchased for 38,600 cash h. two thousand shares of stock were issued for cash at 28 per share i. the company declared and paid 88,000of cash dividends during the year j. net income was 117,900 k. accounts receivable decreased l. merchandise inventory increased m. accounts payable increased n. income taxes payable decreased

Font Paragraph 46 FYA Debit Credit FYB 42,400 31,000 186,500 102,000 361.900 71.900 25.900 233,800 140,000 472,200 40,800 47,500 9,000 200.000 20,000 64,400 51.300 6,000 220,000 56,000 44,600 361 900 74,500 472.200 Balance sheet - Debits Cash Accounts receivable Merchandise inventory Equipment Total debits Balance sheet - Credits Accumulated depreciation equipment Accounts payable Income taxes payable Common stock $10 par value Contributed capital in excess of par vahae, common stock Returned eamins Total credits Income statement Sale Cost of goods sold Wages and other operating expanses Interest expanse Income taxes expense Depreciation Espanse Loss on sale of plant assets Gain on retirement of bands Net income Statement of cash flows Operating activities Receipt from customers Payments for merchandise Payments for wages and other operating expenses Payments for tnterest Payments for taxes Investing activities Receipt from sale of plant assets Payments to purchase plant assets Financing activities Payment to retire bonds Receipts from stance of stock Payments of dividends Noncash investing and financing activities Puchane of plant assets financed by bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started