Answered step by step

Verified Expert Solution

Question

1 Approved Answer

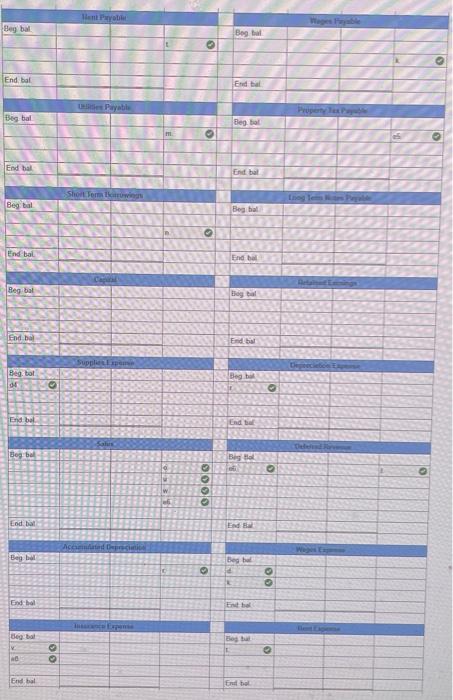

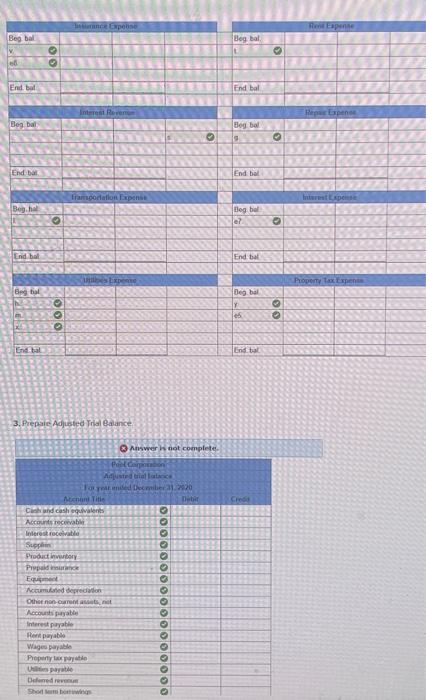

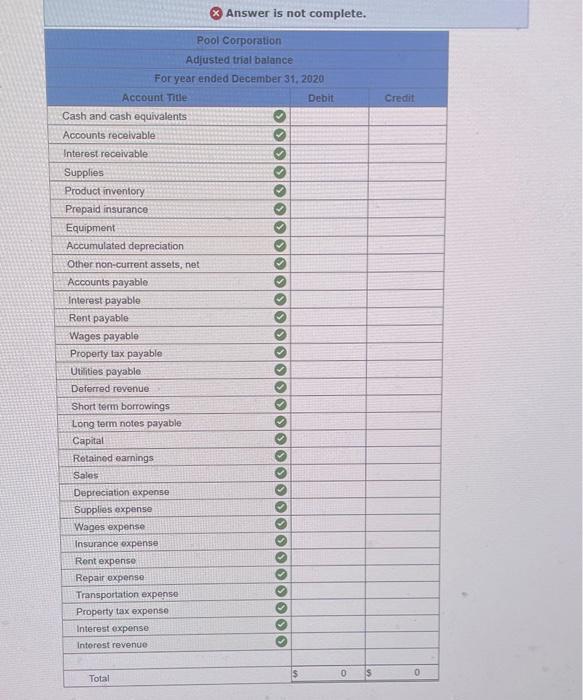

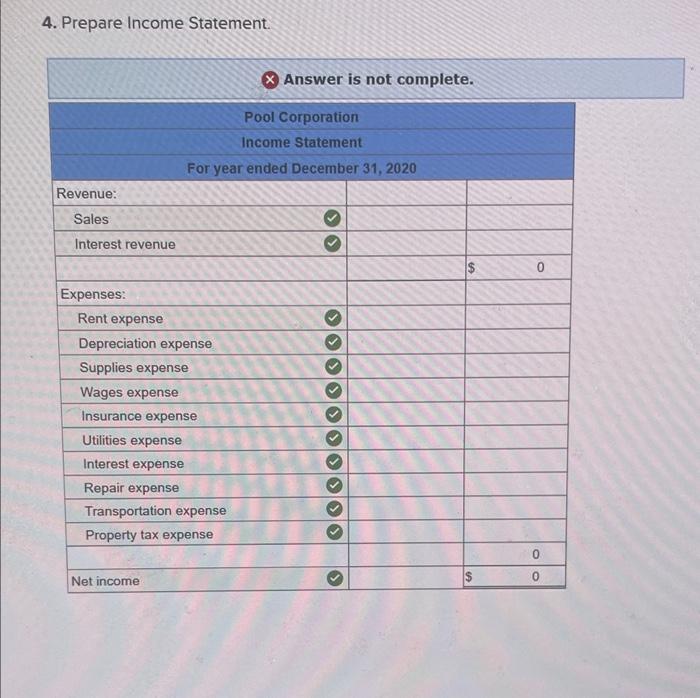

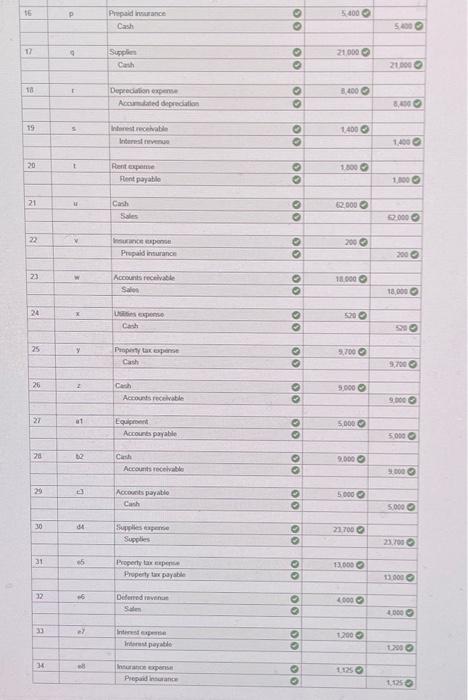

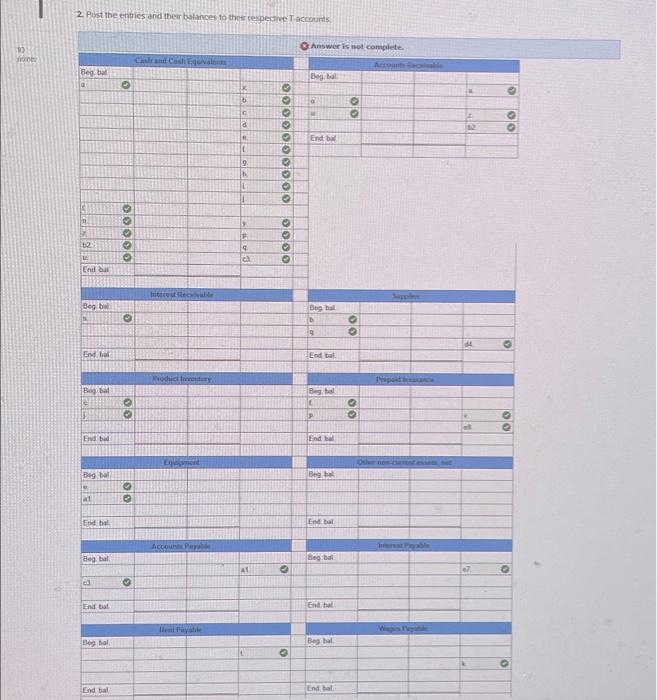

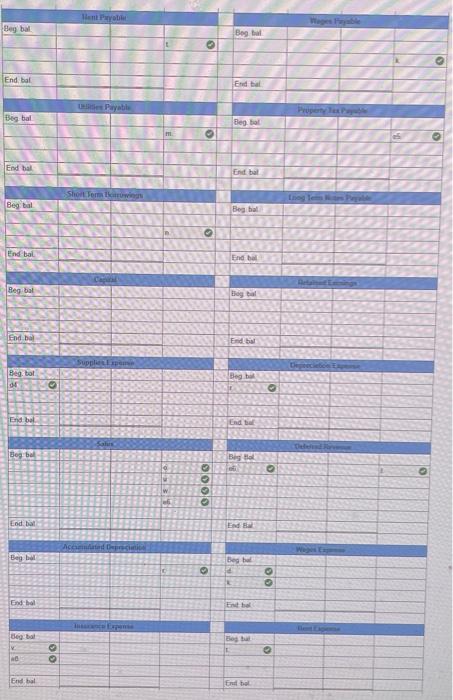

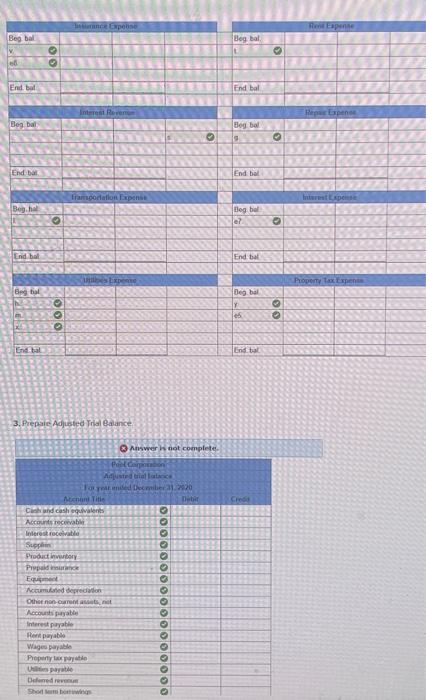

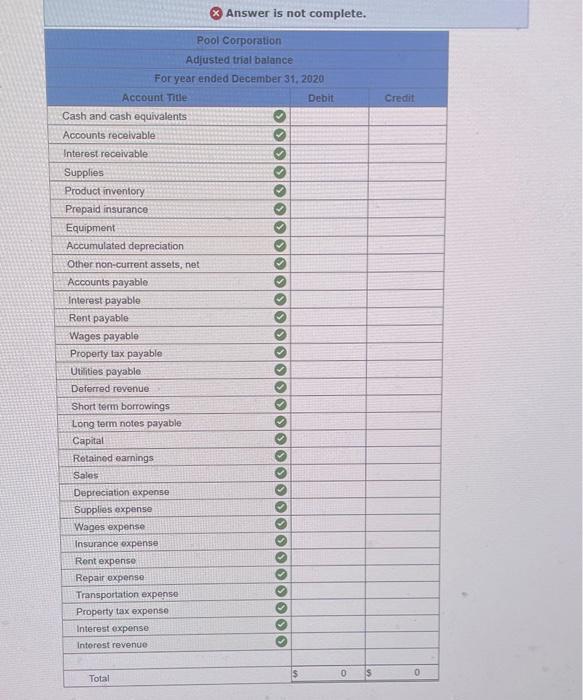

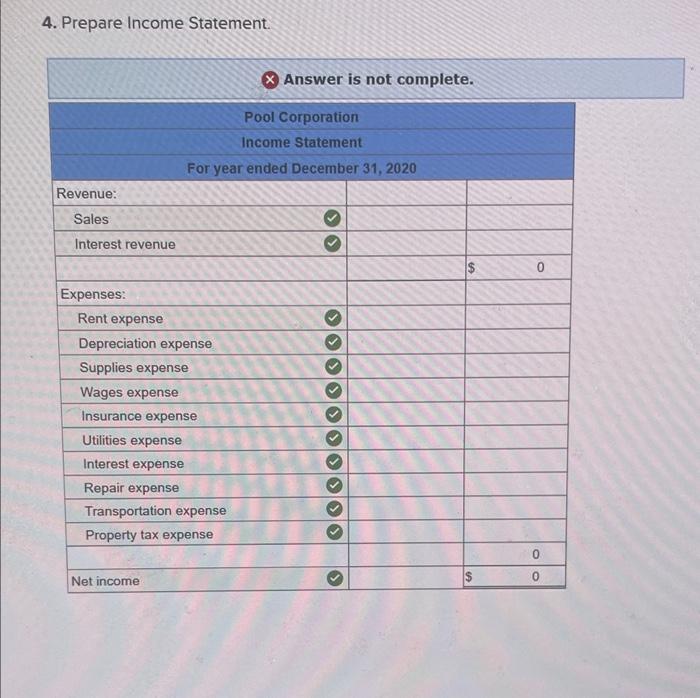

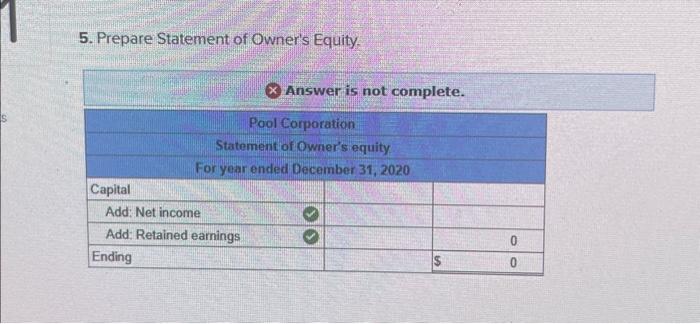

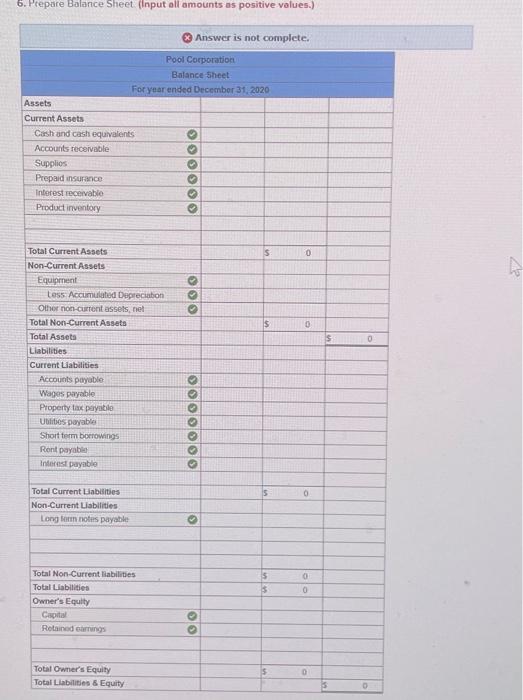

please finish completing each table 3. Prepare Adjusted Frial Qaanice begin{tabular}{|c|c|c|c|c|c|} hline 16 & p & Pripuld herance & 0 & 54000 & hline

please finish completing each table

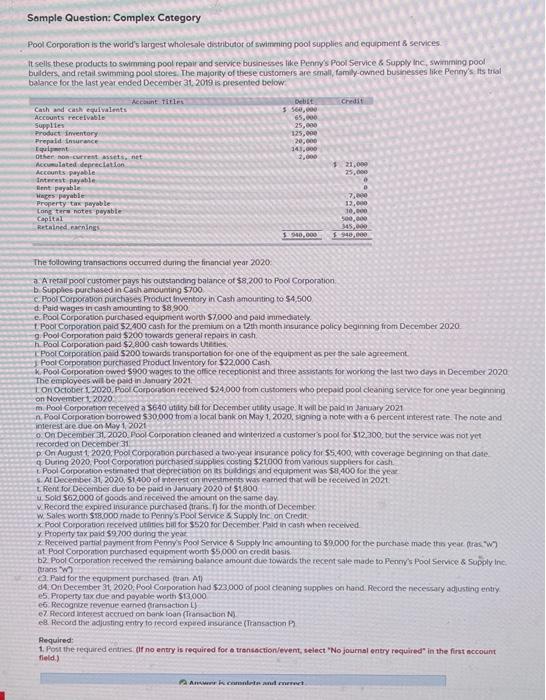

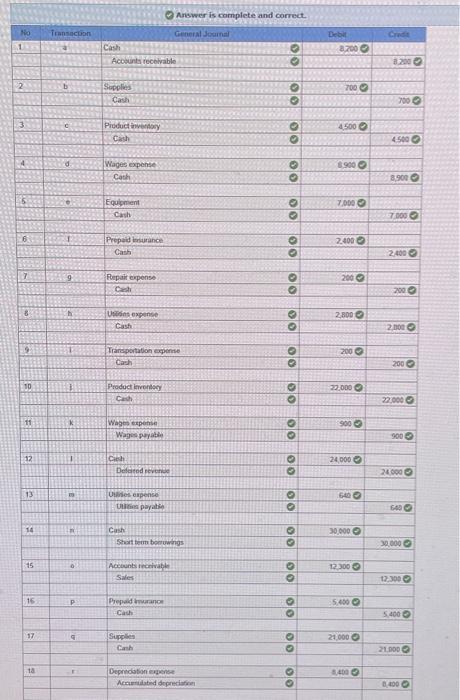

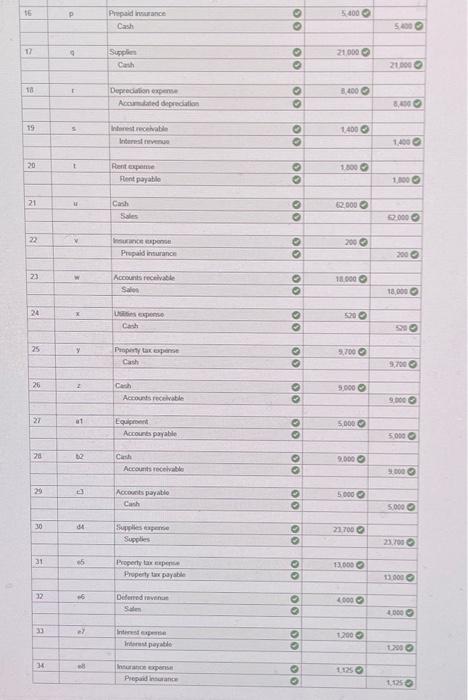

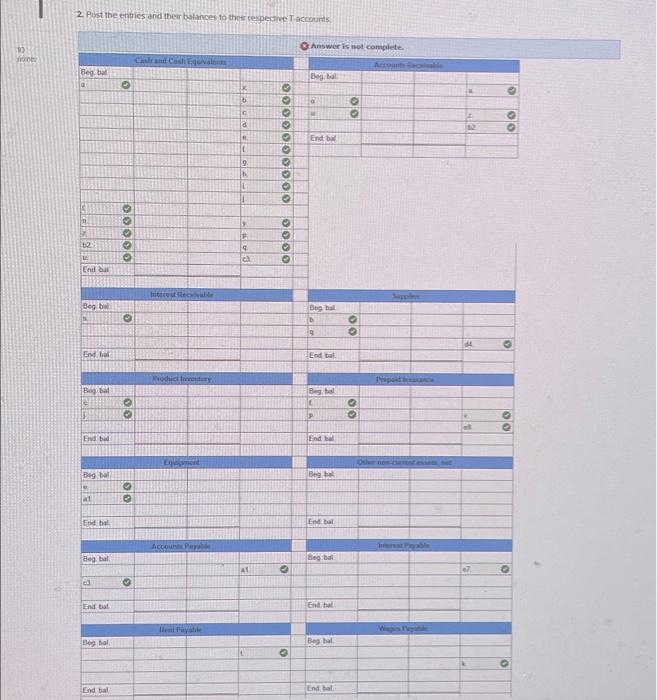

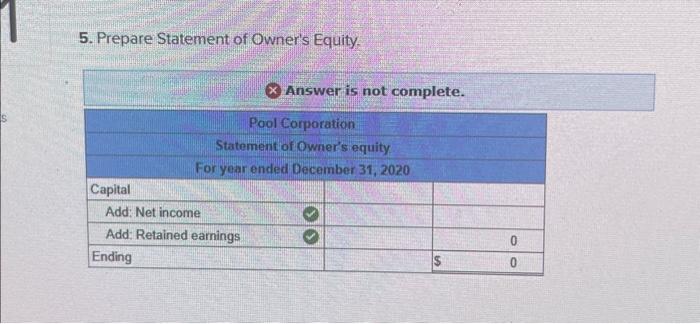

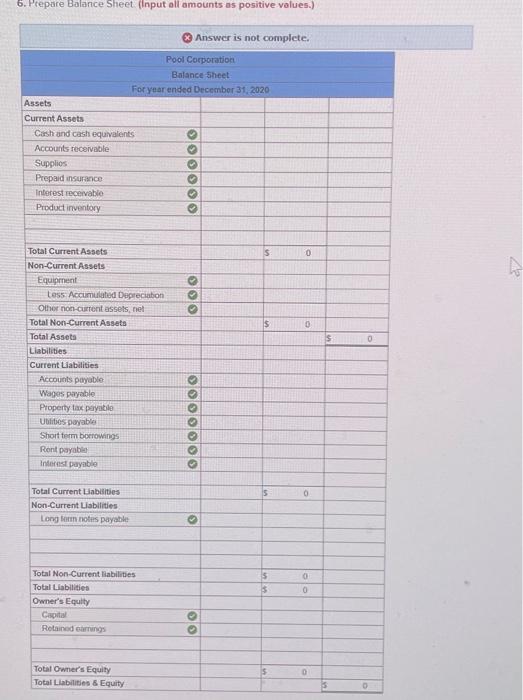

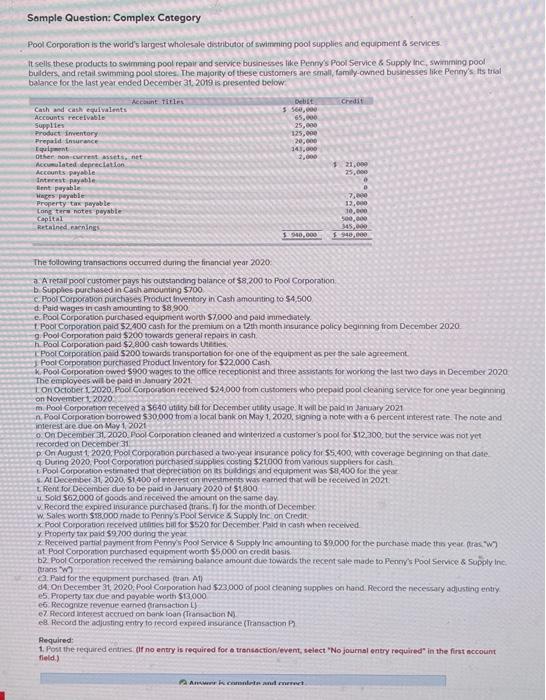

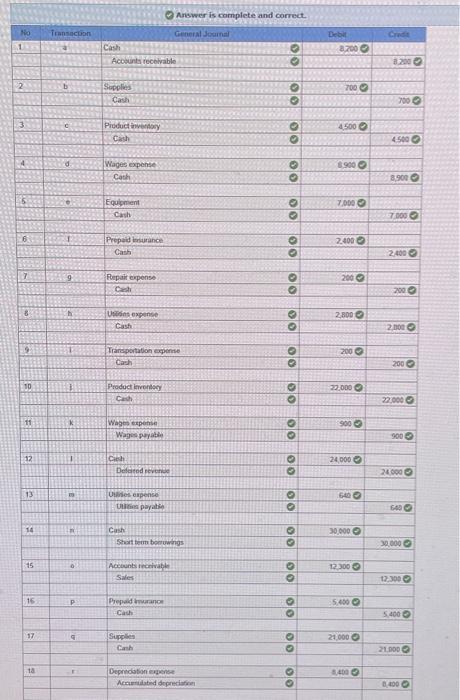

3. Prepare Adjusted Frial Qaanice \begin{tabular}{|c|c|c|c|c|c|} \hline 16 & p & Pripuld herance & 0 & 54000 & \\ \hline & & Cash & 0 & & 5.000 \\ \hline \multirow[t]{3}{*}{n} & 9 & Supplen & 0 & 21.0000 & \\ \hline & & Carh & 0 & & 21.0600 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{18} & r & Depredialion expeme. & 0 & 1,4000 & \\ \hline & & Acainchited depreciation & 0 & & 8,sen0 \\ \hline \multirow[t]{2}{*}{19} & s & himestrecehathe & 0 & 14000 & \\ \hline & & kbarrest nevenue & 0 & & 1,0000 \\ \hline \multirow[t]{2}{*}{20} & t & Pint equative & 0 & 1.0000 & \\ \hline & & Rent payatio & 0 & & 1,1000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{21} & u & Canh & 0 & 62,0000 & \\ \hline & & Soles & 0 & & $20000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{22} & x & hourince epoment & 0 & 2000 & \\ \hline & & Pripais insurance & 0 & & 2000 \\ \hline \multirow[t]{2}{*}{23} & w & Accounts rectivate & 0 & 180000 & \\ \hline & & Salen & 0 & & 1a,0000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{24} & x & \begin{tabular}{l} Uatim expere \\ Cosh \end{tabular} & 0 & 5>00 & 500 \\ \hline & - & Cosh & 0 & & sine \\ \hline \multirow[t]{2}{*}{25} & y & Propery lax equarse & 0 & 2,1000 & E \\ \hline & & Cath & 0 & & \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{26} & 2 & Cech & 0 & 5,0000 & \\ \hline & & Accounts recaliate & 0 & & 90000 \\ \hline \multirow{2}{*}{27} & & & & & \\ \hline & at & \begin{tabular}{l} Equigient \\ Accourb pryatio \end{tabular} & 0 & 50000 & 5,0000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{2a} & to & Canch & 0 & 2.0000 & \\ \hline & & Accounts riscotrad to & 0 & & 20000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{20} & a & Nocounts payatio & 0 & 50000 & \\ \hline & = & Canh & 0 & & 5,0000 \\ \hline \multirow[t]{2}{*}{30} & a & Sisyples experive & 0 & 217000 & \\ \hline & & Suples: & 0 & & 20,1000 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{31} & $5 & Propect tar expense & 0 & 110000 & \\ \hline & & Propetr terpayatile & 0 & & 100000 \\ \hline & & & & + & \\ \hline \multirow[t]{3}{*}{n} & 6 & Delentined intene & 0 & 10000 & \\ \hline & & siten & 0 & & 40000 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{3} & et & Intirest expensie & 0 & 12000 & \\ \hline & & intanse perate & 0 & & 1000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{34} & & hestatice ogensen & 0 & cos0 & \\ \hline & & Prepaid houance & 0 & & \\ \hline \end{tabular} 5. Prepare Statement of Owner's Equity Answer is not complete. 4. Prepare Income Statement. Answer is not complete. Pool Corporation Adjusted trial balance For year ended December 31,2020 6. Prepare Balance Sheet (Input all amounts as positive values.) 2. Post the eniries and their batinces to thet respecome Taccourts. 10 horets Somple Question: Complex Cotegory Pool Corporation is the world's largest wholesale distributor of swimang poot supplies and equipment \& services. It sells these products to swirming pool repoir and service businesses tike Pennys Pool Service 8 Supply inc, swinming pool bulders, and refail swimming pool stores. The majorify of these customers are small, family-owned businesses like Penny's its thial balance for the last year ended Deceaber 31,2010 is presented below: The following transactions occurred duing the financial year 2020 a. A retait pool customer pays his outstanding balance of $8,200 to Pool Corporation b. Supplies purchased in Cash amounting $700 c. Pool Corporatoen purchases Product lnventory in Cash amounting to $4,500 d. Paid wages in cash amounting to $8,900 e. Pool Corporation purchased equipment worts $7,000 and paid imimediately. 1 Poor Corporation paid $2400 cash for the premium on a 12 th month insurance policy begirning from December 2020 . g. Pool Corporation paid $200 towards general repairs in cash. h. Pocl Corporation paid $2.800 cash fowards theties. IC Poot Corporation paid $200 towards transportation for one of the equipment as per the sale agreement. Pool Corporition purchased Product Inventory for $22,000 Cash x. Pool Corporation owed $900 wages to the office receptionist and three assistants for worlong the last nwo diays in December 2020 The employees wit be pad in Junuary 2021. 1 On October 1 2020. Pool Corporation ieceived $24.000 froen customers who peopuld pool cleaning service for one year beginning on November 1,2020 m. Pood Corpormion received a $640 utily bul for December utlity usspe: it wall be paid in January 2021 i. Poci Coiporation bocrowed 530,000 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate, The notr and imetest are due on May 1,2021 0. On December 31,2020. Fool Corporation cieaned and winterized a customer's pool for 512,300 , but the service was not yet recorded on December 31 p. On August 1, 2020, Pool Corpocanon purchased a two year insurance policy for 55,400 , with coverage begining on that date. q. Duting 2020. Poot Corporation purchased supplies costing $21000 from vacious suppliers for cash. t. Pool Corpotation estrnated that depreciation on its buldings and equipment was $9,400 for the year 5. At December 31,2020,51,400 of interest on invegiments was earned that wab be ieceinedin 2021 t. Fent for December dive to be paid in January 2020 of 51800 4, 5 old 562000 of goods and received the amount on the same day. v. Record the expired insurance purchased trans in for the monith of December. x. Pool Corporation recelved utarties bili for $520 for December. Pald in cash when teceived. y. Propenty tax paid $9700 doring the yoat at. Pool Corporation purchased equipenent worth 55,000 on credit basis: b2. Pool Corporation recewed the remuining balance amount due towards the recent sale made to Penrys Pool service \& supply inc. c. Paid for the equipment purchased (toan A1) e5. Property tix due and poryable worth $13,000 ef. Recognce revenue earned (inarsaction L) ez frecond interest accrued on bank loan (Transaction N ) e8. Record the adjusting eritry to record expeed insurance (Transaction P? Pequired: 1. Pout the required entres, of no ensy is required foc o trensoction/event, select "No journal entry required" in the first nccount field.) 3. Prepare Adjusted Frial Qaanice \begin{tabular}{|c|c|c|c|c|c|} \hline 16 & p & Pripuld herance & 0 & 54000 & \\ \hline & & Cash & 0 & & 5.000 \\ \hline \multirow[t]{3}{*}{n} & 9 & Supplen & 0 & 21.0000 & \\ \hline & & Carh & 0 & & 21.0600 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{18} & r & Depredialion expeme. & 0 & 1,4000 & \\ \hline & & Acainchited depreciation & 0 & & 8,sen0 \\ \hline \multirow[t]{2}{*}{19} & s & himestrecehathe & 0 & 14000 & \\ \hline & & kbarrest nevenue & 0 & & 1,0000 \\ \hline \multirow[t]{2}{*}{20} & t & Pint equative & 0 & 1.0000 & \\ \hline & & Rent payatio & 0 & & 1,1000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{21} & u & Canh & 0 & 62,0000 & \\ \hline & & Soles & 0 & & $20000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{22} & x & hourince epoment & 0 & 2000 & \\ \hline & & Pripais insurance & 0 & & 2000 \\ \hline \multirow[t]{2}{*}{23} & w & Accounts rectivate & 0 & 180000 & \\ \hline & & Salen & 0 & & 1a,0000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{24} & x & \begin{tabular}{l} Uatim expere \\ Cosh \end{tabular} & 0 & 5>00 & 500 \\ \hline & - & Cosh & 0 & & sine \\ \hline \multirow[t]{2}{*}{25} & y & Propery lax equarse & 0 & 2,1000 & E \\ \hline & & Cath & 0 & & \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{26} & 2 & Cech & 0 & 5,0000 & \\ \hline & & Accounts recaliate & 0 & & 90000 \\ \hline \multirow{2}{*}{27} & & & & & \\ \hline & at & \begin{tabular}{l} Equigient \\ Accourb pryatio \end{tabular} & 0 & 50000 & 5,0000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{2a} & to & Canch & 0 & 2.0000 & \\ \hline & & Accounts riscotrad to & 0 & & 20000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{20} & a & Nocounts payatio & 0 & 50000 & \\ \hline & = & Canh & 0 & & 5,0000 \\ \hline \multirow[t]{2}{*}{30} & a & Sisyples experive & 0 & 217000 & \\ \hline & & Suples: & 0 & & 20,1000 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{31} & $5 & Propect tar expense & 0 & 110000 & \\ \hline & & Propetr terpayatile & 0 & & 100000 \\ \hline & & & & + & \\ \hline \multirow[t]{3}{*}{n} & 6 & Delentined intene & 0 & 10000 & \\ \hline & & siten & 0 & & 40000 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{3} & et & Intirest expensie & 0 & 12000 & \\ \hline & & intanse perate & 0 & & 1000 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{34} & & hestatice ogensen & 0 & cos0 & \\ \hline & & Prepaid houance & 0 & & \\ \hline \end{tabular} 5. Prepare Statement of Owner's Equity Answer is not complete. 4. Prepare Income Statement. Answer is not complete. Pool Corporation Adjusted trial balance For year ended December 31,2020 6. Prepare Balance Sheet (Input all amounts as positive values.) 2. Post the eniries and their batinces to thet respecome Taccourts. 10 horets Somple Question: Complex Cotegory Pool Corporation is the world's largest wholesale distributor of swimang poot supplies and equipment \& services. It sells these products to swirming pool repoir and service businesses tike Pennys Pool Service 8 Supply inc, swinming pool bulders, and refail swimming pool stores. The majorify of these customers are small, family-owned businesses like Penny's its thial balance for the last year ended Deceaber 31,2010 is presented below: The following transactions occurred duing the financial year 2020 a. A retait pool customer pays his outstanding balance of $8,200 to Pool Corporation b. Supplies purchased in Cash amounting $700 c. Pool Corporatoen purchases Product lnventory in Cash amounting to $4,500 d. Paid wages in cash amounting to $8,900 e. Pool Corporation purchased equipment worts $7,000 and paid imimediately. 1 Poor Corporation paid $2400 cash for the premium on a 12 th month insurance policy begirning from December 2020 . g. Pool Corporation paid $200 towards general repairs in cash. h. Pocl Corporation paid $2.800 cash fowards theties. IC Poot Corporation paid $200 towards transportation for one of the equipment as per the sale agreement. Pool Corporition purchased Product Inventory for $22,000 Cash x. Pool Corporation owed $900 wages to the office receptionist and three assistants for worlong the last nwo diays in December 2020 The employees wit be pad in Junuary 2021. 1 On October 1 2020. Pool Corporation ieceived $24.000 froen customers who peopuld pool cleaning service for one year beginning on November 1,2020 m. Pood Corpormion received a $640 utily bul for December utlity usspe: it wall be paid in January 2021 i. Poci Coiporation bocrowed 530,000 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate, The notr and imetest are due on May 1,2021 0. On December 31,2020. Fool Corporation cieaned and winterized a customer's pool for 512,300 , but the service was not yet recorded on December 31 p. On August 1, 2020, Pool Corpocanon purchased a two year insurance policy for 55,400 , with coverage begining on that date. q. Duting 2020. Poot Corporation purchased supplies costing $21000 from vacious suppliers for cash. t. Pool Corpotation estrnated that depreciation on its buldings and equipment was $9,400 for the year 5. At December 31,2020,51,400 of interest on invegiments was earned that wab be ieceinedin 2021 t. Fent for December dive to be paid in January 2020 of 51800 4, 5 old 562000 of goods and received the amount on the same day. v. Record the expired insurance purchased trans in for the monith of December. x. Pool Corporation recelved utarties bili for $520 for December. Pald in cash when teceived. y. Propenty tax paid $9700 doring the yoat at. Pool Corporation purchased equipenent worth 55,000 on credit basis: b2. Pool Corporation recewed the remuining balance amount due towards the recent sale made to Penrys Pool service \& supply inc. c. Paid for the equipment purchased (toan A1) e5. Property tix due and poryable worth $13,000 ef. Recognce revenue earned (inarsaction L) ez frecond interest accrued on bank loan (Transaction N ) e8. Record the adjusting eritry to record expeed insurance (Transaction P? Pequired: 1. Pout the required entres, of no ensy is required foc o trensoction/event, select "No journal entry required" in the first nccount field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started