Please finish these journal entries

1.

2.

3.

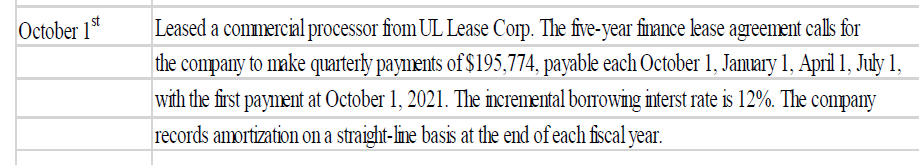

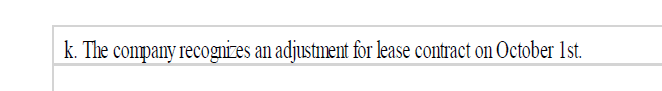

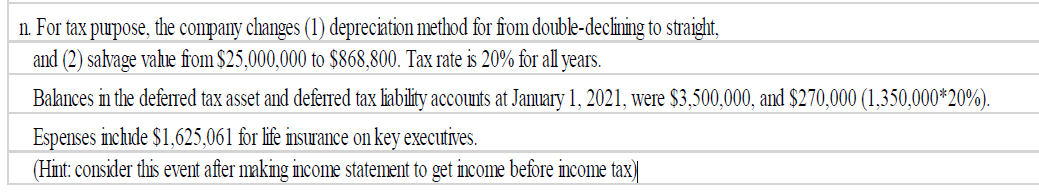

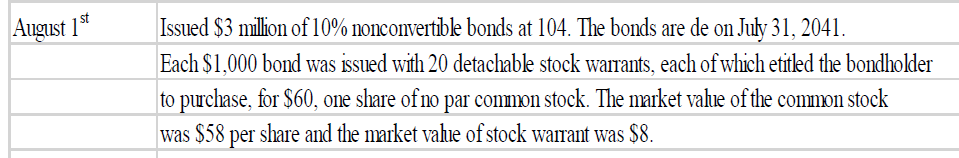

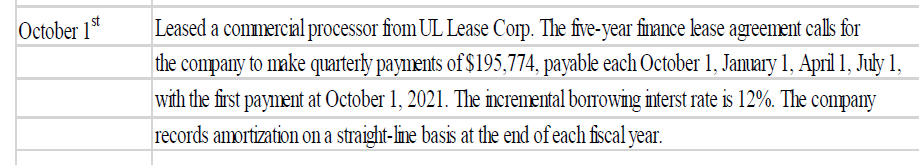

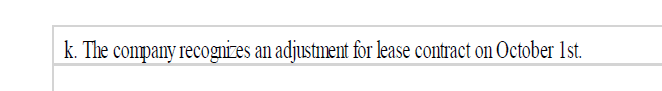

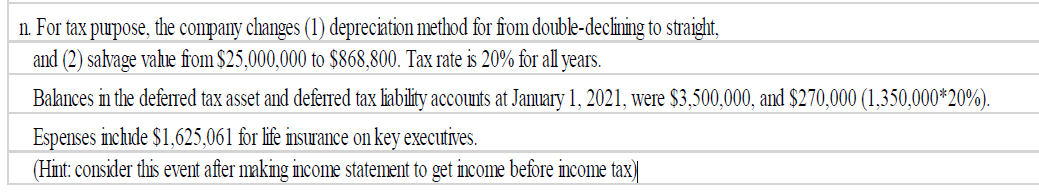

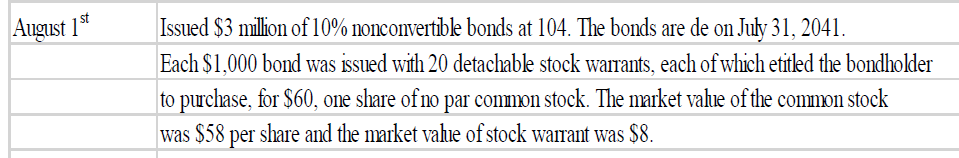

October 1 Leased a commercial processor from UL Lease Corp. The five-year finance lease agreement calls for the company to make quarterly payments of $195,774, payable each October 1, January 1, April 1, July 1, with the first payment at October 1, 2021. The incremental borrowing interst rate is 12%. The company records amortization on a straight-line basis at the end of each fiscal year. k. The company recognizes an adjustment for lease contract on October 1st. n. For tax pupose, the company changes (1) depreciation method for from double-declining to straight, and (2) salvage vahie from $25,000,000 to $868,800. Tax rate is 20% for all years. Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2021, were $3,500,000, and $270,000 (1,350,000*20%). Espenses inchide $1,625,061 for life insurance on key executives. (Hint: consider this event after making income statement to get income before income tax) August 1 st Issued $3 million of 10% nonconvertible bonds at 104. The bonds are de on July 31, 2041. Each $1,000 bond was issued with 20 detachable stock warrants, each of which etitled the bondholder to purchase, for $60, one share of no par common stock. The market vahie of the common stock was $58 per share and the market value of stock warrant was $8. October 1 Leased a commercial processor from UL Lease Corp. The five-year finance lease agreement calls for the company to make quarterly payments of $195,774, payable each October 1, January 1, April 1, July 1, with the first payment at October 1, 2021. The incremental borrowing interst rate is 12%. The company records amortization on a straight-line basis at the end of each fiscal year. k. The company recognizes an adjustment for lease contract on October 1st. n. For tax pupose, the company changes (1) depreciation method for from double-declining to straight, and (2) salvage vahie from $25,000,000 to $868,800. Tax rate is 20% for all years. Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2021, were $3,500,000, and $270,000 (1,350,000*20%). Espenses inchide $1,625,061 for life insurance on key executives. (Hint: consider this event after making income statement to get income before income tax) August 1 st Issued $3 million of 10% nonconvertible bonds at 104. The bonds are de on July 31, 2041. Each $1,000 bond was issued with 20 detachable stock warrants, each of which etitled the bondholder to purchase, for $60, one share of no par common stock. The market vahie of the common stock was $58 per share and the market value of stock warrant was $8