Answered step by step

Verified Expert Solution

Question

1 Approved Answer

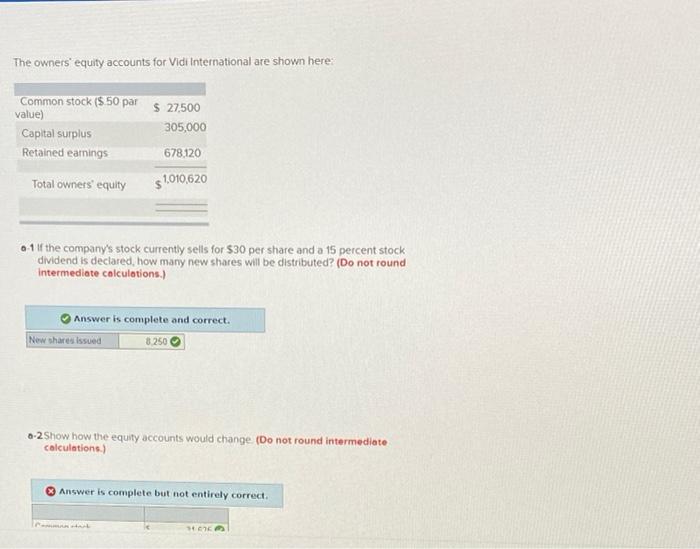

please fix the mistakes The owners' equity accounts for Vidi International are shown here: Common stock ($ 50 par $ 27.500 value) 305,000 Capital surplus

please fix the mistakes

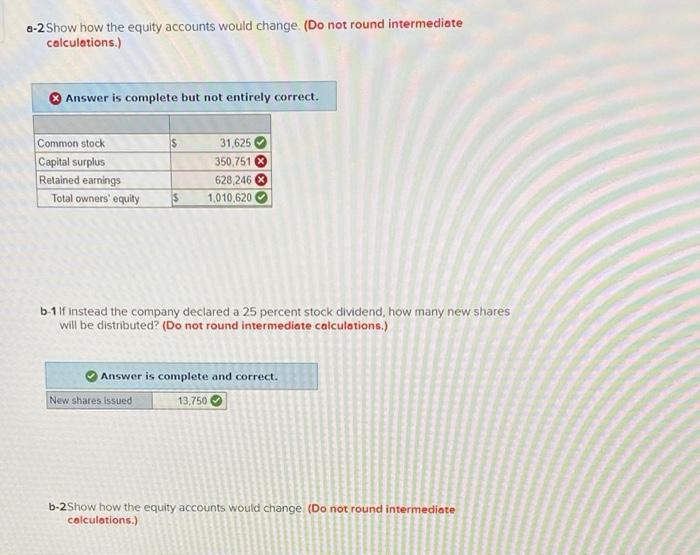

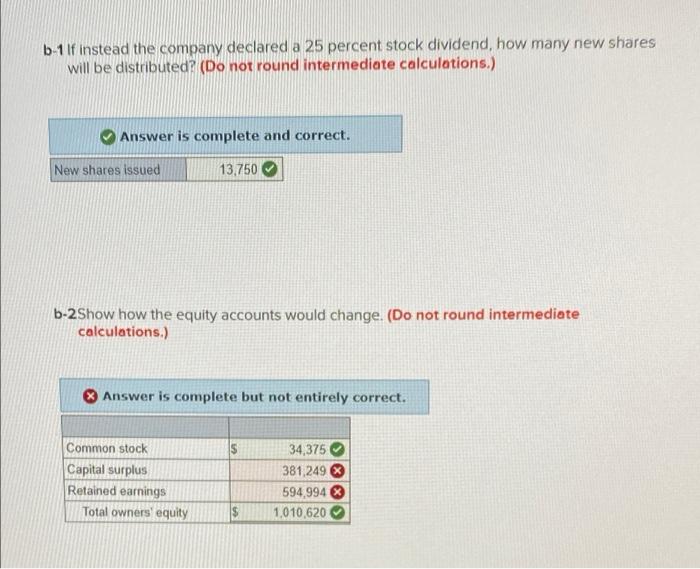

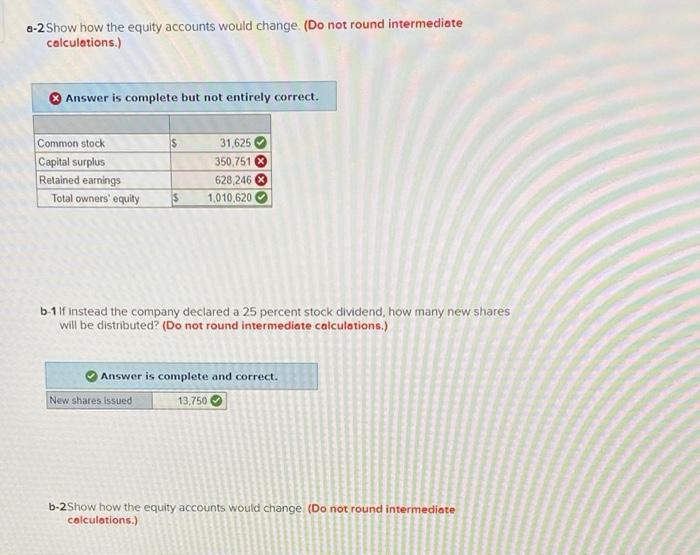

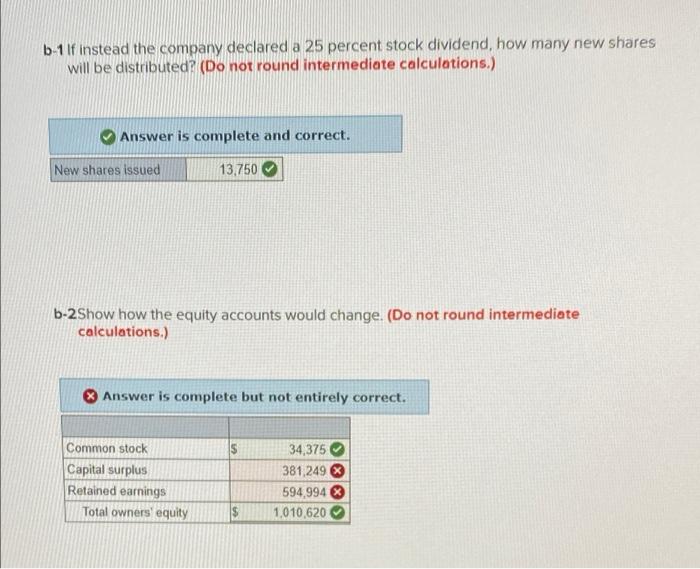

The owners' equity accounts for Vidi International are shown here: Common stock ($ 50 par $ 27.500 value) 305,000 Capital surplus Retained earnings 678120 Total owners' equity 1,010,620 a 11f the company's stock currently sells for $30 per share and a 15 percent stock dividend is declared, how many new shares will be distributed? (Do not round intermediate calculations.) Answer is complete and correct. New shares issued 8250 0-2 Show how the equity accounts would change (Do not round intermediate calculations) Answer is complete but not entirely correct a-2 Show how the equity accounts would change (Do not round intermediate calculations.) Answer is complete but not entirely correct. $ Common stock Capital surplus Retained earnings Total owners' equity 31,625 350 751 628 246 1,010,620 $ b- 11f instead the company declared a 25 percent stock dividend, how many new shares will be distributed? (Do not round intermediate calculations.) Answer is complete and correct. New shares issued 13,750 b-2 Show how the equity accounts would change (Do not round intermediate calculations.) b-1 If instead the company declared a 25 percent stock dividend, how many new shares will be distributed? (Do not round intermediate calculations.) Answer is complete and correct. New shares issued 13,750 b-2Show how the equity accounts would change. (Do not round intermediate calculations.) Answer is complete but not entirely correct. Common stock Capital surplus Retained earnings Total owners' equity 34,375 381,249 594,994 1,010,620

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started