please fix

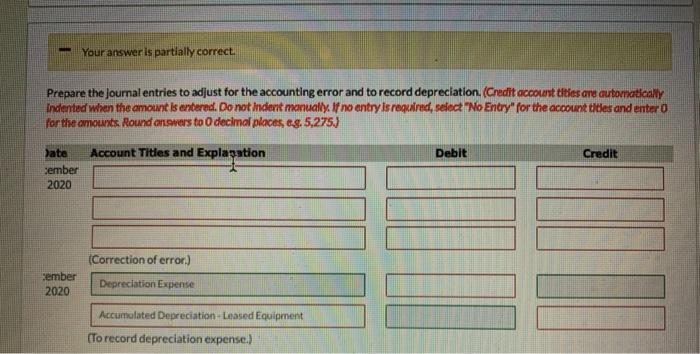

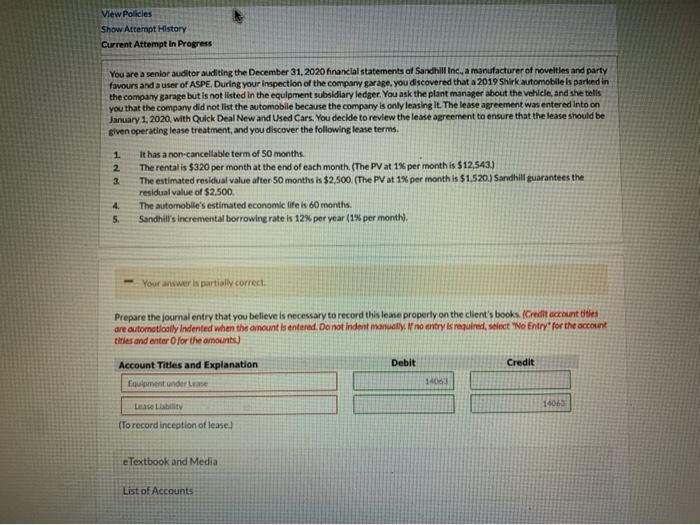

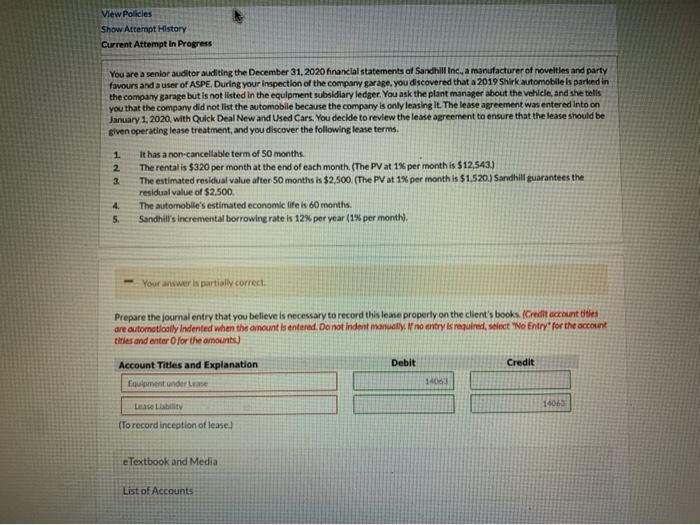

View Policies Show Attempt History Current Attempt In Progress You are a senior auditor auditing the December 31, 2020 financial statements of Sandhill Inc, a manufacturer of novelties and party favours and a user of ASPE, During your inspection of the company garage. you discovered that a 2019 Shirk automobile is parked in the company garage but is not listed in the equipment subsidiary ledger. You ask the plant manager about the vehicle, and she tells you that the company did not list the automobile because the company is only leasing it. The lease agreement was entered into on January 1, 2020, with Quick Deal New and Used Cars. You decide to review the lease agreement to ensure that the lease should be given operating lease treatment, and you discover the following lease terms. 1 2 3 It has a non-cancellable term of 50 months. The rental is $320 per month at the end of each month. (The PV at 1% per month is $12,543.) The estimated residual value after 50 months is $2.500. (The PV at 1% per month is $1.520.) Sandhill guarantees the residual value of $2.500 The automobile's estimated economic life is 60 months Sandhill's incremental borrowing rate is 12% per year (1% per month), 4. 5. Your answer is partially correct. Prepare the journal entry that you believe is necessary to record tisteme property on the client's books. (Credit account titles are automatically Indented when the annount is enterad. Do not indont anually. W no entry is required, select "No Entry for the account tities and enter for the amounts Debit Credit Account Titles and Explanation Equipment ander Lease 14063 14065 Luas Luty (Torecord inception of lease eTextbook and Media List of Accounts - Your answer is partially correct. Prepare the journal entries to adjust for the accounting error and to record depreciation. (Credit account tities are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and entero for the amounts. Round answers to decimal places, eg. 5.275.) Account Titles and Explagation Debit Credit Date Jember 2020 (Correction of error.) ember 2020 Depreciation Expense Accumulated Depreciation Leased Equipment (To record depreciation expense.) View Policies Show Attempt History Current Attempt In Progress You are a senior auditor auditing the December 31, 2020 financial statements of Sandhill Inc, a manufacturer of novelties and party favours and a user of ASPE, During your inspection of the company garage. you discovered that a 2019 Shirk automobile is parked in the company garage but is not listed in the equipment subsidiary ledger. You ask the plant manager about the vehicle, and she tells you that the company did not list the automobile because the company is only leasing it. The lease agreement was entered into on January 1, 2020, with Quick Deal New and Used Cars. You decide to review the lease agreement to ensure that the lease should be given operating lease treatment, and you discover the following lease terms. 1 2 3 It has a non-cancellable term of 50 months. The rental is $320 per month at the end of each month. (The PV at 1% per month is $12,543.) The estimated residual value after 50 months is $2.500. (The PV at 1% per month is $1.520.) Sandhill guarantees the residual value of $2.500 The automobile's estimated economic life is 60 months Sandhill's incremental borrowing rate is 12% per year (1% per month), 4. 5. Your answer is partially correct. Prepare the journal entry that you believe is necessary to record tisteme property on the client's books. (Credit account titles are automatically Indented when the annount is enterad. Do not indont anually. W no entry is required, select "No Entry for the account tities and enter for the amounts Debit Credit Account Titles and Explanation Equipment ander Lease 14063 14065 Luas Luty (Torecord inception of lease eTextbook and Media List of Accounts - Your answer is partially correct. Prepare the journal entries to adjust for the accounting error and to record depreciation. (Credit account tities are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and entero for the amounts. Round answers to decimal places, eg. 5.275.) Account Titles and Explagation Debit Credit Date Jember 2020 (Correction of error.) ember 2020 Depreciation Expense Accumulated Depreciation Leased Equipment (To record depreciation expense.)

please fix

please fix