Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE FOLLOW THE ROUNDING RULES. LAST EXPERT WAS WRONG ANSWER IS NOT $602,524 Your company has been approached to bid on a contract to sell

PLEASE FOLLOW THE ROUNDING RULES. LAST EXPERT WAS WRONG ANSWER IS NOT $602,524

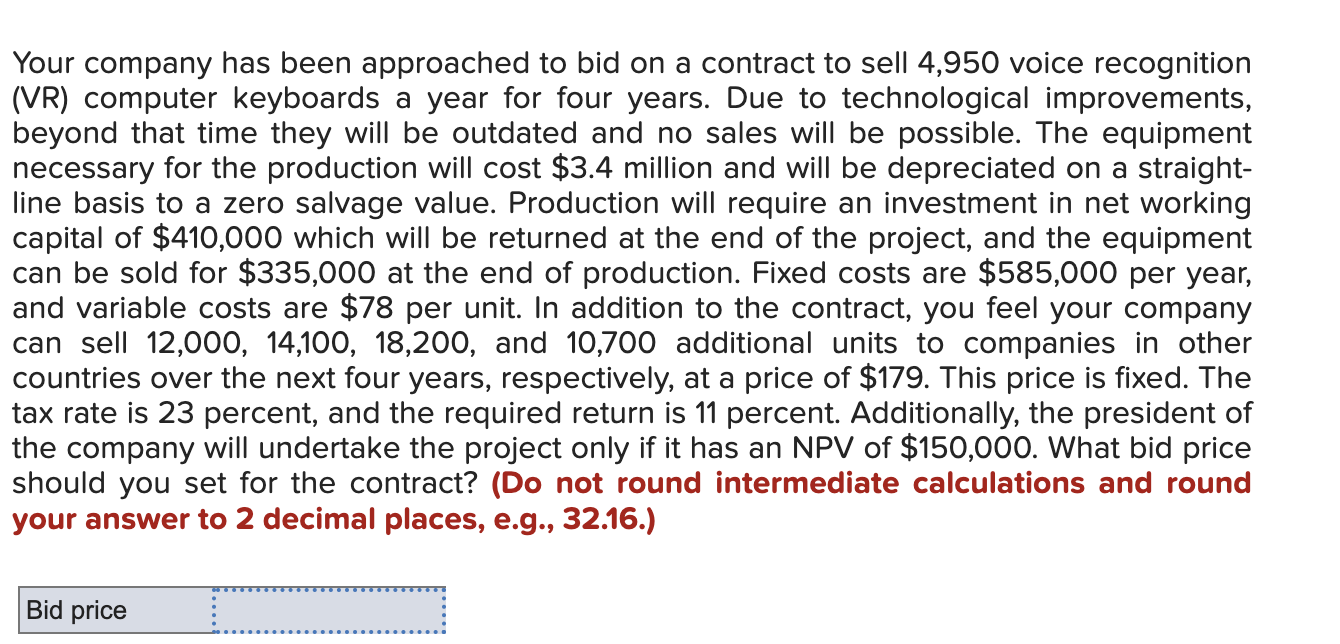

Your company has been approached to bid on a contract to sell 4,950 voice recognition (VR) computer keyboards a year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straightline basis to a zero salvage value. Production will require an investment in net working capital of $410,000 which will be returned at the end of the project, and the equipment can be sold for $335,000 at the end of production. Fixed costs are $585,000 per year, and variable costs are $78 per unit. In addition to the contract, you feel your company can sell 12,000,14,100,18,200, and 10,700 additional units to companies in other countries over the next four years, respectively, at a price of $179. This price is fixed. The tax rate is 23 percent, and the required return is 11 percent. Additionally, the president of the company will undertake the project only if it has an NPV of $150,000. What bid price should you set for the contract? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started