Answered step by step

Verified Expert Solution

Question

1 Approved Answer

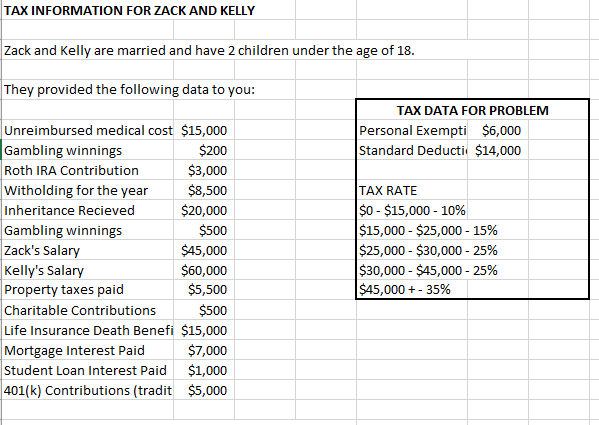

Please follow the tax formula found in the book and show what is included in each step. 1. What is total income that will be

Please follow the tax formula found in the book and show what is included in each step.

1. What is total income that will be used in the calculation? List each one.

2. What is Adjusted Gross Income?

3. Should your client's use the standard deduction or itemize their deductions? What is the total itemized deductions?

4. What is taxable income?

5. What is their tax liability?

6. Will your clients owe money or receive a refund?

TAX INFORMATION FOR ZACK AND KELLY Zack and Kelly are married and have 2 children under the age of 18 They provided the following data to you: TAX DATA FOR PROBLEM Personal Exempti $6,000 Standard Deducti $14,000 Unreimbursed medical cost $15,000 Gambling winnings Roth IRA Contribution Witholding for the year $8,500 Inheritance Recieved Gambling winnings Zack's Sala Kelly's Salary Property taxes paid Charitable Contributions Life Insurance Death Benefi $15,000 Mortgage Interest Paid Student Loan Interest Paid $1,000 401(k) Contributions (tradit $5,000 $200 $3,000 $20,000 $500 $45,000 $60,000 $5,500 $500 TAX RATE so-$15,000-1096 $15,000-$25,000-15% $25,000-$30,000-25% $30,000-$45,000-25% 45,000 +-35% $7,000 TAX INFORMATION FOR ZACK AND KELLY Zack and Kelly are married and have 2 children under the age of 18 They provided the following data to you: TAX DATA FOR PROBLEM Personal Exempti $6,000 Standard Deducti $14,000 Unreimbursed medical cost $15,000 Gambling winnings Roth IRA Contribution Witholding for the year $8,500 Inheritance Recieved Gambling winnings Zack's Sala Kelly's Salary Property taxes paid Charitable Contributions Life Insurance Death Benefi $15,000 Mortgage Interest Paid Student Loan Interest Paid $1,000 401(k) Contributions (tradit $5,000 $200 $3,000 $20,000 $500 $45,000 $60,000 $5,500 $500 TAX RATE so-$15,000-1096 $15,000-$25,000-15% $25,000-$30,000-25% $30,000-$45,000-25% 45,000 +-35% $7,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started