Answered step by step

Verified Expert Solution

Question

1 Approved Answer

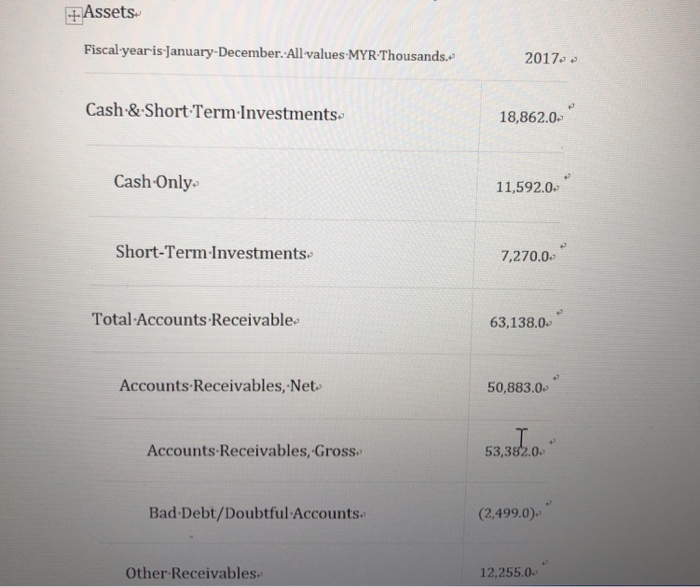

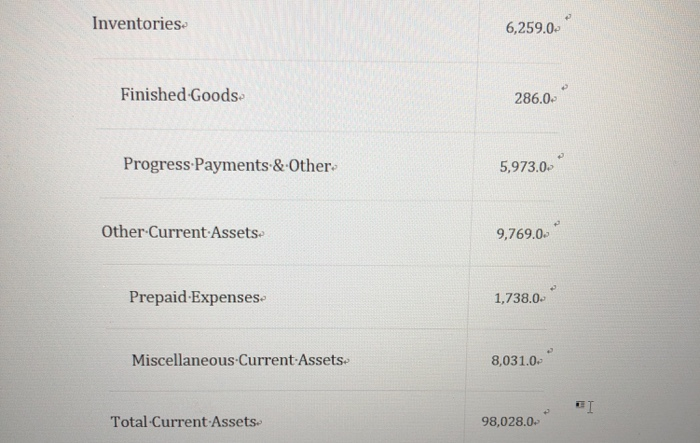

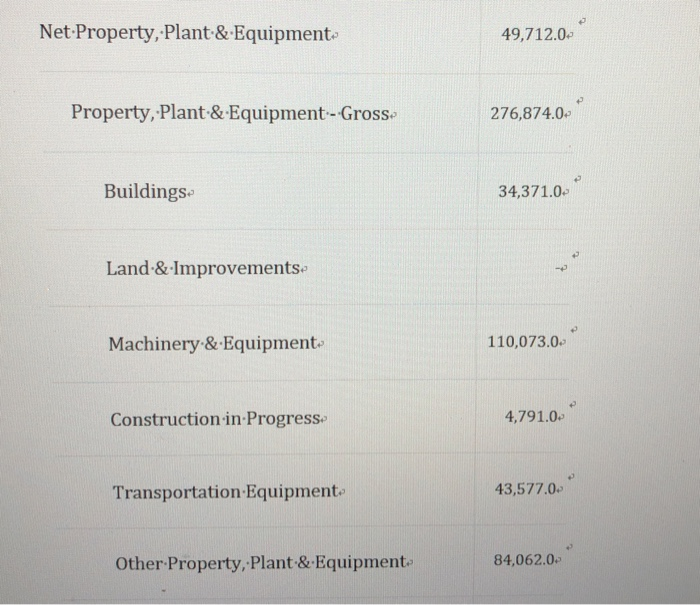

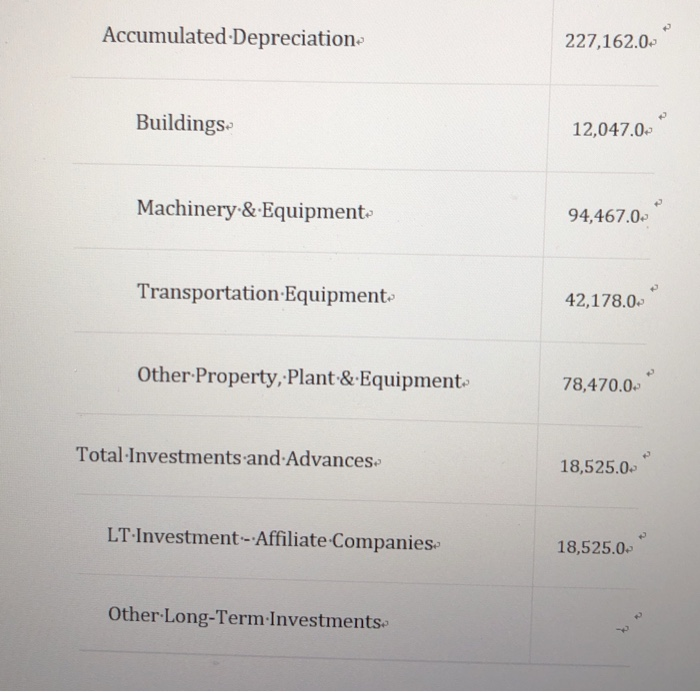

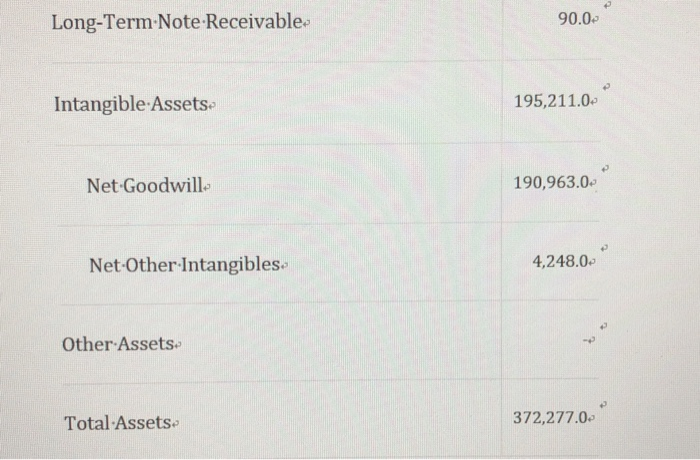

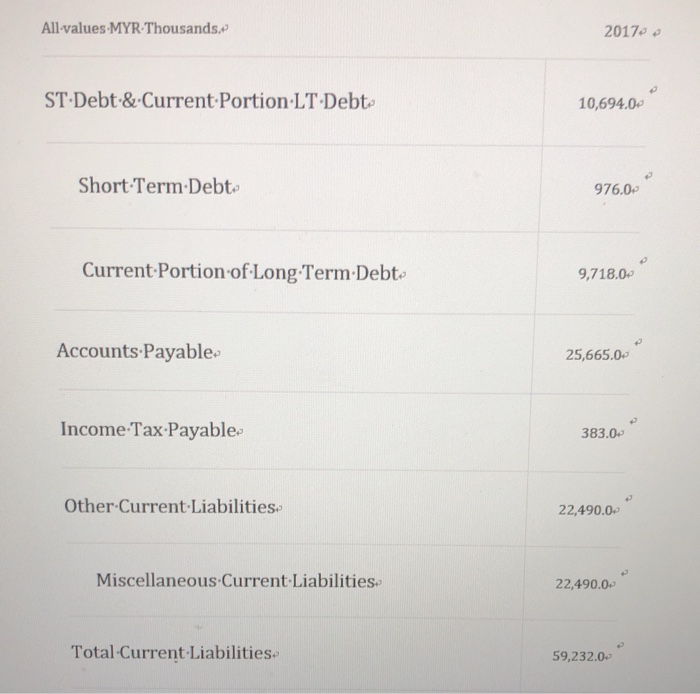

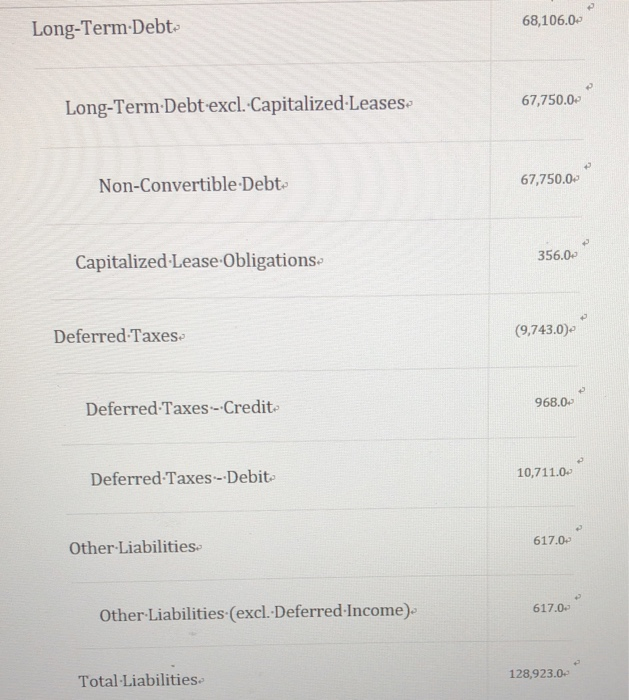

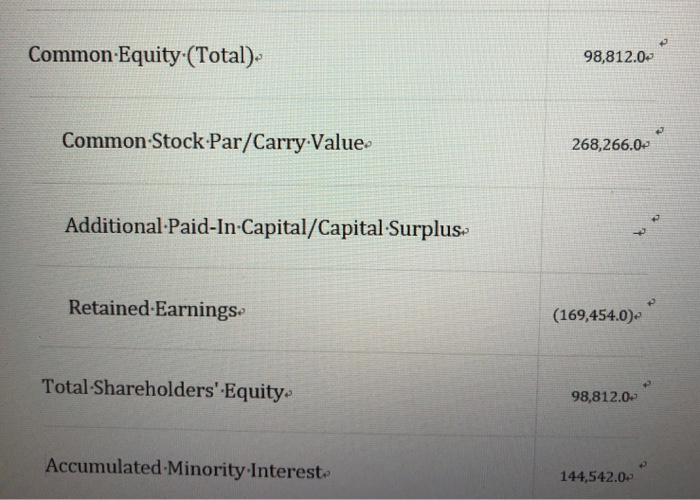

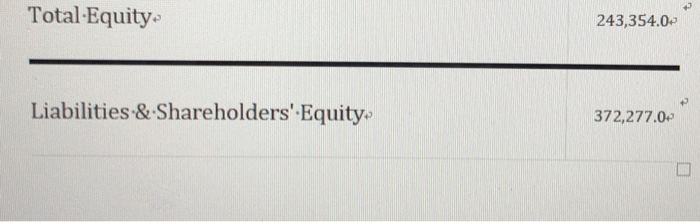

please forecast balance sheet if their sales increase 20%Current sales 291,563.0. Assets- Fiscal yearis January-December. All values-MYR-Thousands. 2017 Cash & Short Term-Investments 18,862.0 Cash -Only

please forecast balance sheet if their sales increase 20%Current sales 291,563.0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started