Please format the chart exactly how its formatted in the question below so there will be no confusion and thank you for helping me

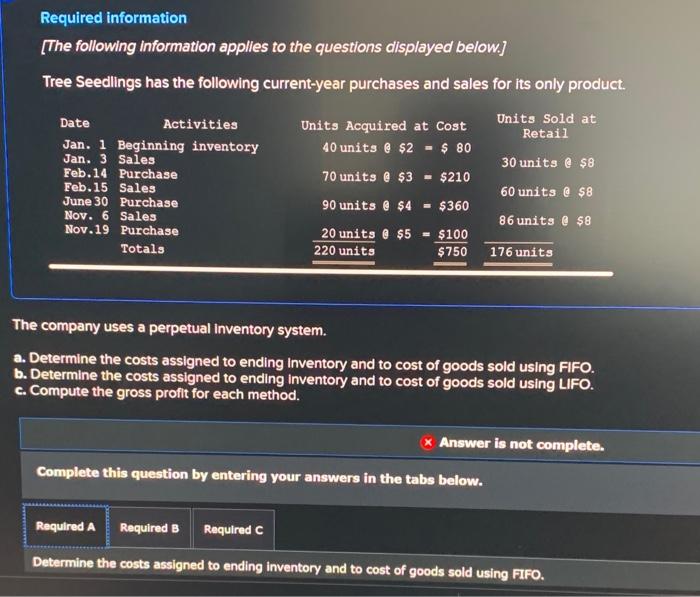

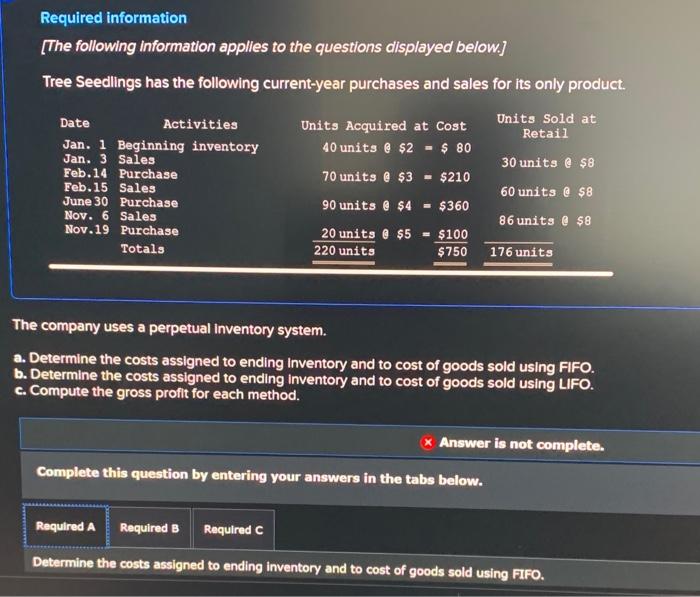

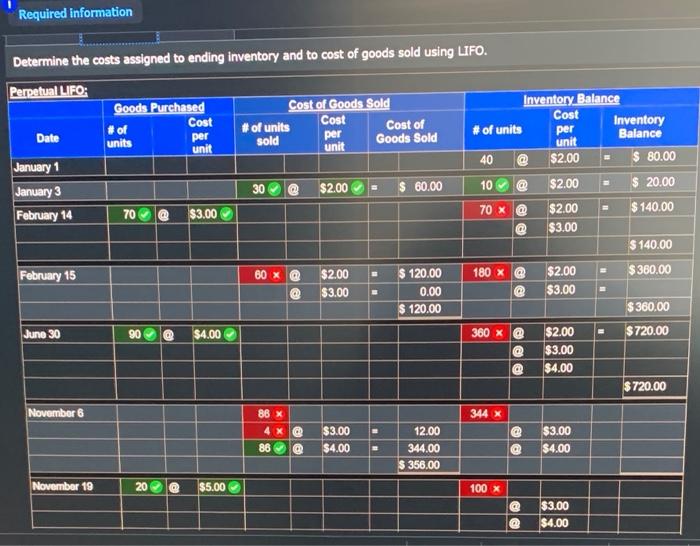

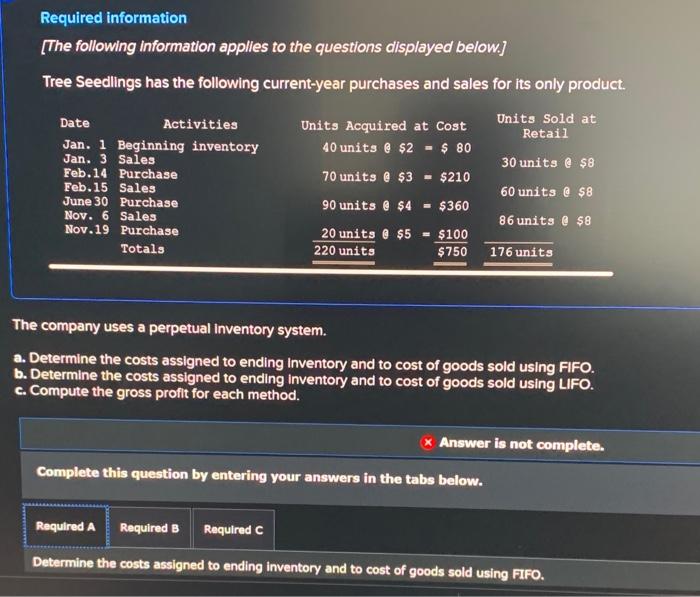

Required information [The following information applies to the questions displayed below.) Tree Seedlings has the following current-year purchases and sales for its only product. Date Activities Jan. 1 Beginning inventory Jan. 3 Sales Feb.14 Purchase Feb. 15 Sales June 30 Purchase Nov. 6 Sales Nov.19 Purchase Totals Units Acquired at Cost 40 units @ $2 - $ 80 70 units @ $3 $210 90 units @ $4 - $360 Units Sold at Retail 30 units @ $8 60 units @ $8 86 units @ $8 20 units @ $5 220 units = $100 $750 176 units The company uses a perpetual Inventory system. a. Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending Inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Required information Required A Required Required C Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Goods Purchased Cost of Goods Sold Inventory Balance Cost Cost Cost #ol of units Cost of Inventory Date per of units units per per sold Goods Sold Balance unit unit unit January 1 40 $2.00 $ 80.00 January 3 2 x $2.00 $ 4.00 30 x @ $2.00 $ 60.00 February 14 70 $3.00 70 x @ $2.00 $140.00 0X @ $3.00 $140.00 6.00 $2.00 February 15 3 x 4 x @ $2.00 $3.00 $ 12.00 $18.00 10 x @ 60 x @ $3.00 $ 20.00 $ 180,00 $ 200,00 June 30 90 $4.00 $2.00 $3.00 $4.00 November 6 20 Date of units LUSI per unit # of units sold LUSI per unit Cost of Goods Sold # of units LUSI per unit $2.00 40 January 1 January 3 February 14 Inventory Balance - $ 80.00 = $ 60.00 $ 140.00 2 x $2.00 $ 4.00 30 x @ $2.00 70 $3.00 70 x > $2.00 $3.00 @ February 15 3 x 6.00 $2.00 $3.00 10 60 x @ $2.00 $3.00 $ 140.00 = $ 20.00 $180.00 $ 200.00 4 X 12.00 $ 18.00 June 30 90 $4.00 $2.00 $3.00 $4.00 November 6 20 x November 19 20 $5.00 100 x 0 OX OX $5.00 Totals 22.00 Required information @ @ @ @ Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Perpetual LIFO: Goods Purchased Cost of Goods Sold Inventory Balance Cost Cost Cost # of #of units Cost of Inventory Date per # of units per per units sold Goods Sold Balance unit unit unit January 1 40 $2.00 $ 80.00 January 3 30 $2.00 $ 60.00 10 $2.00 $ 20,00 February 14 70 $3.00 70 X $2.00 $ 140,00 $3.00 $ 140.00 February 15 60 x $2.00 $ 120.00 180 X @ $2.00 $360.00 $3.00 0.00 $3.00 $ 120.00 $360.00 June 30 90 $4.00 360 x @ $2.00 $720.00 $3.00 $4.00 $ 720.00 November 6 344 x 4 x @ $3.00 12.00 $3.00 86 $4.00 344.00 @ $4.00 $ 356,00 November 19 20 $5.00 @ @ @ @ @ @ 86 x @ @ 100 x @la $3.00 $4.00 Required information Goods Purchased Cost # of units per unit Cost of Goods Sold # of units Cost Cost of sold per unit Goods Sold Inventory Balance Cost # of units Inventory per unit Balance 40 @ $2.00 $ 80.00 Date 30 $2.00 January 1 January 3 February 14 10 $ 60.00 @ $2.00 $ 20.00 $140.00 70 @ $3.00 70 X @ @ $2.00 $3.00 $140.00 60 x 180 x February 15 $360,00 $2.00 $3.00 $ 120.00 0.00 $ 120.00 @ @ $2.00 $3.00 $360.00 June 30 90 $4.00 360 x @ $ 720.00 @ $2.00 $3.00 $4.00 @ $720.00 November 6 344 x 86 x 4 x @ 86 B $3.00 $4.00 12.00 344.00 $ 356.00 @ @ $3.00 $4.00 November 19 20 . es $5.00 100 x $3.00 $4.00 $5.00 @ Totals $ 536.00